You may also like...

Where is ₦5, ₦10, and ₦20 notes – Could the ₦50 Note Be Next?

Nigerian currency notes—₦5, ₦10, and ₦20—are disappearing due to inflation, rising production costs, changing spending h...

Top Crypto Investment Strategies for 2026

Looking to invest in cryptocurrency in 2026? To stay ahead in the crypto market with these proven investment strategies,...

The 16-Year-Old Who Called Out America on Live TV (and Changed Nigerian Broadcasting Forever)

In 1957, a fearless 16-year-old Nigerian challenged American racism on live TV and went on to redefine broadcasting in N...

The Kenyan Government Is Warning Against Cash Bouquets And Here’s What It’s Really About

Kenya’s Central Bank warns against Valentine’s cash bouquets. Read what this is really about and how damaged currency af...

Plastics and Priviledge: How Two Videos Reveal the Country’s Hidden Fault Lines

Two viral videos, one young man carrying plastics to survive, and a billionaire’s son shocked by fuel prices. This is wh...

Africans Who’ve Made Grammy History

Only a handful of Africans have ever crossed the Grammy line. Here are some Africans who made history at the world’s mos...

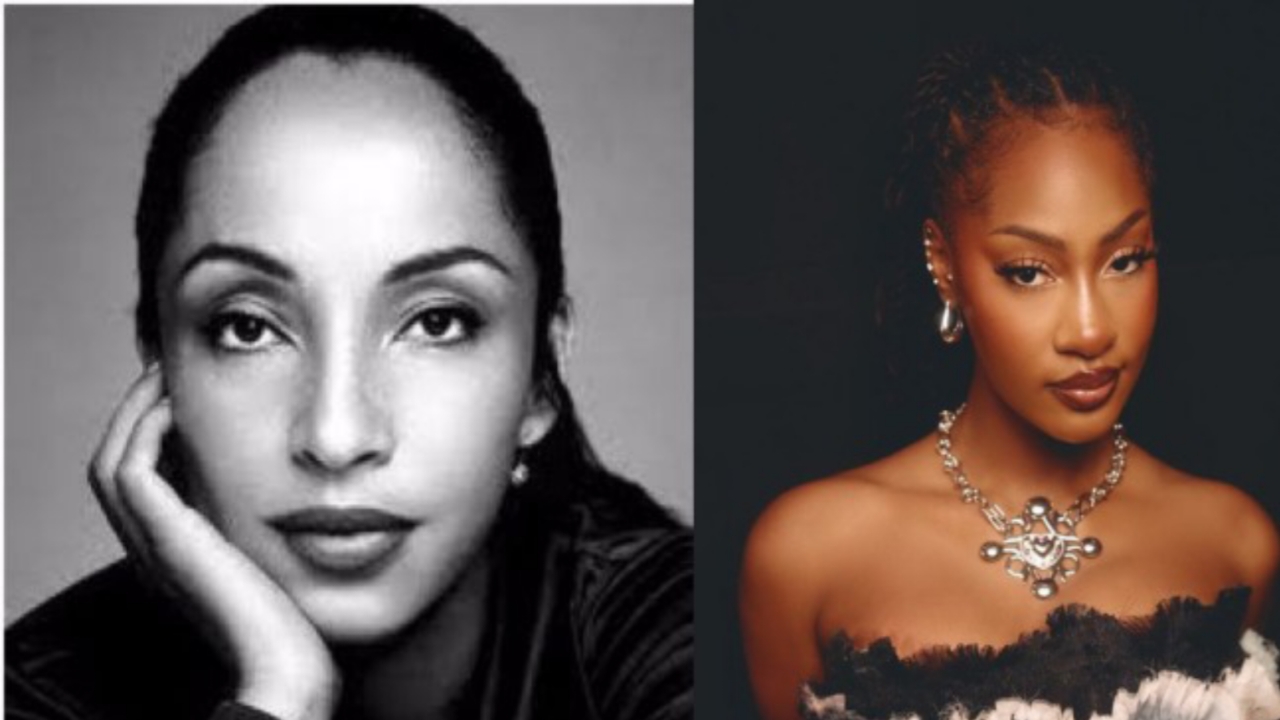

Tems Is Not the First Nigerian Female Artist to Win a Grammy

Tems’ Grammy win made headlines, but a forgotten Nigerian-born icon won decades earlier. Here’s the name most people lea...

Rewind to the Year Nigeria Was Sold in the 1899 Royal Niger Company Deal

In 1899, Britain bought out the Royal Niger Company for £865,000, taking control of territories that would become Nigeri...