GH¢2.3M Diesel Smuggling Ring Decimated in Major Tax Evasion Bust

The Ghana Revenue Authority’s (GRA) Customs Preventive Unit, in a collaborative effort with National Security, has successfully disrupted a significant diesel diversion syndicate. This operation thwarted an attempt to evade customs taxes amounting to approximately GH¢2.3 million, highlighting a recurring pattern of illicit activities that have historically led to substantial revenue losses for the State.

Over the past few months, the GRA and National Security have intensified their efforts, leading to numerous arrests of Oil Marketing Companies (OMCs) found engaged in the diversion of petroleum products. These companies sought to circumvent due process and evade taxes, posing a serious threat to national revenue integrity.

The recent bust involved the interception of ten trucks, collectively loaded with an estimated 540,000 litres of Automotive Gas Oil (AGO), commonly known as diesel. This interception serves as a clear indicator of the GRA's heightened vigilance and unwavering commitment to safeguarding national revenue, thereby supporting Ghana’s broader economic recovery efforts.

Commissioner General of the Ghana Revenue Authority, Anthony Kwasi Sarpong, addressing journalists, revealed the sophisticated methods employed by these syndicates. He noted that the perpetrators deliberately disengaged tracking devices affixed to the trucks just minutes after loading the product. Based on intelligence, the joint team tracked these vehicles to the port, where they were initially suspected to be designated for export. However, upon inspection, it was discovered that no vessel was assigned to receive the product. Further investigations confirmed that the company had deactivated the tracking devices and diverted the tankers under the cover of darkness. Instead of proceeding with an export process, the trucks exited the port area around 3:00 a.m. and were subsequently traced and intercepted at the Kpone enclave.

In response to this brazen attempt at tax evasion, the intercepted vehicles have been impounded in strict adherence to the Customs Law, and comprehensive investigations are currently underway. Commissioner Sarpong reiterated that preliminary estimates suggest this single illegal operation alone could have cost the State approximately GH¢2.3 million in taxes and levies.

The GRA has also initiated a forensic audit into the operations of all identified OMCs. The Authority has made it clear that individuals found culpable of tax evasion, smuggling, and diversion of petroleum products will face the full force of necessary sanctions. Under the leadership of the President and in alignment with the national agenda to restore integrity to revenue systems, the GRA remains resolute in its mission to dismantle such illegal networks that undermine collective progress.

Commissioner Sarpong issued a stern warning, stating, "Let me state clearly: this Authority will not tolerate any act that seeks to defraud the state or undermine the integrity of our petroleum export regime." He further disclosed that the GRA is significantly enhancing its monitoring, enforcement, and intelligence coordination with key partners, including National Security and the National Petroleum Authority (NPA), to ensure absolute compliance with all relevant laws. He urged all licensed petroleum operators, depot managers, and transporters to strictly adhere to established export and tax procedures, emphasizing that any entity or individual found complicit in these revenue-damaging schemes will face severe legal consequences.

Recommended Articles

Ghana's Economy Under Siege: Smuggling Surges as FABAG Blames High Import Duties

Ghana's economy faces a dire threat from escalating smuggling, warns the Food and Beverages Association of Ghana (FABAG)...

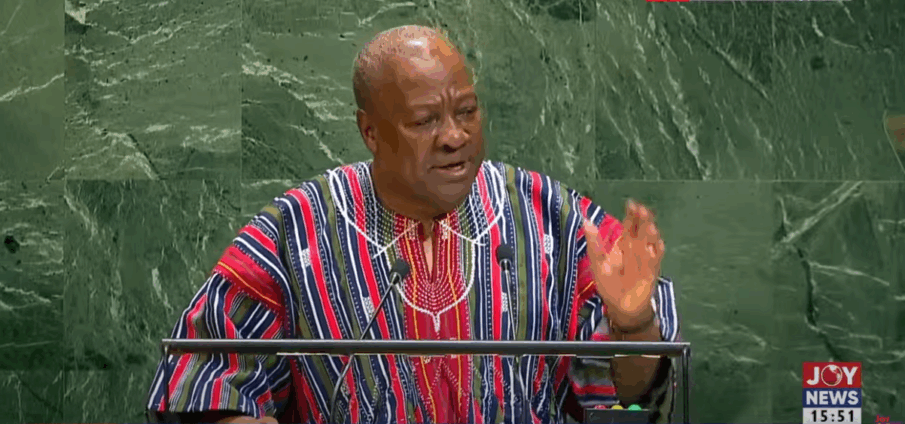

Mahama's Bombshell: Covid-19 Erased Decades of African Poverty, Political Rivals React

President John Mahama's recent address at the UN General Assembly garnered praise for his insights on global issues, tho...

Ghana's Gold Paradox: Record Prices Clash With Mining Struggles

Despite soaring global gold prices, Ghana's mining firms face mixed fortunes due to rising input costs and the need to m...

Education Scandal Rocks Ghana: Ministry Launches Major Probe into School Placement Bribery Allegations

The Ministry of Education has launched an urgent investigation into serious bribery allegations concerning the school pl...

Aso Rock on Alert: Police Vow Crackdown as Court Approves Nnamdi Kanu Protests

The Nigeria Police Force has warned against planned protests for the release of Nnamdi Kanu in Abuja, citing a Federal H...

You may also like...

Digital Portfolios Are the New Business Cards; Here’s How to Build One That Gets Seen

In today’s digital-first economy, your online portfolio is your handshake, résumé, and elevator pitch rolled into one. H...

Career Pivoting: Why Changing Paths Might Be the Smartest Move You Make

In a world where stability often overshadows fulfillment, career pivoting may be the smartest move for professionals se...

Why Your First Failure Might Be the Best Thing That Ever Happened to Your Business

Failure isn’t the end of entrepreneurship, it’s the education success never gives. Here’s why your first business collap...

Consumerism vs Culture: Is Africa Trading Values for Trendy Lifestyles?

Is Africa trading its cultural values for trendy lifestyles? Explore how consumerism, foreign brands, and social media p...

The War on Boys: Are African Male Being Left Behind in Gender Conversations

Why are African boys and men often left out of gender empowerment programs? Explore how emotional suppression, lack of m...

Pay Slip, Motivation Slips: The Silent Crisis Among the Working Class

Across Nigeria, millions of workers are trapped in jobs that pay just enough to survive but too little to live. Beneath ...

Premier League's Unsung Heroes: Bournemouth, Sunderland, and Tottenham Shockingly Exceed Expectations

This Premier League season sees teams like Bournemouth, Sunderland, and Tottenham exceeding expectations. Under Thomas F...

El Clasico Fury: Yamal Controversy and Refereeing Blunders Ignite Post-Match Debates

)

Real Madrid secured a 2-1 El Clasico victory over Barcelona amidst significant controversy surrounding a late penalty de...