Fintech Frontier: Hawala Secures $3M to Transform MENA Finance

Hawala Technology, a pioneering fintech startup operating within the Middle East and North Africa (MENA) region, has successfully closed a $3 million pre-seed funding round. This significant investment, spearheaded by Pharsalus Capital with additional participation from Alumni Ventures and a consortium of notable angel investors including Naguib Sawiris (Chairman, Orascom Development Holding), Hany Rashwan (Co-Founder & CEO, 21.co), Arnold Lee (Co-Founder & CEO, Sphere Labs), and Carl Lin (Founding Engineer, Solana), is earmarked for the crucial purpose of revitalizing its platform and powering the Hawala application.

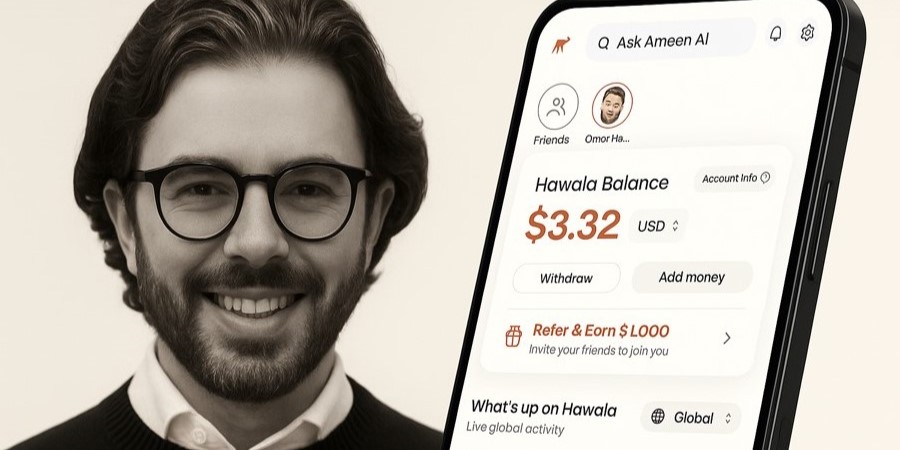

Founded by Omar Hamade in January 2025, Hawala's core mission is to construct a resilient financial infrastructure that seamlessly links the MENA region with global economic markets. The startup is strategically focusing its initial expansion efforts on Egypt, recognized as one of the region's largest and most dynamic economies. Omar Hamade, CEO and Founder, emphasized that this funding round not only solidifies Hawala's dedication to this vision but also positions the company to redefine global access by offering broad coverage, speed, cost-efficiency, and reliability that make cross-border finance feel genuinely local.

Highlighting a notable disparity, Hamade pointed out that while regions like Latin America and Southeast Asia have experienced a boom in fintech innovation over the past decade, MENA has largely lagged. Hawala aims to rectify this imbalance by developing fair, accessible, and transparent financial products for the next generation of global users across MENA. The platform is designed to tackle critical issues prevalent in the region, such as currency volatility, capital restrictions, and limited access to modern financial tools, thereby empowering individuals with greater financial stability and opportunity.

Hawala's innovative platform offers users in over 200 countries the capability to establish a U.S. account and routing number or a European IBAN. This functionality enables them to directly receive and securely hold digital USD and EUR within their Hawala Wallet. Furthermore, the startup has engineered an infrastructure facilitating instant money transfers to both Hawala and non-Hawala users, requiring only an email address. Wallet withdrawals are processed instantly, with many transactions clearing in real-time and nearly all settling within one to two business days, though final speeds can be influenced by local banks and partners.

The $3 million funding is seen as a pivotal stepping stone for Hawala to address one of MENA's most pressing challenges: obtaining access to stable currencies and globally integrated financial instruments. The capital will accelerate the introduction of new features, including the highly anticipated Hawala Card. This card will empower users to spend directly from their Hawala Wallet at more than 150 million merchants and ATMs worldwide that accept Visa. An upcoming interest-free savings product is also in the pipeline, meticulously designed to assist users in transparently and responsibly preserving and growing their financial value.

Hawala is committed to ongoing partnerships with regulated financial institutions and licensed providers to continuously expand its service coverage, enhance transaction speeds, and deliver more accessible financial connectivity to users globally. The startup aspires to become the preferred financial platform for individuals in emerging markets who are globally connected but remain underserved by local financial systems, striving for a future where everyone has equitable access to stability, opportunity, and growth, irrespective of their geographical location.

You may also like...

Super Eagles Fury! Coach Eric Chelle Slammed Over Shocking $130K Salary Demand!

)

Super Eagles head coach Eric Chelle's demands for a $130,000 monthly salary and extensive benefits have ignited a major ...

Premier League Immortal! James Milner Shatters Appearance Record, Klopp Hails Legend!

Football icon James Milner has surpassed Gareth Barry's Premier League appearance record, making his 654th outing at age...

Starfleet Shockwave: Fans Missed Key Detail in 'Deep Space Nine' Icon's 'Starfleet Academy' Return!

Starfleet Academy's latest episode features the long-awaited return of Jake Sisko, honoring his legendary father, Captai...

Rhaenyra's Destiny: 'House of the Dragon' Hints at Shocking Game of Thrones Finale Twist!

The 'House of the Dragon' Season 3 teaser hints at a dark path for Rhaenyra, suggesting she may descend into madness. He...

Amidah Lateef Unveils Shocking Truth About Nigerian University Hostel Crisis!

Many university students are forced to live off-campus due to limited hostel spaces, facing daily commutes, financial bu...

African Development Soars: Eswatini Hails Ethiopia's Ambitious Mega Projects

The Kingdom of Eswatini has lauded Ethiopia's significant strides in large-scale development projects, particularly high...

West African Tensions Mount: Ghana Drags Togo to Arbitration Over Maritime Borders

Ghana has initiated international arbitration under UNCLOS to settle its long-standing maritime boundary dispute with To...

Indian AI Arena Ignites: Sarvam Unleashes Indus AI Chat App in Fierce Market Battle

Sarvam, an Indian AI startup, has launched its Indus chat app, powered by its 105-billion-parameter large language model...