Global week ahead: Banking bellwethers and a tariffs waiting game

Next week, the CNBC teams are back on the road – and it's all about the banks and the ECB. From Frankfurt to Milan, and Paris to London, the financials are in focus.

Banking bellwethers

The markets seem to be banking on the financial sector to keep up the positive earnings momentum this quarter. Citi described the first quarter as "remarkably resilient," with analysts now expecting Stoxx 600 earnings-per-share growth to turn positive year-on-year this quarter.

Much of that optimism is centered on the big banks, while other sectors like luxury, autos and energy have been plagued by earnings downgrades.

Unicredit kicks things off on Wednesday. The Italian banking giant will try to keep investors focused on the numbers, rather than its M&A ambitions. While its moves around Commerzbank have seen it increase its equity stake to 20%, Saxo Bank analysts highlight the uncertainty around its potential takeover of Banco BPM, after an Italian court blocked the move until further conditions are met. The stock is up over 50% so far this year, providing some cheer for CEO Andrea Orcel as he battles to keep his expansion plans on track.

French financial BNP Paribas — the euro zone's largest lender by assets — reports earnings on Thursday.

Last quarter, the bank soared past expectations driven by performance at its investment bank, but revised its profitability target slightly lower.

On the same day, attention will turn to Frankfurt for Deutsche Bank's latest set of numbers. The German lender logged its best profit in 14 years last quarter, benefiting from increased trading volumes around the market volatility. CEO Christian Sewing told CNBC in June that he sees an opportunity for Europe to invest more in its own defense sector as a key growth area.

The waiting game

For macro-watchers, the highlight of the week in Europe will come from the European Central Bank. President Christine Lagarde and her fellow policymakers are expected to keep rates on hold at 2% on Thursday. But there is a BIG catch…

U.S. President Donald Trump's tariff threats are not expected to derail this meeting's outcome, according to Reuters, citing five ECB governing council member sources. But if Trump does push ahead with 30% tariffs on EU imports, there is a broad assumption the ECB will cut rates in response.

Investors will have until Sept. 11 to assess the impact, as the ECB breaks for the summer after this week's meeting.

Inflation situation

In terms of the underlying economic conditions, Deutsche Bank warns that European inflation risks are "still being underestimated, with a remarkable complacency across key assets," with the tariff impact yet to fully trickle through.

The bank's macro strategist also told CNBC's Squawk Box Europe that the Aug. 1 tariff deadline for negotiations between the U.S. and EU sets the stage for a late outcome to trigger a "very sharp market reaction."

Recommended Articles

Global week ahead: Banking bellwethers and a tariffs waiting game

From Frankfurt to Milan, and Paris to London, next week it’s all about the banks.

Sanford C. Bernstein Upgrades Sonova (OTCMKTS:SONVY) to Strong-Buy

Sanford C. Bernstein raised Sonova from a "hold" rating to a "strong-buy" rating in a research note on Friday.

ONDC plans subsidy revival for food delivery; Rs 100-150 crore incentive pool proposed - check details

India Business News: ONDC is considering reinstating subsidies for food delivery partners with a Rs 100-150 crore incent...

global oil market trends: Oil prices may plunge below $60 as OPEC+ ramps up production - here's what Goldman Sachs and BNP Paribas are predicting for the global energy market - The Economic Times

Oil prices are expected to fall below $60 per barrel as OPEC+ ramps up production, shaking up the global energy market. ...

EU Tells U.S. Tech it Won't 'Stop the Clock' on AI Crackdown | Markets Insider

EU Tells U.S. Tech it Won’t ‘Stop the Clock’ on AI Crackdown

You may also like...

1986 Cameroonian Disaster : The Deadly Cloud that Killed Thousands Overnight

Like a thief in the night, a silent cloud rose from Lake Nyos in Cameroon, and stole nearly two thousand souls without a...

Beyond Fast Fashion: How Africa’s Designers Are Weaving a Sustainable and Culturally Rich Future for

Forget fast fashion. Discover how African designers are leading a global revolution, using traditional textiles & innov...

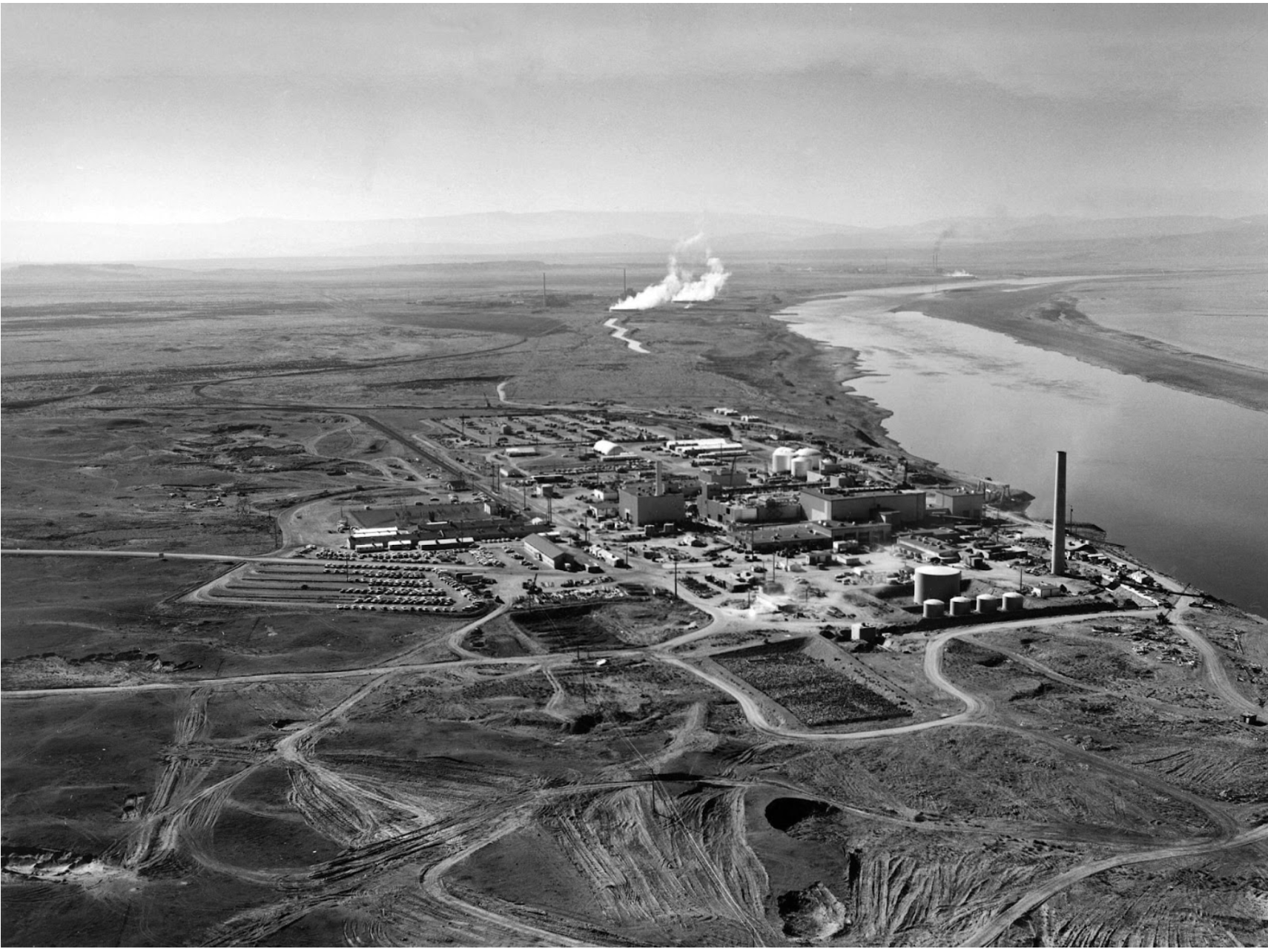

The Secret Congolese Mine That Shaped The Atomic Bomb

The Secret Congolese Mine That Shaped The Atomic Bomb.

TOURISM IS EXPLORING, NOT CELEBRATING, LOCAL CULTURE.

Tourism sells cultural connection, but too often delivers erasure, exploitation, and staged authenticity. From safari pa...

Crypto or Nothing: How African Youth Are Betting on Digital Coins to Escape Broken Systems

Amid inflation and broken systems, African youth are turning to crypto as survival, protest, and empowerment. Is it the ...

We Want Privacy, Yet We Overshare: The Social Media Dilemma

We claim to value privacy, yet we constantly overshare on social media for likes and validation. Learn about the contrad...

Is It Still Village People or Just Poor Planning?

In many African societies, failure is often blamed on “village people” and spiritual forces — but could poor planning, w...

The Digital Financial Panopticon: How Fintech's Convenience Is Hiding a Data Privacy Reckoning

Fintech promised convenience. But are we trading our financial privacy for it? Uncover how algorithms are watching and p...