Crypto Power Play: KindlyMD Buys Billions in Bitcoin, Merges with Nakamoto for Mega-Treasury!

KindlyMD, Inc. (NASDAQ: NAKA) and Bitcoin-native holding company Nakamoto Holdings Inc. have successfully completed their highly anticipated merger, establishing a new publicly traded Bitcoin treasury vehicle. Operating under the KindlyMD name on the Nasdaq Capital Market, the combined entity has set an ambitious goal to acquire one million Bitcoin (BTC). Nakamoto Holdings will function as a wholly owned subsidiary, overseeing the Bitcoin financial services division of the new company.

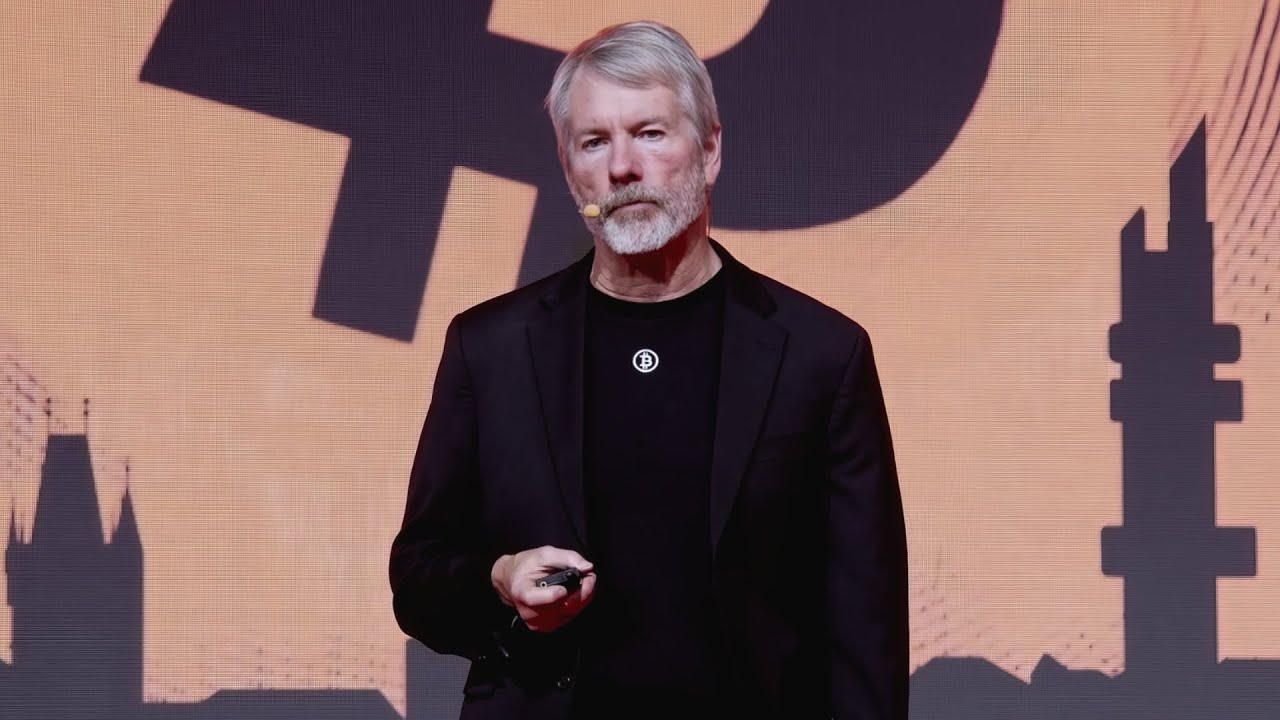

David Bailey, CEO and Chairman of the combined company, articulated a clear vision: "Our vision is for the world’s capital markets to operate on a Bitcoin standard. Today’s merger represents the beginning of that journey for our company." He emphasized his long-held belief in Bitcoin's potential to become the most valuable asset globally, adopted by individuals, companies, and governments alike. Tim Pickett, former KindlyMD CEO and now Chief Medical Officer, highlighted the extension of KindlyMD’s operational excellence to its capital strategy, stating, "Bitcoin gives us the ability to preserve value with the same integrity we apply to delivering care."

The merger transaction was bolstered by approximately $540 million in gross proceeds from a private placement in public equity (PIPE) financing, with these funds primarily earmarked for Bitcoin purchases. Additionally, a $200 million convertible note offering was expected to close shortly after the merger. The leadership team under Bailey includes Amanda Fabiano as COO, Tyler Evans as CIO, and Andrew Creighton as CCO, supported by a diverse board of independent directors, including Charles Blackburn, Perianne Boring, Eric Weiss, Greg Xethalis, Mark Yusko, and Tim Pickett. The company's mission is to build a premier, institutional-grade Bitcoin treasury vehicle to drive corporate and government adoption of the asset, simplifying its integration into global capital markets.

Following the merger, KindlyMD swiftly made its first significant Bitcoin acquisition on August 19, 2025, purchasing 5,743.91 BTC for approximately $679 million. This acquisition, executed at a weighted average price of $118,204.88 per Bitcoin, brings the company’s total holdings to 5,764.91 BTC, establishing KindlyMD as a notable participant in the evolving corporate Bitcoin treasury landscape. This purchase utilized proceeds from the recently completed PIPE financing, underscoring the company's commitment to a disciplined Bitcoin treasury strategy.

CEO David Bailey reaffirmed the company's conviction, stating, "This acquisition reinforces our conviction in Bitcoin as the ultimate reserve asset for corporations and institutions alike." He reiterated the long-term mission of accumulating one million Bitcoin, reflecting the belief that Bitcoin will anchor the next era of global finance. The $200 million convertible note offering, which successfully closed on August 15, 2025, also had its proceeds specifically designated for additional Bitcoin purchases, demonstrating a sustained strategy for growth.

The merger and subsequent Bitcoin acquisition mark significant milestones in KindlyMD's transformation into an institutional-grade Bitcoin treasury vehicle. This strategic shift aligns with the rapid evolution of the corporate Bitcoin treasury landscape in 2025, where traditional financial institutions increasingly acknowledge Bitcoin as a legitimate treasury asset. This trend has led to the development of more sophisticated financial instruments and investment vehicles for corporate Bitcoin exposure, positioning KindlyMD as a leader in this burgeoning market. As part of its broader strategy, Nakamoto is in partnership with Bitcoin Magazine’s parent company BTC Inc, which provides certain marketing services to Nakamoto to build a global network of Bitcoin treasury companies.

You may also like...

Man Utd's Amorim Assurance: Chiefs Back Manager Despite Struggles

Despite a devastating derby loss and their worst league start since 1992, Manchester United chiefs are standing by Ruben...

Arsenal's UCL Glory: Martinelli's Blitz & Bilbao Battle Scars

Arsenal secured a winning start to their Champions League campaign against Athletic Bilbao, overcoming a challenging fir...

Man of Steel Lands: James Gunn's Superman Gets Exciting Streaming Debut Date!

James Gunn's <i>Superman</i>, starring David Corenswet, is set to arrive on HBO Max this Friday, September 19, following...

Frozen 3 Shakes Up Disney's Formula With Plot Twist Not Seen in 25 Years

The plot for Disney's upcoming 'Frozen 3' has been revealed, teasing a royal wedding between Queen Anna and Kristoff, an...

Farewell to a Legend: Iranian Singer Hooshmand Aghili Dies at 88

Hooshmand Aghili, a revered musician whose voice defined generations for the Iranian diaspora, passed away at 88. His il...

Tune In! BillboardTV to Launch 24/7 Music Channel on Samsung TV Plus

Billboard and Samsung TV Plus have launched BillboardTV, a new 24/7 streaming channel dedicated to music culture and new...

Little Mix Star Jade Thirlwall's Shocking Sacrifice for Diana Ross Sample!

Jade Thirlwall's debut album, "That's Showbiz Baby!", is making waves, featuring a bold sample of Diana Ross's "Stop! In...

Millionaire Pop Star's Wild Undercover Stag Do Adventure at Butlin's Revealed!

Discover the latest from the entertainment world, including Ed Sheeran's surprising love for Butlin's holidays, Paul Mes...