Michael Saylor's Bitcoin Prophecies: From Tarantino Allusions to Fiat Collapse Warnings

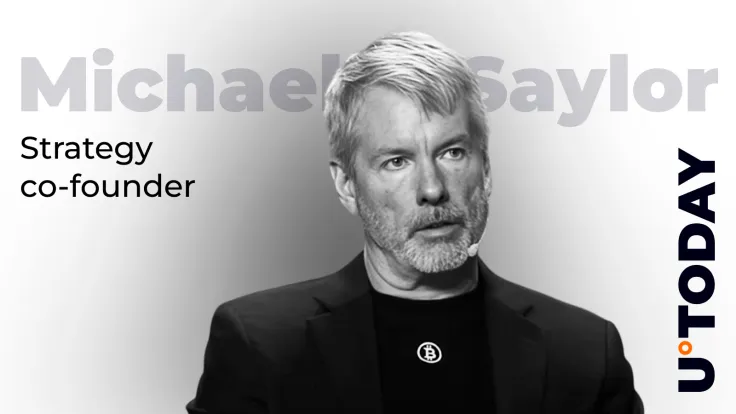

Michael Saylor, a prominent Bitcoin evangelist and co-founder of the BTC-powered company Strategy, consistently champions Bitcoin through various engaging methods, often utilizing the social media platform X and AI-generated visuals. Saylor has adopted distinct personas and creative narratives to highlight Bitcoin's attributes and his unwavering bullish stance to the global crypto community.

One such instance involved Saylor referencing Quentin Tarantino's iconic first movie, “Reservoir Dogs.” In a recent X post, he presented an AI-generated image of himself, donned in a suit with an orange tie—a color strongly associated with Bitcoin—and adopted the moniker “Mr. Orange.” This directly alluded to the movie's color-coded characters, like Mr. White and Mr. Red, reinforcing his deep commitment to Bitcoin and its digital empire, drawing a parallel to Tarantino himself playing Mr. Brown in an episodic role.

Saylor's advocacy is often coupled with Strategy's strategic Bitcoin acquisitions. Traditionally, he signals potential purchases on Sundays by publishing charts with orange dots, often with a caption like “Bitcoin is on sale.” This is typically followed by a Monday announcement of Strategy buying another chunk of BTC to boost its stash. Strategy currently holds $75.15 billion worth of BTC. Furthermore, Strategy recently increased its holdings to 632,457 BTC, adding another 3,081 coins this week, with an average cost of $73,527 per coin. This represents an investment of about $46.5 billion and a market value of almost $71.5 billion, yielding over 53% profit even with market ups and downs.

Further expanding his narrative, Saylor introduced the “Bitcoin Maximus” persona. This involved a post depicting him in full classical Roman attire against a Roman Empire backdrop. This move had some resemblance to Elon Musk's earlier rebranding to “Kekius Maximus.” Saylor's adaptation, however, serves to portray him not just as a passing character in crypto's meme culture, but as a self-appointed defender and architect of a growing digital Bitcoin empire, underscoring Strategy's deep corporate alignment with the cryptocurrency.

Saylor also used AI to visualize Bitcoin's vast potential as a financial tool through the concept of a “Station ₿.” This AI-made video featured Saylor as a tour guide in a “Bitcoin space station” powered by BTC, demonstrating the network's capabilities such as low-cost, seamless financial transactions, and a new menu of fresh Bitcoin-based products. Features within “Station ₿” included a refreshing “signature drink” called “The Sats on the beach” and a Bitcoin ATM for secure transactions, along with a dashboard to watch network activity and make Lightning payments. Saylor concluded the tour by stating, “Bitcoin is the energy that powers the future,” and described the station as a means to survive the upcoming collapse of fiat monetary systems.

Beyond Strategy, other entities are also increasing their Bitcoin holdings. Metaplanet, identified as the fifth-largest Bitcoin treasury company, recently acquired 103 Bitcoins for approximately $11.7 million in fiat, raised from investors via securities issuance. This increased their total holdings to 18,991 Bitcoins, valued at $2,124,268,690.

Amidst these developments, Bitcoin's market performance has seen recent fluctuations. The largest cryptocurrency previously dropped 2.41% over a 24-hour period, changing hands at $111,820 per coin. Subsequently, it experienced a more significant decline, dropping by more than 4% over another 24-hour period, slumping from the $111,330 zone to $107,460. This was a result of mammoth liquidations across crypto exchanges, causing Bitcoin to lose more than 5% and the $113,160 price level over two days. Currently, BTC is changing hands at $108,280 per coin, rebounding from under $108,000.

You may also like...

Boxing World Mourns Joe Bugner: Legend Dies at 75

The boxing world mourns the passing of Joe Bugner at 75, a legendary British-Australian heavyweight champion known for f...

Super Falcons Seize 10th WAFCON Title, Oshoala Faces Retirement Rumours

)

The Super Falcons of Nigeria clinched their record-extending 10th Women's Africa Cup of Nations title with a dramatic 3-...

Hilarious Heartbreak: Benedict Cumberbatch & Olivia Colman's 'The Roses' Takes On Divorce

A cinematic triptych highlights recent film releases, from Jay Roach's dark comedy "The Roses" re-evaluating modern marr...

Pure Gold! Liam Neeson & Pamela Anderson's Chemistry Ignites 'Naked Gun' Remake

Recent film releases offer a diverse cinematic experience, featuring Liam Neeson's surprising comedic turn in 'The Naked...

Cardi B Unfiltered: Superstar Dishes on New Album, Family & 'Bad Karma' in Explosive Billboard Feature!

Seven years after her debut, Cardi B is ready to launch her highly anticipated second album, "Am I the Drama?" The artis...

African Music Crowns Its Best: AFRIMA 2025 Nominees Unleashed!

The All Africa Music Awards (AFRIMA) 2025 has unveiled a record-breaking list of 343 nominees across 40 categories, foll...

Chrisley Family's Tumultuous Return: Post-Prison Confessions & New Reality Show Drama Unfold

The Chrisley family returns to television with their new Lifetime series, "The Chrisleys: Back to Reality," premiering S...

Bianca Censori's Daring Public Looks Spark Frenzy After Kanye West Revelation

My baby she ran away / But first she tried to get me committed / Not going to the hospital ’cause I am not sick I just d...