Goldman Sachs Sounds Alarm: First Brands Face Imminent Bankruptcy Threat!

Auto-parts supplier First Brands Group is facing significant financial distress, with analysts on a Goldman Sachs Group Inc. trading desk expressing "serious doubts" about the company's ability to avoid bankruptcy. These concerns, detailed in a recent client note, stem from First Brands' intricate financing arrangements and substantial debt obligations.

At the heart of the analysts' apprehension are specific financing deals that reportedly carry exceptionally high interest rates, in some cases exceeding 30%. The company is currently engaged in discussions with its creditors to explore various options for restructuring its colossal $6 billion debt, a situation that could potentially lead to a Chapter 11 bankruptcy filing.

Further exacerbating investor concerns is First Brands' reported use of "factoring," an off-balance sheet tactic where companies sell their future revenues for immediate cash. This practice has led to a recent tumble in the value of First Brands’ loans. Goldman Sachs analysts, working outside the bank’s traditional research division, have identified "interesting tidbits that appear off balance sheet but hard to reconcile," highlighting the opacity and complexity of the company's financial structure.

Despite the severity of the situation, Goldman's desk analysts suggest that most of the impending challenges are already accounted for in First Brands’ broadly syndicated debt. On Wednesday, the company’s first-lien loans were quoted between 44.5 and 46.5 cents on the dollar. First Brands Group is known for manufacturing essential auto components such as windshield wipers, water pumps, and filters.

The financial turmoil has left creditors facing potential losses in the billions of dollars. For investors, several critical questions remain unanswered should the company proceed with bankruptcy. These include determining the precise size of any potential debtor-in-possession (DIP) financing, which would take priority over existing creditors; assessing the company's actual profitability once the off-balance sheet debt is unwound; and understanding the ultimate amount of equity creditors would retain in a reorganized entity. Both Goldman Sachs and First Brands have refrained from commenting on the situation.

You may also like...

Bournemouth's Summer Nightmare: £200M Player Exodus Sparks Fan Fear

Bournemouth's decision to retain Antoine Semenyo has been a masterstroke, as the Ghana winger's exceptional performances...

WNBA Finals Game 1 Shocker: Dana Evans, Aces Crush Mercury

The Las Vegas Aces secured an 89-86 victory over the Phoenix Mercury in Game 1 of the 2025 WNBA Finals, driven by their ...

Shocking Ax: Fox Pulls the Plug on Beloved Animated Series 'Great North'

Fox has officially canceled the animated comedy <i>The Great North</i> after five seasons, concluding its run in Septemb...

Unveiling the Horrors: Inside Netflix's Ed Gein Story & Star's Chilling Connection

The Netflix series "Monster: The Ed Gein Story" delves into the life and crimes of the notorious serial killer, explorin...

Backstreet Boys Unleash AI, Brazilian Love, and Millennium Legacy on Tour

Celebrating over three decades in music, Nick Carter and Howie Dorough of the Backstreet Boys reflect on their enduring ...

Ozzy Osbourne's Harrowing Final Confessions Before His Death in Poignant New Documentary

A new documentary, 'Ozzy Osbourne: No Escape From Now,' posthumously showcases the rock legend's final reflections on hi...

Noel Gallagher Unleashes Brutal Critique on Taylor Swift Amid Her 12th Album Launch

Noel Gallagher offers his characteristically blunt, mixed opinions on Taylor Swift's success and modern pop strategies, ...

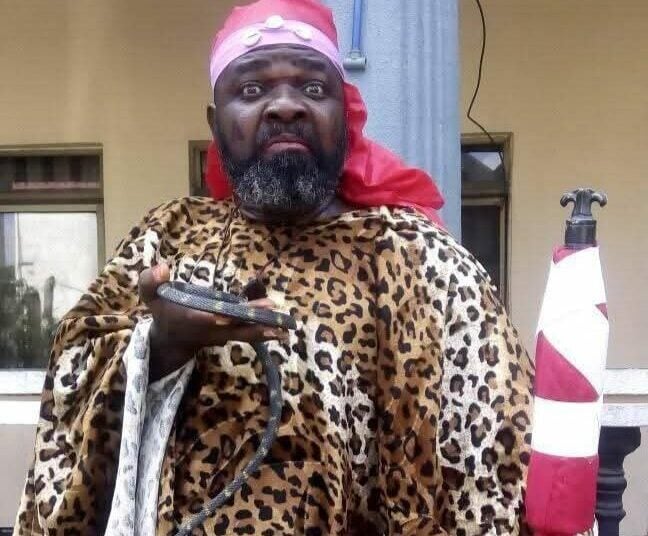

Tragedy Strikes Nollywood: Veteran Actor Duro Michael Passes Away At 67

Nollywood mourns the passing of veteran actor Duro Michael at 67, following a battle with a terminal illness. Producer S...