How Investors Are Reacting To Tesla (TSLA) Leadership Change in AI and Robotics Amid Ongoing Robotaxi Trials

Tesla shareholders need to believe in the company's capacity to execute on its ambitious AI and robotics vision, while weathering volatility from executive turnover and external headlines. The recent departure of the Optimus robotics head, followed by Ashok Elluswamy stepping in, has drawn more investor attention but does not appear to materially affect the most important short-term catalyst: the progression of Tesla's robotaxi trials. The biggest immediate risk remains political and regulatory uncertainty tied to high-profile leadership disputes.

Tesla’s recent rollout of robotaxi testing in Austin stands out as especially relevant, given the leadership changes in its robotics division. As these autonomous vehicle initiatives continue to be watched closely, both new management stability and successful expansion of robotaxi trials will likely be priority areas for investors focused on near-term catalysts.

In contrast, some investors may be overlooking the heightened regulatory and political challenges, details of which could significantly reshape the risk profile...

Read the full narrative on Tesla (it's free!)

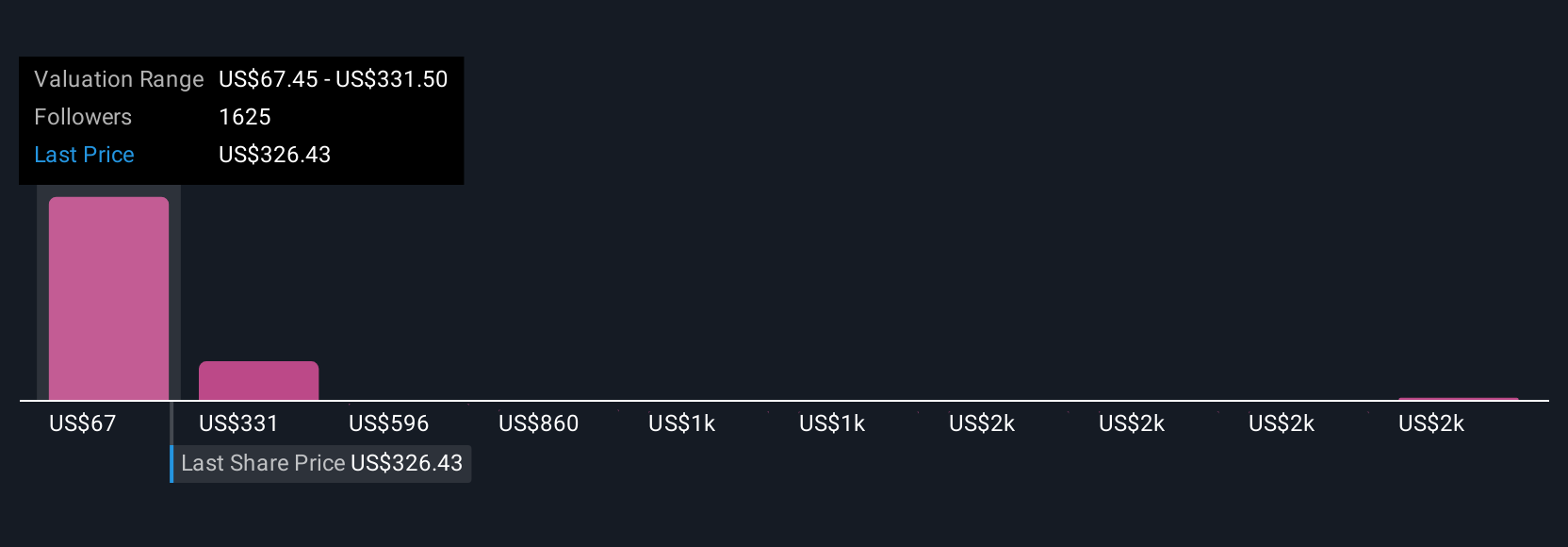

Private fair value estimates from 186 members of the Simply Wall St Community range widely from US$67 to US$2,707 per share. With executive turnover heightening questions around Tesla's innovation trajectory, these varied forecasts show how much investor opinions can differ, consider reviewing multiple viewpoints for a fuller picture.

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

Every day counts. These free picks are already gaining attention. See them before the crowd does:

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring

Alternatively, email [email protected]

You may also like...

1986 Cameroonian Disaster : The Deadly Cloud that Killed Thousands Overnight

Like a thief in the night, a silent cloud rose from Lake Nyos in Cameroon, and stole nearly two thousand souls without a...

Beyond Fast Fashion: How Africa’s Designers Are Weaving a Sustainable and Culturally Rich Future for

Forget fast fashion. Discover how African designers are leading a global revolution, using traditional textiles & innov...

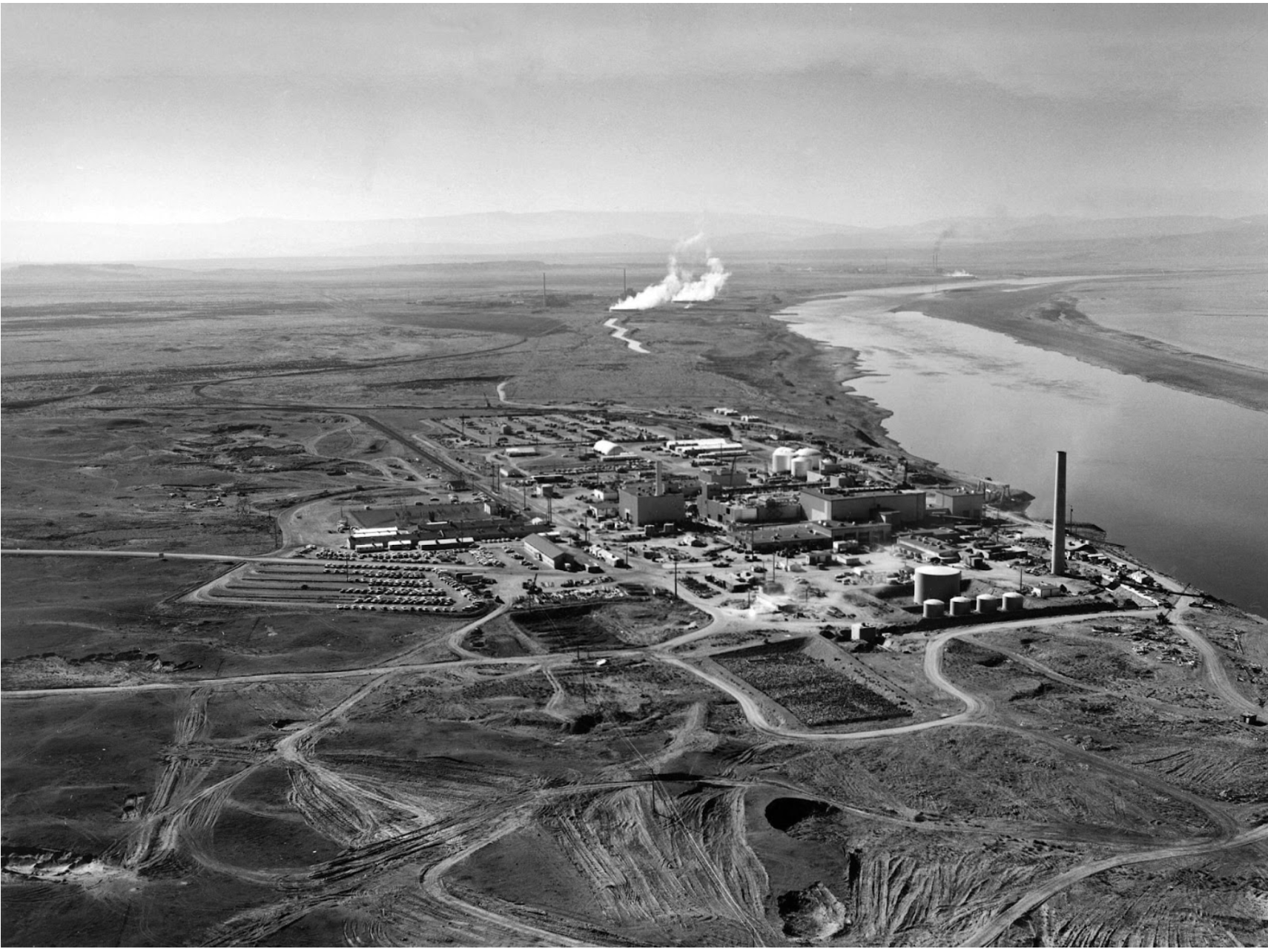

The Secret Congolese Mine That Shaped The Atomic Bomb

The Secret Congolese Mine That Shaped The Atomic Bomb.

TOURISM IS EXPLORING, NOT CELEBRATING, LOCAL CULTURE.

Tourism sells cultural connection, but too often delivers erasure, exploitation, and staged authenticity. From safari pa...

Crypto or Nothing: How African Youth Are Betting on Digital Coins to Escape Broken Systems

Amid inflation and broken systems, African youth are turning to crypto as survival, protest, and empowerment. Is it the ...

We Want Privacy, Yet We Overshare: The Social Media Dilemma

We claim to value privacy, yet we constantly overshare on social media for likes and validation. Learn about the contrad...

Is It Still Village People or Just Poor Planning?

In many African societies, failure is often blamed on “village people” and spiritual forces — but could poor planning, w...

The Digital Financial Panopticon: How Fintech's Convenience Is Hiding a Data Privacy Reckoning

Fintech promised convenience. But are we trading our financial privacy for it? Uncover how algorithms are watching and p...