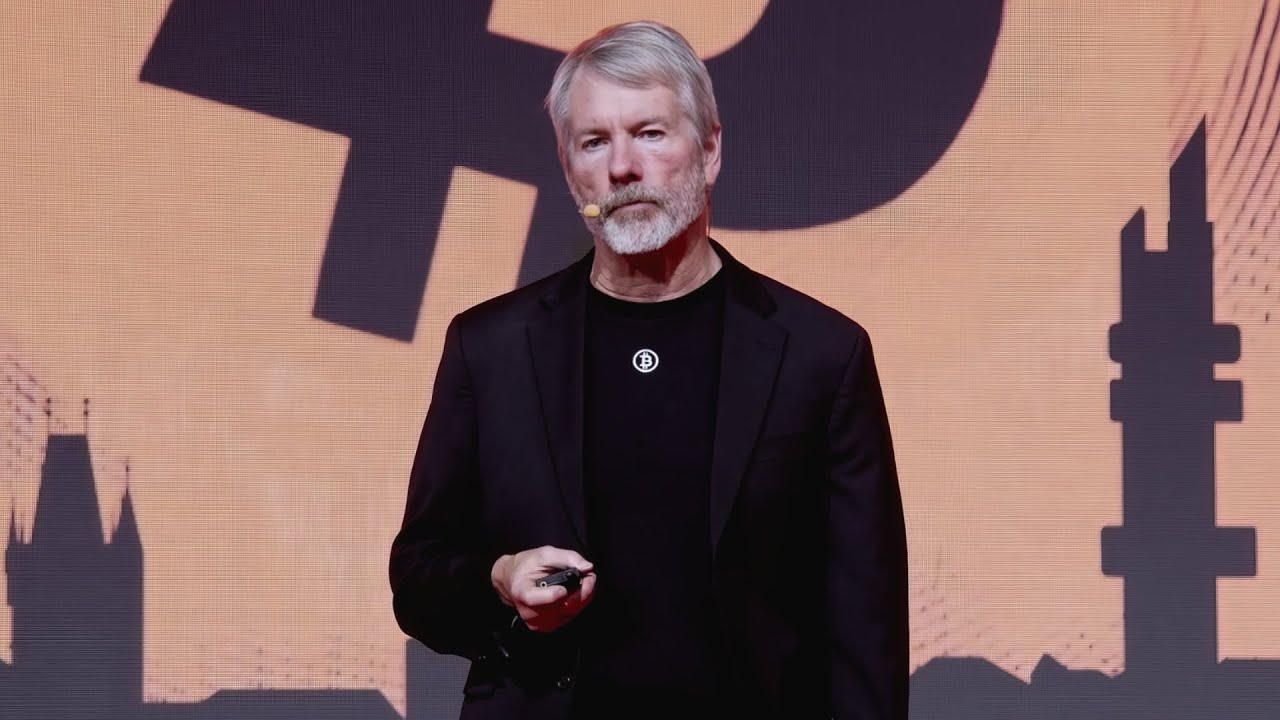

Michael Saylor's Unwavering Bitcoin Crusade: Tweets, Buys, and Treasury Gains

The United States government has officially recognized Bitcoin as a treasury asset, a development heralded by Michael Saylor, cofounder and executive chairman of Strategy. This acknowledgment follows a statement from U.S. Treasury Secretary Scott Bessent, who confirmed the government's intention to establish a Strategic Bitcoin Reserve. This reserve was first mandated by the U.S. president's executive order in March and is set to commence with the existing 200,000 BTC already held by the government. Bessent also reiterated former President Trump’s promise to position the U.S. as the "Bitcoin superpower of the world." Saylor summarized this monumental shift succinctly, stating, “The US is now recognizing Bitcoin as a Treasury Reserve Asset.”

Despite this significant announcement, Bessent's prior comments to CNBC, suggesting no new Bitcoin purchases were planned, triggered diverse reactions within the BTC community. Cypherpunk legend Adam Back, whose Hashcash invention laid foundational work for Bitcoin, dismissed Bessent's earlier statement as a "misspeak." He also mused that the phrase "budget-neutral ways to accumulate more Bitcoin" might be a justification for overspending, aiming to mitigate public criticism over resource allocation. Anthony Pompliano, CEO of ProCap Financial, was among those who believed the latter statement to be more indicative of the government's true intentions.

Further paving the way for Bitcoin's integration, the Federal Reserve has decided to discontinue a controversial crypto bank oversight program initiated in August 2023. This program had subjected banks exploring cryptocurrency services or blockchain projects to heightened scrutiny, designed to manage potential risks in the volatile crypto sector through focused oversight. However, the Fed now deems existing oversight tools sufficient, having gained a better understanding of the risks and banking institutions' capabilities to manage them.

This move by the Fed is considered a significant catalyst for further mainstream institutional adoption and regulatory clarity in the U.S. It is expected to clear the path for Bitcoin and the banking sector, enabling deeper integration of crypto into traditional finance. Federal Reserve Chair Jerome Powell has previously acknowledged crypto's move into the mainstream. Pro-Bitcoin Senator Cynthia Lummis hailed the decision as a "big win," signifying an end to "Operation Chokepoint 2.0," which allegedly pressured banking institutions to deny services to crypto companies. The Fed's decision follows the introduction of specific guidelines for banking institutions willing to engage in crypto custody last month.

Amidst these regulatory and governmental shifts, Michael Saylor remains a fervent Bitcoin evangelist. His company, MicroStrategy, has notably transformed into Strategy Inc., a dedicated Bitcoin treasury company. Saylor frequently takes to social media to reinforce his unwavering commitment, encapsulated by phrases like “Bitcoin Forever” and the evocative “Satoshi started a fire in cyberspace,” a reference to Bitcoin’s mysterious creator, Satoshi Nakamoto, as a modern-day Prometheus.

Strategy’s commitment is reflected in its aggressive Bitcoin accumulation strategy. The company now holds a staggering 629,376 BTC, acquired for approximately $46.15 billion at an average price of about $73,320 per Bitcoin. Recent acquisitions include an additional 430 BTC for ~$51.4 million at an average price of ~$119,666 per BTC. This strategy has resulted in an impressive 25.1% Year-to-Date (YTD) yield for Strategy in 2025, demonstrating its continued profitability despite market fluctuations.

Even during market downturns, or a "bloodbath" as described, Strategy continues its Bitcoin purchases, often "buying the dip." Reports on the firm’s portfolio performance indicate substantial profits, a testament to its long-term accumulation strategy initiated in 2020. While BlackRock's iShares spot Bitcoin ETF (IBIT) holds a larger amount, Strategy remains the largest Bitcoin treasury company in the market, funding its regular BTC purchases through various securities like MSTR, STRC, STRK, STRF, and STRD, offering diverse Bitcoin-based investment tools.

The broader Bitcoin market has experienced significant volatility, reaching new historic price peaks before falling. Bitcoin recently lost 5.42% from an all-time high above $124,000, trading around $117,730, and further dropping to the $115,000 level. These movements have been influenced by factors including geopolitical events. Additionally, a significant event involved a Bitcoin OG whale, wallet "19D5J8" holding 23,969 BTC, awakening after five years of dormancy to transfer 3,000 BTC (worth over $353 million) to a new wallet.

You may also like...

Margot Robbie and Colin Farrell's New Fantasy Film Faces Rotten Tomatoes Score Drop

"A Big Bold Beautiful Journey," starring Margot Robbie and Colin Farrell, is set for release on September 19, 2025, as a...

Highlander Reboot Gets 'John Wick' Level Hype from Dave Bautista and Henry Cavill

Dave Bautista has landed his dream role as The Kurgan in Chad Stahelski's Highlander reboot, a part he has passionately ...

Ozuna Dominates Latin Airplay with 33rd Chart-Topper!

Ozuna's "Sirenita" has officially become his 33rd No. 1 hit on Billboard’s Latin Rhythm Airplay chart, climbing to the t...

Music World Mourns: Hitmaker Omen Passes Away at 49

Renowned hip-hop producer Sidney “Omen” Brown has died at 49. Known for his work with Roc-A-Fella, Drake, Lil Wayne, and...

Alien: Earth Stars Spill on Episode 7's Terrifying Twists and Iconic Sci-Fi Nods

Dive into the intense world of <em>Alien: Earth</em> Episode 7, "Emergence," through interviews with Adarsh Gourav and D...

Emmys 2025 Red Carpet: The Most Stunning Celebrity Looks That Broke the Internet!

The Emmys red carpet redefined celebrity fashion, moving beyond traditional attire to embrace daring and expressive look...

Davido Takes Center Stage: Exclusive Nigerian Act for Coachella 2026!

Coachella has revealed its highly anticipated 2026 lineup, featuring headliners Justin Bieber, Sabrina Carpenter, Karol ...

M&S Autumn Collection Promises High Street Revolution with Style & Value!

Marks & Spencer is shaking up the High Street with its most daring and eclectic fashion collection, the "She's Back" cam...