Elite Investors Divided: Family Offices Split on Oracle's Future Amid Ellison's Wealth Boom

Investment firms managing wealth for the world's ultra-rich displayed a divided approach regarding their holdings in Oracle Corp. This divergence occurred during a period when the US software giant's stock experienced its most significant rally in over three decades, briefly elevating Chairman Larry Ellison to the status of the world's richest person.

Regulatory filings, specifically 13F forms, for the three months ending September 30, revealed distinct investment strategies. Two family offices associated with Sweden's Rausing dynasty, along with an investment firm overseeing a portion of Microsoft Corp. co-founder Paul Allen's fortune, substantially increased their stakes in Ellison's software company.

Conversely, during the same quarter, investment firms managed by hedge fund billionaire David Tepper and duty-free shopping tycoon Alan Parker opted to reduce their Oracle positions. Notably, Tepper's Appaloosa LP completely divested its entire stake in Oracle, which was valued at $32.8 million as of September 30.

These investment decisions coincided with a remarkable event: Oracle's largest single-day stock gain since 1992. This surge followed an optimistic forecast from the Austin-based company concerning its cloud business, solidifying its competitive standing in the burgeoning market for artificial intelligence computing support. The impressive results, which exceeded analysts' expectations, led to a staggering $89 billion increase in Larry Ellison's wealth, marking the largest one-day rise ever documented in the history of the Bloomberg Billionaires Index. However, it is important to note that Oracle's shares have subsequently declined by approximately 30%.

Money managers overseeing more than $100 million in US equities are mandated to file a 13F form within 45 days of each quarter's end. These filings provide a valuable and rare insight into the investment strategies employed by hedge funds and certain large family offices regarding their US exchange-traded stock holdings.

You may also like...

Super Eagles Dominate! Nigeria Crushes Algeria 2-0 in AFCON Quarter-Final, Marches to Semis

Nigeria's Super Eagles secured a commanding 2-0 victory over Algeria in the 2025 AFCON quarter-finals, ending their oppo...

Ralph Fiennes' Horror Sequel Hailed as Early Contender for 2026's Best Film

Early reactions to <i>28 Years Later: The Bone Temple</i> are overwhelmingly positive, with many hailing it as a potenti...

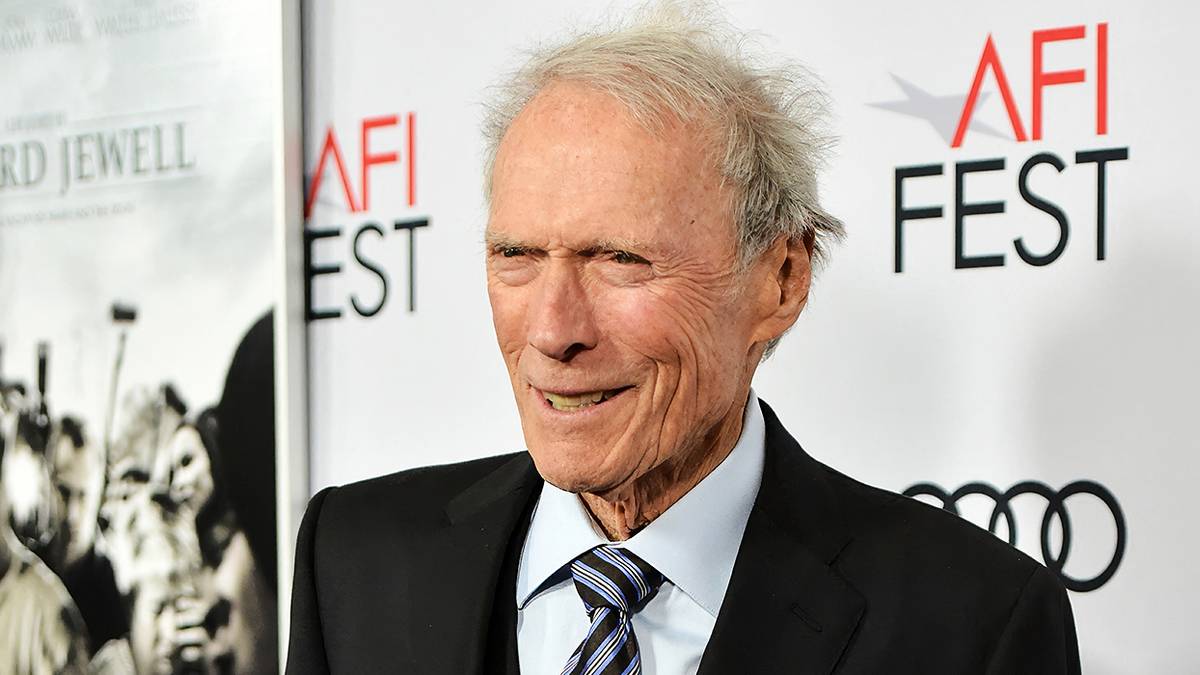

Clint Eastwood's Final Film Resurrected on Streaming After Theatrical Disaster

Clint Eastwood concludes his legendary filmmaking career with <i>Juror #2</i>, a legal thriller starring Nicholas Hoult....

Country Legend Dolly Parton Skips Grand Ole Opry 80th Bash, Sends Love From Afar

Dolly Parton has revealed she will not be attending her 80th birthday celebration at the Grand Ole Opry, sharing a video...

Billie Eilish Sparks Firestorm: DHS Slams Pop Star's 'Garbage Rhetoric' on Minneapolis Shooting

The Department of Homeland Security has responded sharply to Billie Eilish after she criticized ICE following a fatal sh...

Pixar's 'Number One Sin' Exposed by Netflix Director Alex Woo!

Director Alex Woo's Netflix debut, "In Your Dreams," explores family dynamics through a dream world quest, earning criti...

Exclusive Access: Jason Statham's 'Shelter' Screening with Director Ric Roman Waugh!

Get ready for an exclusive advanced screening of Jason Statham's new action thriller, 'Shelter,' in New York City. Witne...

Football Icons Score Big: Super Eagles Soar to AFCON 2025 Semi-Finals!

Nigeria's Super Eagles have advanced to the 2025 Africa Cup of Nations semi-finals after a decisive 2–0 victory over Alg...