Meta’s $16 Billion Scam Problem: How Facebook and other Meta Platforms Profits from Fraud

Meta, the parent company of leading social media platforms — Facebook, Instagram and WhatsApp, reportedly earned nearly $16 billion in 2024 from ads that had ties with scams, and fraudulent activities. This has raised questions about how social media platforms can profit from frauds.

According to a recent report from Reuters, Meta projected late last year that it would earn about 10% of its overall annual revenue – or $16 billion – from running advertising for scams and banned goods.

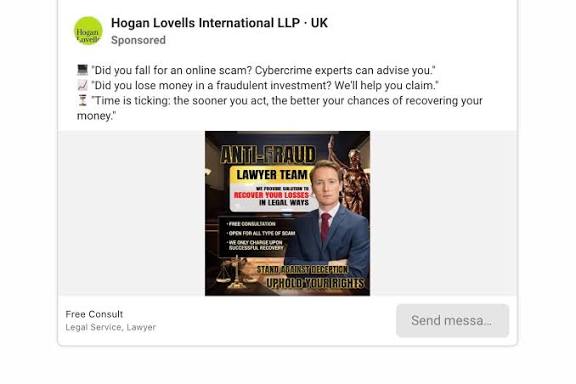

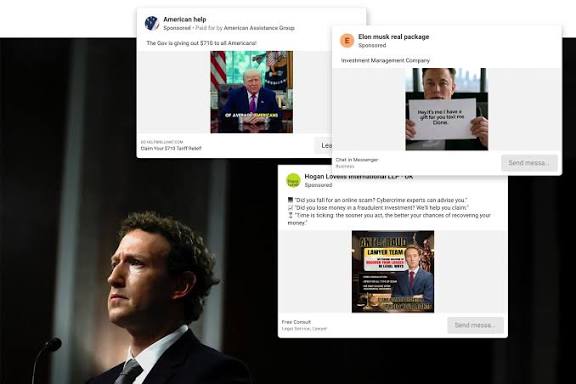

Other documents reviewed by Reuters also show that for the last 3 years, Meta had intentionally failed to identify and stop an avalanche of scam ads that flooded their social media apps — exposing billions of users to fraudulent e-commerce and investment schemes, illegal online casinos, and the sale of banned medical products.

Meta brought in more than $164.5 billion in overall sales for 2024. Last week, the company said that third-quarter sales rose 26% year-over-year to $51.24 billion and that it lifted the low end of its total expenses for the year by $2 billion as part of its massive investments into artificial intelligence.

Among the documents reviewed, another report from December 2024, notes that the company exposes its users to at least 15 billion “higher risk” scam advertisements on a daily basis. Another late 2024 document states that this advertisements that show clear signs of being fraudulent earns Meta about $7 billion in annualised revenue.

Most of the ads that fall into this category are suspicious enough to be flagged and taken down by Meta's internal warning system. But the company only bans advertisers if it's automated system provides that it has at least 95% certainty that the page is a scam.

The documents reveal that if the company is less certain, but perceives that the advertiser is a scammer, they simply increase the ad rate as a penalty to dissuade suspected advertisers from placing ads.

Latest Tech News

Decode Africa's Digital Transformation

From Startups to Fintech Hubs - We Cover It All.

The documents further reveal that because of its ad-personalisation system, users who come across scam ads and click them are likely to have more of related scam ads on their feeds which can lead to repeated scams on the same user.

USER AND GLOBAL IMPACT

The scale of Meta's scam problem is concerning — having billions of users exposed to scam contents on a daily basis. The fake ads that range from fake e-commerce websites that promise goods that never arrive to personality thefts that lure individuals to invest with the belief they're doing it with a public figure or brand. The depth of this problem extends far beyond what Meta appears to acknowledge.

For users in regions like Africa and Nigeria where Cyber crime is on the ever high, the impact can be particularly severe. Many scams already target users with phishing campaigns, fake online stores, and misleading investment opportunities, often exploiting the lack of widespread digital literacy and regulations. The repetitive nature of Meta's algorithm as said earlier, makes the problem even more profound — users who click on scam ads are likely to encounter more related scams, increasing the risk of repeated financial loss.

One can not possibly go without highlighting the scale of distortion this does to the ad economy. When fraudulent advertisers flood Meta’s system with billions of daily impressions, they inflate competition for placement, drive up CPMs, and erode trust.

For every fake crypto ad or investment scam, visibility and legitimacy are being siphoned away from the actual legitimate brands. And in a matter of time, the line between the legitimate and illegitimate advertisers would be so blur, it would be impossible to not fall into scams.

Meta's leaked documents reveal that their company has little to no incentive to police scam ads as it would risk loss in billions in ad revenues and deter investor's confidence. By doing this — treating scam advertisers as revenue sources, Meta has blurred the line between moderation and monetisation.

Latest Tech News

Decode Africa's Digital Transformation

From Startups to Fintech Hubs - We Cover It All.

Each deceptive ad approved by Meta chips away at the credibility of Meta advertising tools and the legitimate brands that rely on them. If this continues, analysts warn that advertisers may leave the meta space and source out platforms with more secure verification and transparency standards.

META'S RESPONSE TO THE ISSUE

Sandeep Abraham, a fraud examiner and former Meta safety investigator who now runs a consultancy called Risky Business Solutions came out to give his piece on the issue. According to him "Meta’s acceptance of revenue from sources it suspects are committing fraud highlights the lack of regulatory oversight of the advertising industry."

“If regulators wouldn’t tolerate banks profiting from fraud, they shouldn’t tolerate it in tech,” he told Reuters.

Meta has acknowledged the presence of scam ads on its platforms but disputes the scale and interpretation of the reported figures.

Meta Spokesman Andy Stone in response, said the documents seen by Reuters “present a selective view that distorts Meta’s approach to fraud and scams.”

The company’s internal estimate that it would earn 10.1% of its 2024 revenue from scams and other prohibited ads was “rough and overly-inclusive,” Stone said. The company had later determined that the true number was lower, because the estimate included “many” legitimate ads as well, he said but declined to give an updated figure.

“The assessment was done to validate our planned integrity investments – including in combatting frauds and scams – which we did,” Stone said. He added: “We aggressively fight fraud and scams because people on our platforms don’t want this content, legitimate advertisers don’t want it and we don’t want it either.”

Latest Tech News

Decode Africa's Digital Transformation

From Startups to Fintech Hubs - We Cover It All.

"Over the past 18 months, we have reduced user reports of scam ads globally by 58 percent and, so far in 2025, we’ve removed more than 134 million pieces of scam ad content,” Stone said.

He also assured that the company aims to lower this share to approximately 7.3% by the end of 2025, and fugee to 5.8% by 2027.

Although some of the documents just as Stones said show that Meta aims to reduce the amount of bogus ads on its platform, the Reuters report also said that other documents suggest the company is concerned that its business projections could be impacted by any abrupt removal of the fraudulent promotions.

Meta's Scam as dilemma raises pressing questions about regulation and corporate ethics in the digital advertising space. Unlike the traditional banks and businesses, tech platforms have for long operated with minimal oversight, allowing high-risk revenue systems to persist with limited consequence.

Ultimately, Meta's $16 billion scam problem underscores a fundamental tension in the digital space and while Meta claims to be working to solve this problem — billions of users remain exposed and the internal documents leaked reveal the challenges that come with battling this issue. What ever decision Meta makes in response to this will determine the trust that will remain in the online advertising space.

You may also like...

Bundesliga's New Nigerian Star Shines: Ogundu's Explosive Augsburg Debut!

Nigerian players experienced a weekend of mixed results in the German Bundesliga's 23rd match day. Uchenna Ogundu enjoye...

Capello Unleashes Juventus' Secret Weapon Against Osimhen in UCL Showdown!

Juventus faces an uphill battle against Galatasaray in the UEFA Champions League Round of 16 second leg, needing to over...

Berlinale Shocker: 'Yellow Letters' Takes Golden Bear, 'AnyMart' Director Debuts!

The Berlin Film Festival honored

Shocking Trend: Sudan's 'Lion Cubs' – Child Soldiers Going Viral on TikTok

A joint investigation reveals that child soldiers, dubbed 'lion cubs,' have become viral sensations on TikTok and other ...

Gregory Maqoma's 'Genesis': A Powerful Artistic Call for Healing in South Africa

Gregory Maqoma's new dance-opera, "Genesis: The Beginning and End of Time," has premiered in Cape Town, offering a capti...

Massive Rivian 2026.03 Update Boosts R1 Performance and Utility!

Rivian's latest software update, 2026.03, brings substantial enhancements to its R1S SUV and R1T pickup, broadening perf...

Bitcoin's Dire 29% Drop: VanEck Signals Seller Exhaustion Amid Market Carnage!

Bitcoin has suffered a sharp 29% price drop, but a VanEck report suggests seller exhaustion and a potential market botto...

Crypto Titans Shake-Up: Ripple & Deutsche Bank Partner, XRP Dips, CZ's UAE Bitcoin Mining Role Revealed!

Deutsche Bank is set to adopt Ripple's technology for faster, cheaper cross-border payments, marking a significant insti...