Wall Street Roars: Goldman Sachs Forecasts Staggering M&A Boom for Startups by 2026

Goldman Sachs Inc. anticipates a substantial increase in global dealmaking towards the close of the current year, with a strong possibility that 2026 could set a new record for mergers and acquisitions (M&A) activity. According to Tim Ingrassia, Goldman’s co-chairman of global mergers and acquisitions, the bank projects global deal flow to reach approximately $3.1 trillion this year, escalating to $3.9 trillion in 2026. This forecasted figure for 2026 would surpass the previous record of $3.6 trillion in M&A recorded in 2021, based on data from research firm Dealogic, which excludes deals involving special purpose acquisition companies.

Ingrassia, speaking at the bank’s 15th Annual EMEA Credit and Leveraged Finance Conference in London, expressed that if the present momentum continues, 2026 indeed has the potential to become an all-time high for M&A activity. M&A activity has seen a gradual build-up over the summer, rebounding from a sluggish start to the year, which was characterized by volatility related to US trade tariffs that dampened enthusiasm for dealmaking. Despite this, the total number of takeovers remains roughly consistent with the previous year, punctuated by a few notable transactions, such as Union Pacific Corp.’s agreement to acquire railroad operator Norfolk Southern Corp. for over $80 billion, including debt.

This optimistic outlook from Ingrassia aligns with earlier statements made by Christina Minnis, Goldman’s global head of credit finance. Minnis observed a significant uptick in the willingness of corporate boardrooms and sponsors to engage in transactions. She expressed considerable optimism for the latter part of 2025 and moving into 2026, noting that some companies are capitalizing on favorable credit markets to pursue acquisitions that might have been unattainable in the past. Concurrently, some sponsor portfolio companies are re-engaging in dealmaking after a period primarily focused on dividend recaps.

A major driving force behind this anticipated activity is the rush to construct the necessary infrastructure to support the burgeoning field of Artificial Intelligence (AI). Minnis highlighted that an analysis by Bloomberg News last year estimated that at least $1 trillion would be allocated to data centers, electricity suppliers, and communications networks. She emphasized the incredible developments in infrastructure, predicting that this will necessitate significant financing, largely driven by advancements in AI, computing, and data centers. This trend suggests that a substantial amount of capital raising will be required over the next decade. In Europe, specific regulations are expected to limit the traditional role of banks as infrastructure financiers, thereby pushing more of this financing towards capital markets.

You may also like...

Chaos Erupts at Derby Clash: Fans Chase Players Down Tunnel as Riot Police Fail

A German derby match between Hallescher and Chemie Leipzig ended in chaos as home fans stormed the pitch, attacking visi...

Chelsea BOMBSHELL: Maresca Axes £97M Star Sterling from First Team in Brutal Squad Shake-Up

Chelsea manager Enzo Maresca has definitively sidelined Raheem Sterling, Axel Disasi, and David Datro Fofana, confirming...

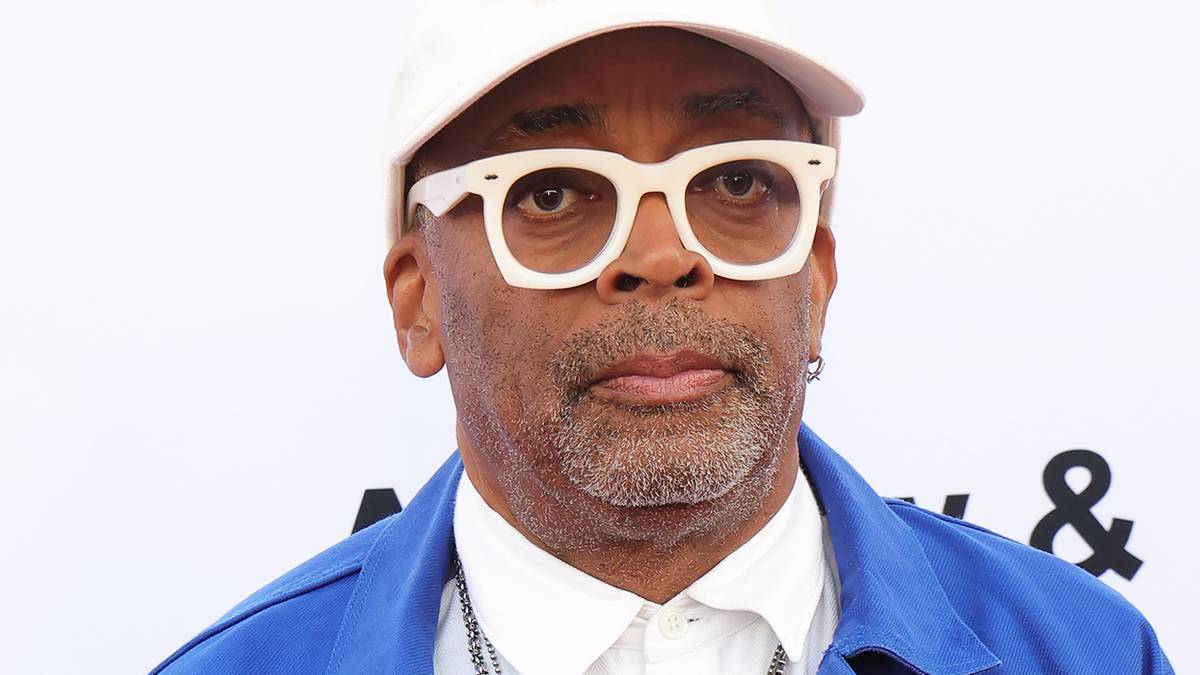

Spike Lee's Hidden Gem: Director Calls for Recognition of Overlooked 'Game of Thrones' Collaboration

Spike Lee's 2002 film, "25th Hour," is celebrated by the director himself as an underrated masterpiece, offering a poign...

Hollywood Shocker: Sean Astin Elected SAG-AFTRA President, Succeeding Fran Drescher

Sean Astin, known for his roles in "Rudy" and "The Lord of the Rings," has been elected president of SAG-AFTRA, succeedi...

Shocking Split: Akon's Wife Files for Divorce After Nearly Three Decades!

Akon's wife, Tomeka Thiam, has filed for divorce, citing irreconcilable differences, just shy of their 29th wedding anni...

Unlock Instant Savings! Two-Minute Trick Reveals £300 Bill Reduction

UK households could save over £300 annually by adopting a simple 'shower pause' technique, turning off the water while l...

Sophie Turner Unleashes Horrifying Truths of 'Young Actress World' in New Thriller

Sophie Turner and director Carlson Young discuss their new thriller 'Trust,' which explores themes of privacy, technolog...

Daily Pulse: Africa's Travel Headlines, September 12, 2025

South Sudan's Vice-President Riek Machar faces murder and treason charges, while South Africa's Constitutional Court gra...