Interesting TACs of the Week (March 24 - March 30, 2025)

How about a statistical probability projection on market action in April from a time-tested analyst?

In case you wondering what Signor Detrick is saying?

Was there any one who came in on Friday afternoon & was positive? One man we heard was Craig Johnson of Piper Sandler who thankfully was allowed to speak for a couple of minutes just before 5pm on CNBC. As we recall, he called this week’s sell-off as a re-test & pointed to the “extremely low volume“; he also said there were “no buyers out there“; he said that “sentiment measures are really extreme” and he “wants to be greedy when others are fearful“.

Why was Craig Johnson relegated to the last couple of minutes of Friday’s 4 pm show when the host & presumably the show’s handler knew he was going to say Buy? Especially when the show spent several times longer discussing theory about China in the show’s opening segment! Then the CNBC show did NOT put the clip of Mr. Johnson’s bullish statements on YouTube or on CNBC.com!!!!

As we recall, Craig Johnson has come on CNBC during some previous serious downturns & essentially said buy. On those occasions, he has been proved right. So why was his appearance not put on CNBC’s website? Was a theoretical conversation about China so important to CNBC on that turmoil-ridden Friday after the close? As we have said before, CNBC’s priorities perplex us.

Below is a summary of the thoughts of a sensible practitioner:

A quick look at the last week via US Indices & some key stocks:

2. US vs. Europe & China

The evidence is clear so far in 2025:

Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – Europe is having a year! +13% YTD. USA dead last.

Given this near-consensus, we were pleasantly surprised to hear Stephanie Link say on CNBC Half-Time on Tuesday that “I would fade Europe in a heartbeat”; … Europe over USA is done“.

We also saw:

Also on Tuesday, we saw:

That brings us to the clip that CNBC Closing Bell Overtime chose to feature as its top story after a horrible day in the US Stock market while relegating to the bottom Craig Johnson’s bullish views on US stocks. Read what Gary Dvorchak, Blueshirt Group managing director, said at the beginning of the segment:

This is important stuff no doubt in a strategy sense but the clip doesn’t include any views about the Chinese Stocks/ADRs US investors own. We don’t get why CNBC chose this “robust” discussion to lead the after-market show on the worst Friday of 2025.

Stephanie Link said on Tuesday on CNBC Half-Time that she only owns China via US companies in China. Then she added “Best value internationally is India; best earnings growth between now & 2030; that’s where you have to put money; you will see 6% type growth“. For a more detailed discussion on India, see the clip of Jim Walker, Chief Economist of the Alethia Group in Honk Kong.

A quick look at last week in International Stocks;

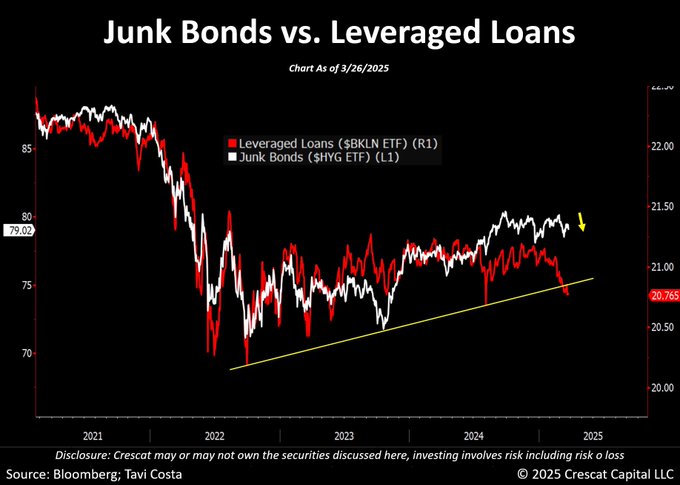

3. Fixed Income vs. Equities

Think back to 2007-2008. How long did the Fed resist lowering rates despite steady erosion in the soft data? They waited too long & then they panicked to little avail. Now we are seemingly back to a similar situation. The soft data is not only getting weak but it is getting weaker & faster. But it is not yet showing up in the hard data, labor data. So this Fed is publicly resistant to the idea of easing sooner.

This was brought up again this week by Max Kettner, chief multi-asset strategist at HSBC, a man who has been right more often than wrong. Look what he said to BTV’s Jonathan Ferro this week:

So what could happen? Kettner said:

So Kettner is now negative on US Equities & Under-weight High -yield credit & Under-weight Investment Grade credit. Guess that leaves Treasuries. Now look what Treasury rates did on Friday despite a stronger PCE number:

Another money manager agrees:

The Fed signals that it doesn’t care yet. Is that because they disagree with the above risks OR because they are terribly afraid of a really big storm they face in the Treasury market?

How do we know while Fin TV economic reporters don’t know or pretend to not know? We know because, despite being of simple minds, we can read. Read what 4 economics luminaries named Anil Kashyap, Jeremy Stein, Jonathan Wallen & Joshua Younger published last Wednesday, March 26, 2025 on Brookings.edu. CNBC viewers might recall that Steve Liesman recently said Fed Chair Powell considers Anil Kashyap as the smartest economist he has met.

The title of their article is – Treasury market dysfunction and the role of the central bank. Excerpts below might help understand the scale of the problem.

- The authors recommend that the Federal Reserve, in periods of extreme stress, be prepared to take over the hedge funds’ positions. As before, the Fed could stand ready to purchase Treasury securities but it would also, as the hedge funds do, take offsetting short positions in derivatives.

So the Fed has to be ready to take over the mega ($4 trillion+?) Treasury positions of Hedge Funds? How puny does that make the Long Term Capital bailout? Is this why the financial stocks did what they did last week?

- BAC down 2.8%; C down 2.3%; GS down 4.2%; JPM up 23 bps; KRE down 1.8%; EUFN up 3 bps; SCHW down 94 bps; HDB up 2%; IBN down 6 bps;

How bad did it get in March 2020? As the report states – “the Federal Reserve purchased more than $4 trillion of Treasuries and government-backed mortgage securities to calm turmoil in those markets triggered by the COVID pandemic“. How much bigger would be a 2025 purchase bailout? Let’s not even think how tiny was the Long Term Capital crisis that threatened to destroy Wall Street!

Those who prefer to have someone explain such stuff to them instead of reading it might watch the clip below. We would recommend you ignore the sensation creating title of the clip that really focuses on the above Brookings Report:

With all this stuff, are we glad we have an expert like Treasury Secretary Scott Bessent to manage this mess which was left behind by whoever? You Bet!

4. Our two cents

Despite all the above, we tend to concur with Craig Johnson, Ryan Detrick & the others who are looking ahead. Not because we know even a fraction of these veterans know but because we are simple in our mind & thinking. Think back to March 2023 when Schwab stock cratered because of bond maturity crisis. Think way back to March 2008 when the Bear Stearns hedge funds cratered. One worked well, one didn’t. BUT remember that both blowups in March-April were smoothened without a crisis. What we see is that crisis that erupts in March-April is almost always gets addressed & at least temporarily solved without major market damage.

We expect the same with the fast & frightening stock market correction going on & the specter of the basis point turmoil in the Treasury market. We can’t speak about the September-October timeframe but this crisis in March-April 2025 should get resolved to the upside.

But when Friday close is as bad as Friday March 28 was, prudence since 1987 dictates purchase of 1-2 days puts way out of the money, such as for example March 31 QQQ 450 puts for $0.12 cents. Probably amateurish stupidity but 12 cents is worth a pleasant weekend!

Send your feedback to [email protected] Or @MacroViewpoints on X.