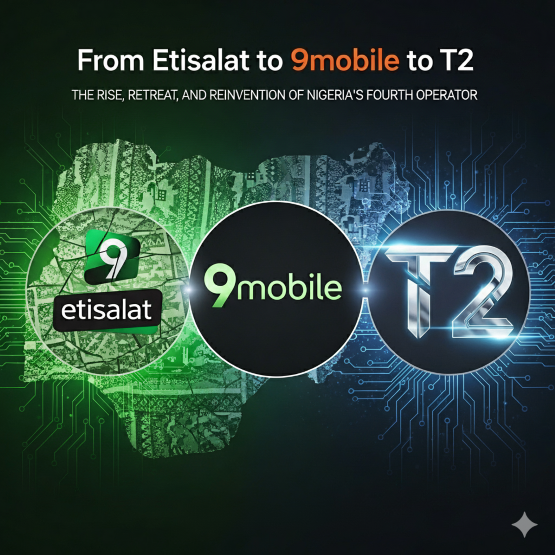

From Etisalat to 9mobile to T2: The Rise, Retreat, and Reinvention of Nigeria’s Fourth Operator

A New Challenger Arrives (2008)

In late October 2008, a glossy launch in Lagos announced a fifth GSM player in a market already shaped by MTN, Glo, and Airtel’s predecessors. The newcomer—Etisalat Nigeria, was the operating face of Emerging Markets Telecommunication Services (EMTS), a consortium promoted by Nigerian financier Hakeem Belo-Osagie alongside powerful Abu Dhabi interests: Mubadala Development Company and the Etisalat Group, which initially took a 40% stake and management control. EMTS had secured a unified access licence from the Nigerian Communications Commission in 2007, clearing the way for full mobile services on 900/1800 MHz spectrum. Commercial service kicked off on October 24, 2008.

From the start, the operator leaned into youth culture and urban cool—remember “0809ja”?, positioning itself as the nimble, customer-first alternative to behemoths that could feel monolithic. The strategy paid off. Between 2008 and 2016, Etisalat Nigeria grew into a double-digit-million network, peaking north of 22–23 million subscribers by late 2016, the year the macroeconomic tide began to turn.

The Founders’ Blueprint

Image Credit: Iciri Nigeria

The founding architecture mattered. Mubadala’s capital, Etisalat’s operational know-how, and EMTS’s local stewardship under Belo-Osagie offered a textbook blend: foreign investment and expertise yoked to Nigerian ownership and legitimacy. The licence terms were broad—fixed and mobile voice, long-distance, international gateway, allowing optionality beyond prepaid voice. In 2010, the operator added 3G capacity via the acquisition of Alheri Mobile Services, positioning for data growth. In a country where mobile was often the first and only internet, that bet looked prescient.

What Worked: Successes and Market Strategies

Brand clarity and youth focus. Etisalat’s “easycliq” and “0809ja” campaigns translated into cultural cachet. It priced aggressively, simplified offers, and courted early smartphone adopters—particularly in cities.

Network investment and experience. The early-2010s push into 3G and urban capacity delivered perceptible quality for data-hungry segments, a differentiator while rivals were still rationalizing their footprints.

Customer intimacy. Smaller scale helped Etisalat feel responsive—call centres, retail, and product tweaks skewed toward experience rather than sheer coverage bragging rights, a narrative that resonated with Nigeria’s young, mobile-first consumers. (Subscriber growth through 2016 told the story.)

The Unraveling: Debt, Dollar Scarcity, and a Brand in Free Fall

Behind the brand momentum was leverage. In 2013, Etisalat Nigeria took a $1.2 billion syndicated loan from a club of Nigerian and foreign banks to refinance earlier borrowings and fund network expansion. When oil prices crashed and FX liquidity dried up, servicing dollar debt from naira revenues became brutally hard. By early 2017, the company had defaulted; by June it had repaid roughly $500 million but still couldn’t square the circle.

In July 2017, after restructuring talks collapsed, the Etisalat Group terminated its management agreement and demanded the brand be phased out. A Nigerian asset had to stand on its own.

What followed was an emergency identity shift, Etisalat Nigeria rebranded to 9mobile within days—plus a regulator-supervised sale process. The Senate probed the loan; Barclays ran an auction; by late 2018, Teleology Holdings (fronted by former MTN Nigeria CEO Adrian Wood) emerged as preferred bidder and obtained regulatory approval.

The honeymoon was brief. Governance friction and funding constraints blunted the turnaround, and years of under-investment eroded network quality just as competitors doubled down on 4G and fiber backhaul. Market share fell; churn rose.

Survival Mode: 9mobile’s Long Middle

Image Credit: Telecoms.com

Latest Tech News

Decode Africa's Digital Transformation

From Startups to Fintech Hubs - We Cover It All.

If 2017–2023 was a holding pattern, it was a costly one. The company shed millions of subscribers, sliding from the mid-20 millions to single digits as customers sought reliability and nationwide reach elsewhere. That shrinkage wasn’t just marketing failure: it mirrored the hard math of capex starvation in a coverage-driven industry. An operator that doesn’t keep up on spectrum, sites, and transmission quickly loses not just speed tests, but mindshare.

A turning point arrived in 2024 when Lighthouse (LH) Telecommunication Limitedacquired a majority stake in EMTS/9mobile, giving the company a reset on ownership and, crucially, a path to capital and governance stability. A year later, in August 2025, the reset came with a new name. 9mobile transitioned to T2.

The Pivot to T2: What’s Different This Time?

Image Credit: Tech Cabal

The T2 rebrand is more than a palette swap. Management describes a four-phase recovery plan and a digital-first posture: smaller where it must be, partner-heavy where it can be. The most consequential proof is a national roaming arrangement with MTN Nigeria, effectively letting T2 subscribers lean on MTN’s ubiquitous radio network while T2 rebuilds selectively. In an industry where “more bars” still wins, that’s pragmatic judo. In July of 2025, early NCC-tracked data, points to the first net subscriber gain in nearly two years, against an overall market that actually shrank that month.

The branding thesis is sharper, too. T2 positions itself as agile and innovation-led—less a traditional MNO trying to match tower for tower, more a platform for digital services, MVNO-like partnerships, and lifestyle bundles. The public rollout in August 2025 framed “Transformation” as the current phase, with a refreshed leadership bench and talk of customer experience as a differentiator. Whether rhetoric becomes reality will depend on execution. But the scaffolding, ownership clarity, partnership strategy, and a cleaner balance-sheet story, is sturdier than it’s been in years.

What 9mobile Got Right, and Wrong

Image Credit: Fity Club

Strengths. The company has repeatedly demonstrated brand craft and customer intuition. In both 2008 and 2017, it built identities that felt contemporary. When funded, it invested smartly in urban data capacity and youth-skewing propositions. Those are teachable strengths for a challenger.

Weaknesses. Balance-sheet risk proved existential. Dollar debt in a volatile FX regime was a structural mismatch. Years of ownership churn—Etisalat’s exit, Teleology’s contested tenure, then a protracted search for a new majority investor—sapped capex at precisely the wrong time as rivals sprinted into 4G/4G+ and fiberized their RAN. Service inconsistency compounded the slide; between 2016 and 2024, active subscriptions cratered from the 20-millions to the low single-millions.

The Founders’ Legacy, Reconsidered

It’s tempting to index the “founders” solely to personalities. But the more interesting legacy is structural: EMTS’s local sponsorship gave the venture political and market legitimacy; Mubadala and Etisalat brought capital and playbooks. That blend produced real value until macroeconomics and leverage pulled the rug. The lesson for Nigerian telecoms is sobering: governance and capital structure can be as decisive as spectrum and marketing.

Can T2 Work?

T2 is an admission that the old 9mobile couldn’t win a coverage arms race. Its strategy is to change the rules: roam where it must, invest where it counts, and differentiate on experience and digital services. The early optics—earned media, stakeholder buy-in, and a flicker of subscriber growth—are encouraging. The risks are plain: roaming economics must pencil out; brand warmth must translate into daily reliability; and Lighthouse must keep the capex tap open long enough for trust to return.

But if the last 17 years say anything, it’s that Nigeria’s mobile market rewards those who read the moment. Etisalat read the moment in 2008; 9mobile misread it a decade later. T2 is a third reading—leaner, wiser, and hopefully more collaborative. In a country where connectivity is the gateway to work, school, and play, that may be exactly the kind of operator Nigeria needs.

You may also like...

If Gender Is a Social Construct, Who Built It And Why Are We Still Living Inside It?

If gender is a social construct, who built it—and why does it still shape our lives? This deep dive explores power, colo...

Be Honest: Are You Actually Funny or Just Loud? Find Your Humour Type

Are you actually funny or just loud? Discover your humour type—from sarcastic to accidental comedian—and learn how your ...

Ndidi's Besiktas Revelation: Why He Chose Turkey Over Man Utd Dreams

Super Eagles midfielder Wilfred Ndidi explained his decision to join Besiktas, citing the club's appealing project, stro...

Tom Hardy Returns! Venom Roars Back to the Big Screen in New Movie!

Two years after its last cinematic outing, Venom is set to return in an animated feature film from Sony Pictures Animati...

Marvel Shakes Up Spider-Verse with Nicolas Cage's Groundbreaking New Series!

Nicolas Cage is set to star as Ben Reilly in the upcoming live-action 'Spider-Noir' series on Prime Video, moving beyond...

Bad Bunny's 'DtMF' Dominates Hot 100 with Chart-Topping Power!

A recent 'Ask Billboard' mailbag delves into Hot 100 chart specifics, featuring Bad Bunny's "DtMF" and Ella Langley's "C...

Shakira Stuns Mexico City with Massive Free Concert Announcement!

Shakira is set to conclude her historic Mexican tour trek with a free concert at Mexico City's iconic Zócalo on March 1,...

Glen Powell Reveals His Unexpected Favorite Christopher Nolan Film

A24's dark comedy "How to Make a Killing" is hitting theaters, starring Glen Powell, Topher Grace, and Jessica Henwick. ...