Digital Dustbin: Study Reveals NFT Market Has Collapsed with Tokens Below JPEG Value!

The explosive growth of NFTs (Non-Fungible Tokens) during 2021–2022 captured global attention.

These unique digital collectibles, often tied to the Ethereum blockchain, reached unprecedented highs in trading volume, with iconic collections like Bored Ape Yacht Cluband CryptoPunks selling for millions.

Celebrity investors, including Stephen Curry and Snoop Dogg, further fueled the hype.

However, the collapse of the broader cryptocurrency market in 2022, with Bitcoin falling to around $27,000 and Ethereum near $1,630, marked the beginning of NFT market decline.

A report by Insider highlighted that 95% of NFTs are now considered worthless, leaving over 23 million holders with essentially valueless assets.

Questionable Value and Market Risks

The NFT market remains riddled with speculative pricing and questionable collections. Some high-profile examples include Melania Trump’s “Man on the Moon” NFT, which violated NASA rules and sold minimally, and Canon’s planned NFT photos via Cadabra, which has yet to launch.

Major companies like Meta abandoned NFT initiatives in 2023 after testing them in their metaverse plans, reflecting the sector’s unsustainable nature.

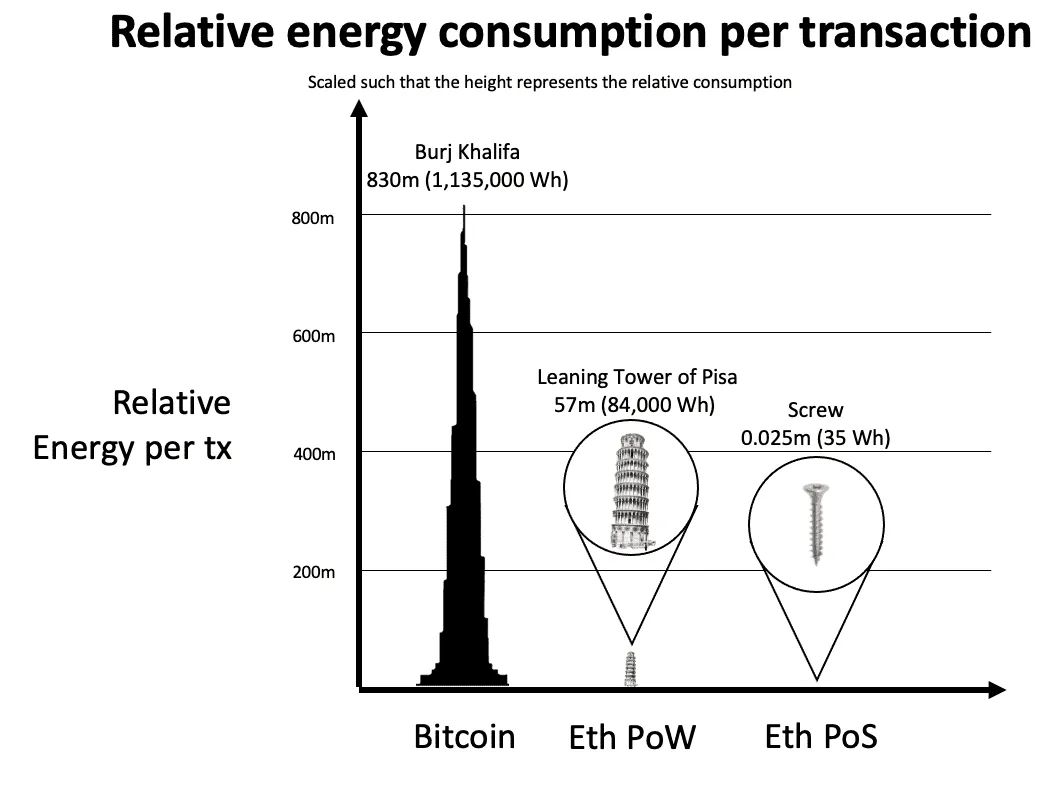

Beyond financial losses, NFTs have a significant environmental impact, as minting these tokens consumes enormous amounts of energy, often from fossil fuels.

As a result, both economic and ecological risks have contributed to waning interest and declining market participation.

NFT Scams and Fraudulent Practices

The NFT market is increasingly vulnerable to scams, including:

• Fake Sales: Bogus listings for non-existent NFTs.

• Phishing Websites: Sites impersonating marketplaces to steal wallets.

Latest Tech News

Decode Africa's Digital Transformation

From Startups to Fintech Hubs - We Cover It All.

• Stolen Digital Art: Illegally minted NFTs sold as originals.

• Pump and Dump Schemes: Price manipulation by coordinated groups.

• Rug Pulls: Exploitation of smart contract vulnerabilities.

• Impersonation Scams: Fraudsters posing as celebrities or artists.

• Fake Projects: Copycat initiatives that mislead investors.

These issues underscore the extreme volatility and risk in the NFT market, highlighting the need for caution among collectors and investors.

For those considering entering the space, awareness of scams and understanding the lack of intrinsic value in many NFTs is essential.

You may also like...

Be Honest: Are You Actually Funny or Just Loud? Find Your Humour Type

Are you actually funny or just loud? Discover your humour type—from sarcastic to accidental comedian—and learn how your ...

Ndidi's Besiktas Revelation: Why He Chose Turkey Over Man Utd Dreams

Super Eagles midfielder Wilfred Ndidi explained his decision to join Besiktas, citing the club's appealing project, stro...

Tom Hardy Returns! Venom Roars Back to the Big Screen in New Movie!

Two years after its last cinematic outing, Venom is set to return in an animated feature film from Sony Pictures Animati...

Marvel Shakes Up Spider-Verse with Nicolas Cage's Groundbreaking New Series!

Nicolas Cage is set to star as Ben Reilly in the upcoming live-action 'Spider-Noir' series on Prime Video, moving beyond...

Bad Bunny's 'DtMF' Dominates Hot 100 with Chart-Topping Power!

A recent 'Ask Billboard' mailbag delves into Hot 100 chart specifics, featuring Bad Bunny's "DtMF" and Ella Langley's "C...

Shakira Stuns Mexico City with Massive Free Concert Announcement!

Shakira is set to conclude her historic Mexican tour trek with a free concert at Mexico City's iconic Zócalo on March 1,...

Glen Powell Reveals His Unexpected Favorite Christopher Nolan Film

A24's dark comedy "How to Make a Killing" is hitting theaters, starring Glen Powell, Topher Grace, and Jessica Henwick. ...

Wizkid & Pharrell Set New Male Style Standard in Leather and Satin Showdown

Wizkid and Pharrell Williams have sparked widespread speculation with a new, cryptic Instagram post. While the possibili...