Hollywood's Desperate Plea: Can Congress Halt Netflix's WB Mega-Deal?

The proposed acquisition of Warner Bros. Discovery (WBD) by Netflix, for an estimated $72–82 billion, is poised to send seismic shockwaves through Hollywood. This mega-merger arrives at a critical moment for an industry already grappling with massive consolidation, labor strikes, and a theatrical landscape struggling to recover. If approved, the deal could fundamentally reshape global entertainment, merging one of the world’s largest streaming platforms with a studio defined by its deep theatrical heritage.

At the center of the industry’s growing anxiety is the stark ideological clash between the two companies. Warner Bros. is synonymous with blockbuster cinematic experiences—from DC tentpoles and Barbie to Dune and Harry Potter—franchises built on long theatrical windows and worldwide rollouts. Netflix, by contrast, has spent a decade perfecting a model of immediate streaming access, often bypassing traditional theaters altogether. This contradiction has sparked alarm across Hollywood.

A consortium of “concerned feature film producers” recently issued an open letter to Congress, warning that Netflix’s acquisition could “destroy the theatrical ecosystem.” Their fears center on the likelihood of drastically shortened theatrical windows, or worse, a full shift away from theater-first releases. Such a move, they argue, threatens thousands of jobs and collapses the revenue generated through downstream licensing. The producers also cited past statements by Netflix co-CEO Ted Sarandos, who has repeatedly insisted that “driving folks to a theater is just not our business.”

Sources close to the negotiations indicate that Netflix may shorten Warner Bros.’ theatrical windows to just a few weeks before films move to streaming. While Netflix’s formal announcement softened its wording—claiming it “expects” to maintain theatrical operations—Sarandos later told analysts that theatrical windows would “evolve to be more consumer-friendly,” widely interpreted as a euphemism for shorter release periods.

Global theater owners, represented by Cinema United, condemned the merger as an “unprecedented threat to the exhibition business,” warning of severe consequences for multiplexes and small-town theaters alike. Alongside the anonymous producers, they have urged Congress to apply “the highest level of antitrust scrutiny,” framing the stakes not just economically but culturally.

Meanwhile, rival studio Paramount has been unusually vocal in opposing Netflix’s bid. Paramount—armed with an all-cash offer backed by Larry Ellison—warned WBD executives that a Netflix–Warner deal may “never close” under U.S. or foreign antitrust laws. Their argument appears to be gaining traction: a senior administration official described the White House’s position as one of “heavy skepticism.” Paramount has also been briefing lawmakers, highlighting Netflix’s alleged attempt to include TikTok and YouTube as competitors, which they argue is a strategic attempt to skirt traditional antitrust definitions.

Paramount, in contrast, pledged to operate Warner Bros. as a standalone studio, promising at least 14 theatrical releases annually—a stance designed to appeal to Washington’s pro-competition instincts. Most observers expect the regulatory battle to be long, contentious, and deeply political in both Washington and Europe.

Offering an expert perspective, David King, Higdon Professor of Management at Florida State University and a mergers-and-acquisitions specialist, explained to Collider that the deal reflects a larger industry trend toward consolidation. According to King, companies like Disney, Amazon, and Netflix are converging into a marketplace dominated by a handful of massive players. He describes Netflix as a hybrid technology-and-entertainment entity, uniquely positioned to pursue aggressive acquisitions.

King noted that Netflix likely sees this moment as a rare chance to acquire irreplaceable content, especially as consumer behavior increasingly shifts from theaters to streaming. This shift, he argues, places immense pressure on traditional studios such as Paramount and Universal. Even if certain films still benefit from theatrical prestige, the broader trend favors streaming dominance. In essence, King believes we are witnessing a landscape consolidating around three major companies—Disney, Netflix, and Amazon—aligned with modern content consumption habits.

While Netflix insists that viewers will not see immediate changes—mergers of this magnitude often take over a year to finalize and face prolonged reviews—long-term shifts are inevitable. A major point of speculation is the future of HBO Max. Although Netflix denies any immediate intent to merge platforms, it has hinted at future bundling, which would instantly create the most expansive SVOD offering on the planet.

Content strategy is also likely to change. Netflix’s goal is not nostalgia but volume. Owning Warner Bros. would accelerate IP mining, reshape greenlighting decisions, and echo Amazon’s approach after acquiring MGM. Most importantly, Warner’s vast library—from Friends and Looney Tunes to decades of HBO classics—would be a streaming goldmine, dramatically reducing Netflix’s licensing costs while strengthening subscriber loyalty in an era where streaming is a digital nostalgia engine.

This potential merger is far more than another Hollywood shuffle—it represents an unprecedented consolidation of power within a single entertainment platform. Netflix, already a global architect of modern streaming, would gain significant influence over theatrical strategy through Warner Bros. This dual dominance has no modern precedent and is precisely why producers, exhibitors, and rival studios are sounding alarms.

Whether regulators approve or block it, this moment is undeniably pivotal. It signals a more aggressive phase in the streaming wars, one in which major players are no longer just competing but absorbing each other. For an industry still reeling from disruption, the merger forces a crucial question:

What happens when a platform built on skipping theaters becomes the new owner of a studio defined by them?

You may also like...

NBA Bombshell: LeBron James and Ayton Out for Pacers Clash!

The Los Angeles Lakers will be severely impacted by injuries, with LeBron James, Deandre Ayton, and Maxi Kleber all side...

Man City Stays: Pep Guardiola Drops Major Hint on Future!

Pep Guardiola has hinted at staying at Manchester City, expressing confidence that his team will reach its full potentia...

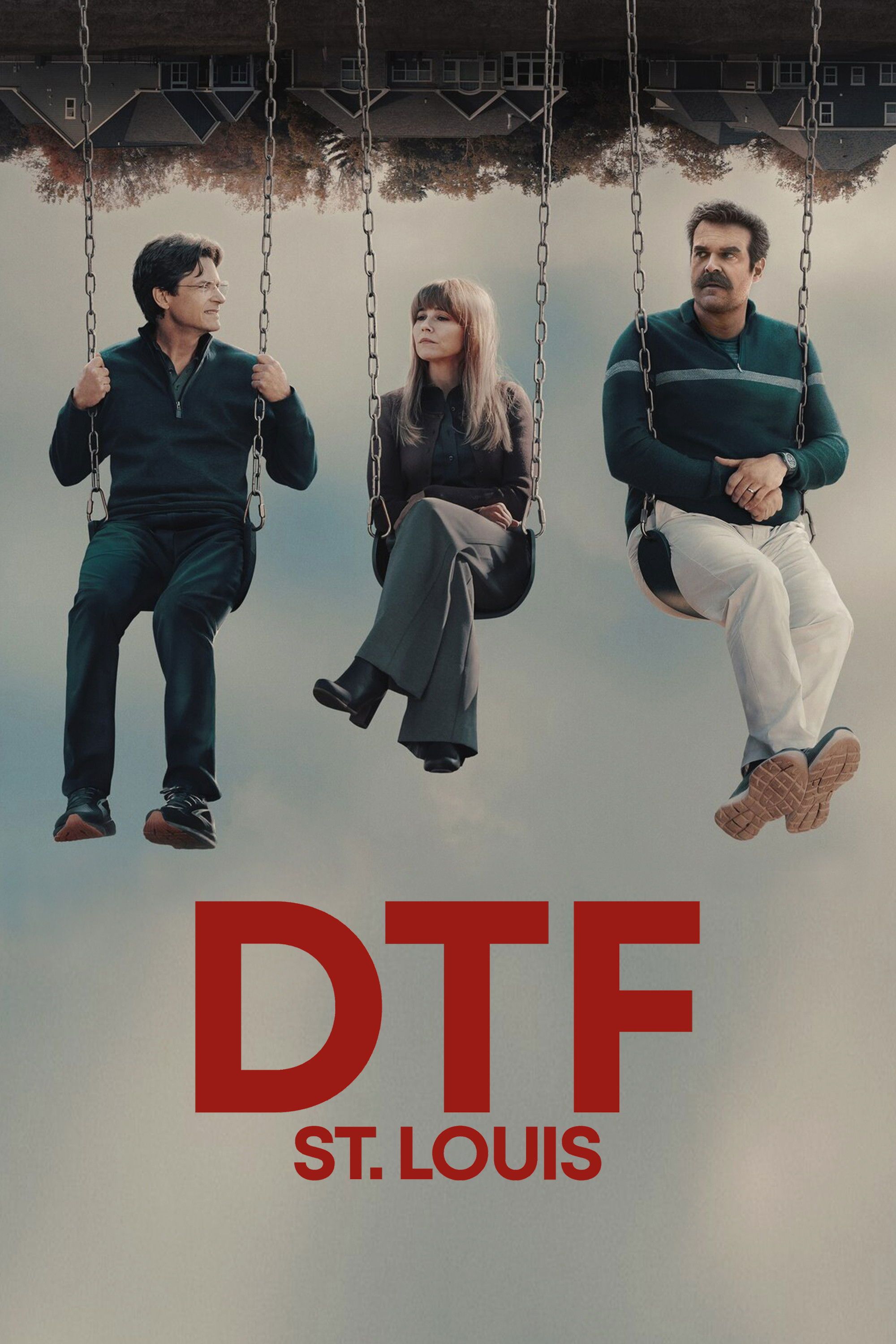

HBO's New Crime Thriller Dethrones 'A Knight of the Seven Kingdoms' in Streaming Battle

HBO Max is currently showcasing two notable series: 'DTF St. Louis,' a star-studded crime story praised for its blend of...

SZA Slams Chart Predictions, Defying Taylor Swift Comparison: 'Anything Is Possible!'

SZA's album SOS defied expectations by topping the Billboard 200 over Taylor Swift, a feat her label initially doubted. ...

Sam Asghari Demands Privacy Amid Britney Spears’ DUI Arrest After Explosive Comments

Sam Asghari has addressed Britney Spears' recent DUI arrest during a Fox News interview, calling for privacy for his ex-...

Giant Meets Miniature! World's Tallest Dog Shares Paws With the Smallest Canine Star!

The world's shortest dog, Pearl the Chihuahua, and a towering Great Dane named Reggie, had an unforgettable playdate arr...

End of an Era: Girl Scouts Announce Retirement of Two Beloved Cookie Flavors After 2025 Season!

Girl Scout cookie season is officially underway, but fans should prepare to say goodbye to Toast-Yay! and S’mores, which...

Unlock Peak Performance: Timing Magnesium for Ultimate Muscle Recovery

:max_bytes(150000):strip_icc()/Health-GettyImages-MagnesiumBeforeOrAfterWorkout-1012169458424c3791686bd6c68427e5.jpg)

Magnesium is vital for athletes, supporting muscle function, energy, and recovery, with increased demands during intense...