Kuku FM Soars: $550M Valuation as Krafton Leads $80M Funding Round

Audio streaming platform Kuku FM is reportedly on the verge of securing a substantial new funding round, having signed a term sheet to raise approximately $70–80 million. The round is expected to be led by South Korean-based video game publisher Krafton, with participation from existing investors. This fundraise is anticipated to elevate Kuku FM's post-money valuation to an estimated $500–550 million, a significant leap from its previous valuation, reflecting growing investor confidence in the platform's trajectory.

Sources familiar with the development indicate that investors are currently engaged in due diligence and documentation processes. The fundraise is strategically positioned around the burgeoning demand for code-based mini-dramas, underscoring a wider investor interest in serialized micro-drama formats and the short-video content ecosystem. While Kuku FM co-founder Lal Chand Bisu and the company have not commented on the matter, a Krafton spokesperson stated their policy not to comment on matters related to their portfolio companies.

Existing investors such as Nandan Nilekani’s Fundamentum Partnership and India Quotient are likely to participate in this latest round. Kuku FM has a history of successful fundraising, having last secured $25 million in its Series C round in September 2023. That round was co-led by Fundamentum Partnership and the International Finance Corporation, with Vertex Ventures also contributing, valuing the company at about $185 million post-money at the time. To date, Kuku FM has amassed roughly $70 million in equity from a diverse group of domestic and global investors, including prominent names like Google, Paramark, 3one4 Capital, V Cube Ventures, FounderBank Capital, in addition to Fundamentum, India Quotient, Vertex Ventures, and Krafton from previous rounds. Krafton, a notable backer, previously spearheaded Kuku FM’s $19.5 million Series B in 2022 and has been actively expanding its investments beyond gaming into consumer content within India.

Founded in 2018 by Lal Chand Bisu, Vinod Meena, and Vikas Goyal, Kuku FM initially established itself as an audio platform. It offers creation tools enabling users to produce and publish original shows across multiple Indian languages. The platform has claimed an impressive ecosystem of over 30,000 creators and more than 2.5 million active paid subscribers. While its initial focus was on audiobooks spanning genres such as self-help, personal finance, romance, and spirituality, Kuku FM has strategically evolved into a creator-led platform. It now actively commissions and hosts original audio series, monetizing content primarily through subscriptions.

In a parallel development and a strategic diversification, the company also operates Kuku TV, a distinct video-focused application. Unlike Kuku FM’s audiobook-centric service, Kuku TV specializes in short-form and mini-drama programming, with a continuous influx of new titles daily. Reports suggest the platform has been adding over 200 new shows in a single month, with numerous micro-dramas achieving more than 50 million views each, highlighting its rapid growth in the video segment.

Kuku FM operates within an intensely competitive market, which has attracted a crowded field of challengers. Rival Pocket FM, for instance, is reportedly engaging Goldman Sachs to raise $100-150 million to fuel its global expansion efforts. Other venture capital-backed players like Flick TV (funded by Stellaris Venture Partners) and Dashverse (funded by Peak XV), alongside Zee Entertainment’s Bullet, are vying for market share. Established media firms and social platforms, including Balaji Telefilms’ Kutingg, Sharechat’s Moj, and QuickTV, are also scaling up their efforts in this space.

Analysts from business consulting firm Redseer estimate India’s short-form video and micro-drama ecosystem to currently generate approximately $50 million in monthly revenue, translating to roughly $600 million annually. This market already boasts over 300 million users and holds substantial potential for expansion, projected to grow into an $8–12 billion market by 2030, underscoring the strategic importance of Kuku FM’s focus areas.

Regarding its ownership structure, Kuku FM’s founders collectively retain around 20% of the company. Fundamentum Partnership stands as the largest institutional shareholder with approximately 12.8% ownership, followed by Vertex Ventures at about 11.1%. Krafton currently holds an approximately 10.2% stake in Kuku FM, according to data from private market intelligence platform Tracxn, solidifying its position as a key investor.

You may also like...

Wolves Fandom Erupts: 'Sell the Club!' Chants Rock Stadium Amidst Frustration!

Wolves fans' frustration reached a boiling point at Molineux, with chants against the club's ownership and manager Vitor...

Haaland's Agony: Disallowed Goal and Injury Plague Man City's Disappointing Outing!

Manchester City's nine-match unbeaten run came to an end at Villa Park as Aston Villa secured a victory, highlighted by ...

Andrew Garfield Teases Spider-Man Return, But Fans Should Brace for a 'Catch'

Andrew Garfield has expressed a keen interest in joining Sony's animated *Spider-Verse* franchise, hinting at a potentia...

Mel Gibson's 'Passion of the Christ' Sequel Faces Blasphemy Outcry Over Jesus Recasting

Mel Gibson's highly anticipated sequel, "The Resurrection of the Christ," is moving forward two decades after the origin...

Snoop Dogg Drops Bombshell at Verzuz Relaunch in Vegas, Igniting No Limit-Cash Money Battle

Snoop Dogg made a surprise appearance at ComplexCon in Las Vegas, joining his former label, No Limit Records, in a star-...

Daft Punk Legend Thomas Bangalter Stuns Paris with Surprise DJ Set Alongside Fred again..

Daft Punk's Thomas Bangalter made a rare surprise appearance with Fred again.. for a DJ set at Paris' Centre Pompidou. T...

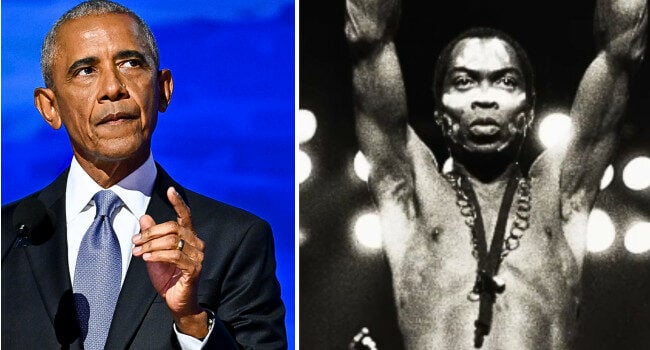

Obama Dives Deep: New Podcast Honors Revolutionary Fela Kuti

Former U.S. President Barack Obama has curated a new 12-episode podcast series, "Fela Kuti: Fear No Man," celebrating th...

Waje & KCee Ignite Romance with New Track 'Luvey Luvey'

Waje has released a new single, “Luvey Luvey,” featuring KCee, a warm and feel-good song celebrating love. Blending Afro...