Kenya's Sovereign Wealth and Investment Funds: A Blueprint to Debt-Smart Development

President William Ruto recently announced that Kenya is establishing a Sovereign Wealth Fund and Infrastructure Fund to channel investments into key sectors of the economy while reducing dependence on external loans. This move isn't only important but a bold step towards building a more sustainable and self-reliant financial future for Kenya.

A DECADE OF AMBITIOUS GROWTH AND FINANCIAL STRAIN.

Over the years, Kenya's economy has experienced massive growth driven largely by ambitious infrastructure projects, from highways and rail lines to power plants and industrial parks. Much of these projects, however, were financed through heavy borrowing from both local and international lenders.

As a result, Kenya's public debt ballooned and recent reports indicate that in the 2023/2024 fiscal year, debt servicing consumed 68.3% of the nation's ordinary revenue, up from 58.8% the previous year — a challenge the newly proposed Sovereign wealth and infrastructure funds aim to address by providing alternative, sustainable sources of capital for the country's developmental projects.

THE SOVEREIGN WEALTH AND INFRASTRUCTURE FUNDS

The Introduction of the Sovereign Wealth Funds and Infrastructure Funds marks a strategic shift in Kenya's financial future, allowing it to take charge of financing its own growth. A Sovereign Wealth Fund is essentially a state-owned investment fund that allows a country to save and invest its own surplus revenue, which is usually generated from sectors like natural resources, trade surpluses, among other sources.

The idea is to ensure that future generations benefit from today's earnings, while also providing a safeguard for periods of economic uncertainty.

Kenya's version of the fund, however, isn't limited to savings alone. The Electricity Hub indicates that the Sovereign Wealth and Infrastructure Funds are created to drive green growth. It seeks to invest strategically in sectors like Energy, Agriculture, manufacturing, and technology to generate long-term national wealth. The Infrastructure Fund complements this by targeting high-impact development projects like highways and power grids with the ultimate goal of fostering growth without the heavy borrowing that has long plagued Kenya's development model.

Together, the Sovereign Wealth Fund and Infrastructure Fund symbolise a shift in Kenya's financial future — a move from spending borrowed money to growing national wealth, positioning Kenya to join a host of other nations with Sovereign Wealth Funds.

PRIVATISATION: KENYA'S NEW INDUSTRIAL DRIVE

To kickstart this, the Kenyan government plans to raise money by selling parts of its stake in state-owned companies. The first on the list of companies to be privatised is the Kenyan Pipeline Company (KPC). This state firm manages the transportation of petroleum products within Kenya and also to neighbouring States.

President William Ruto, via reputable outlets, asserts that the share offer is expected to raise at least 130 billion Shillings, which is convertible to $1.01bn. These proceeds will serve as the seed capital for both the Sovereign Wealth Funds and the Infrastructure Funds, marking a crucial step towards reducing Kenya's reliance on external loans.

Beyond generating funds, the privatisation of these state-owned companies represents a move towards transparency and public participation. By listing a portion of KPC’s shares on the Nairobi Securities Exchange (NSE), the country’s principal stock market that facilitates public ownership of national enterprises, the Kenyan government aims to broaden citizen participation in state assets. This was also announced via the President’s official X account.

The move also signals confidence in Kenya’s financial markets, positioning the NSE as a key instrument in driving domestic investment. By doing so, the company will operate under stricter disclosure and governance standards, strengthening accountability and investor confidence in Kenya’s fiscal reforms.

Credible Sources report that the infrastructure fund will primarily support the agricultural sector — the backbone of Kenya's economy to boost productivity and expand exports. The Kenyan government also plans to finance efforts that will lead to an increase of the country's electricity generation capacity, which is currently at 2300 megawatts. President William Ruto estimates that an extra 10,000 megawatts will be needed to drive Kenya's industrialization.

However, making this transformation a reality involves more than just generating more electricity. Kenya's development highlights the need to strengthen every part of the energy sector, and this can be done by improving power grids, building regional connections, introducing smart meters, and reforming tariffs to attract private investors.

Kenya's renewable resources already give a head start, but the main challenge lies in funding the less visible parts of the system that link energy production to people’s daily lives.

For the agricultural sector, where climate shocks have reduced agricultural yields across East Africa, the Investment fund could help turn the tide. Strategic investments in irrigation systems, cold storage, and electricity-powered processing plants would not only improve food production but also reduce post-harvest losses. By enabling farmers to process and export higher-value goods, Kenya can strengthen its agricultural exports while promoting a more sustainable and resilient economy.

A BLUEPRINT FOR DEBT-SMART DEVELOPMENT

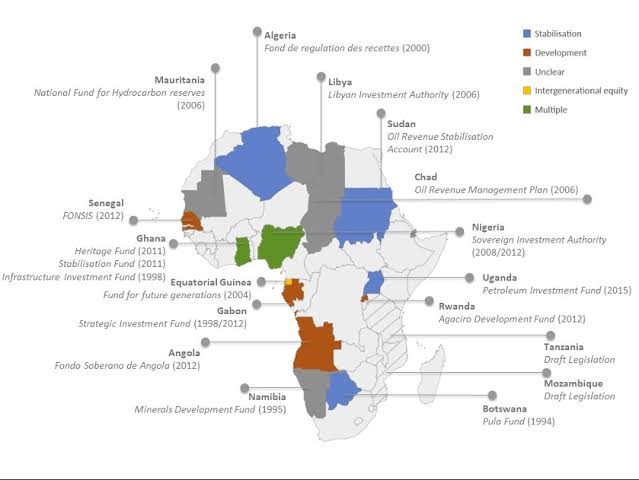

Kenya's initial seed capital of $1.01bn might sound modest if compared to the sovereign wealth funds of nations like Nigeria, Angola, Botswana, among others. What makes this stand out, however, isn't the size of the fund; it's the idea — the philosophy behind it, a master plan to put a stop to the borrowing that has characterised their development, and it doesn't end at putting a stop, but finding ways to ensure that the country can develop its own economy by itself. It is a deliberate shift from debt-driven growth to sustainable and self-sufficient growth.

If executed effectively, the Sovereign Wealth and Infrastructure Funds could mark a turning point in Kenya’s economic story. By channeling proceeds from strategic state assets into agriculture, energy, and technology, Kenya is charting a course toward fiscal independence.

The success of this plan will, however, fall into the hands of those who lead the people. Transparency, Inclusion, and accountability will determine whether this will be a continent-wide model for other African Nations to follow or just another policy experiment. Should this model thrive, it could set off a positive chain of action that will end with more African nations not just creating Sovereign funds of their own, but doing it right — with transparency, accountability, and the people at the heart of the process.

Conclusively, Kenya's bold step could become more than just an economic reform; it could mark the dawn of a new era in Africa, an era of African Financial Independence where development is driven by self-reliance and smart development.

You may also like...

Super Eagles Fury! Coach Eric Chelle Slammed Over Shocking $130K Salary Demand!

)

Super Eagles head coach Eric Chelle's demands for a $130,000 monthly salary and extensive benefits have ignited a major ...

Premier League Immortal! James Milner Shatters Appearance Record, Klopp Hails Legend!

Football icon James Milner has surpassed Gareth Barry's Premier League appearance record, making his 654th outing at age...

Starfleet Shockwave: Fans Missed Key Detail in 'Deep Space Nine' Icon's 'Starfleet Academy' Return!

Starfleet Academy's latest episode features the long-awaited return of Jake Sisko, honoring his legendary father, Captai...

Rhaenyra's Destiny: 'House of the Dragon' Hints at Shocking Game of Thrones Finale Twist!

The 'House of the Dragon' Season 3 teaser hints at a dark path for Rhaenyra, suggesting she may descend into madness. He...

Amidah Lateef Unveils Shocking Truth About Nigerian University Hostel Crisis!

Many university students are forced to live off-campus due to limited hostel spaces, facing daily commutes, financial bu...

African Development Soars: Eswatini Hails Ethiopia's Ambitious Mega Projects

The Kingdom of Eswatini has lauded Ethiopia's significant strides in large-scale development projects, particularly high...

West African Tensions Mount: Ghana Drags Togo to Arbitration Over Maritime Borders

Ghana has initiated international arbitration under UNCLOS to settle its long-standing maritime boundary dispute with To...

Indian AI Arena Ignites: Sarvam Unleashes Indus AI Chat App in Fierce Market Battle

Sarvam, an Indian AI startup, has launched its Indus chat app, powered by its 105-billion-parameter large language model...