Crypto Mogul Sam Bankman-Fried’s Appeal Plays Out Amid Questions of Justice

From FTX’s Rise and Fall to a Bid for Redemption

In New York, November 2025, two years after Sam Bankman-Fried’s conviction for one of the most stunning financial crimes in U.S. history, Sam Bankman-Fried, the onetime poster child of crypto innovation is fighting to reclaim his narrative.

According to CoinDesk, on Tuesday, the U.S. Court of Appeals for the Second Circuit in Manhattan begins hearing oral arguments in Bankman-Fried’s appeal. His defense team insists the original trial was flawed given that FTX was never insolvent, and that the judge restricted his ability to defend himself, but before the appeal, before the prison sentence and courtroom drama, there was FTX, once hailed as the crown jewel of the cryptocurrency world.

Founded in 2019, FTX quickly became one of the world’s largest cryptocurrency exchanges. Under Bankman-Fried’s leadership, it attracted millions of users and billions in trading volume, promising transparency, security, and a new era for digital finance. By 2021, the company was valued at over $32 billion, backed by elite investors such as Sequoia Capital, SoftBank, and Tiger Global. Bankman-Fried often called “the next Warren Buffett” became a billionaire by age 30 and one of the most influential figures in Washington, donating millions to political campaigns and advocating for crypto regulation. At the peak of his success, he shared stages with world leaders and celebrities, appearing in Super Bowl ads and sponsoring the FTX Arena in Miami, but behind the glitter of success, a dangerous web was tightening.

In November 2022, reports byCoinDesk exposed financial entanglements between FTX and its sister trading firm Alameda Research, both controlled by Bankman-Fried. The revelation showed that Alameda’s balance sheet was filled with FTT tokens, a cryptocurrency created by FTX itself, raising concerns that customer funds were being used to prop up the company’s finances. When rival exchangeBinanceannounced plans to sell its FTT holdings, panic spread. Within days, users withdrew billions of dollars, sparking a liquidity crisis, which can also be called a digital “run on the bank.”

FTX froze withdrawals and filed for bankruptcy on November 11, 2022. Regulators later alleged that Bankman-Fried had misappropriated over $8 billion of customer deposits to cover Alameda’s trading losses, make political donations, and buy luxury real estate from the US Department of Justice. The fallout was catastrophic as investors were wiped out, users lost access to their funds, and public trust in crypto dropped.

In December 2022, Bankman-Fried was arrested in the Bahamas and extradited to the United States. His trial began in October 2023 in New York and lasted nearly a month. Prosecutors presented evidence showing that he diverted billions in customer deposits into Alameda’s trading accounts and personal expenditures. Former executives, including Caroline Ellison and Gary Wang, testifiedthat SBF directed them to manipulate balance sheets and conceal losses.

The jury deliberated for only five hours before convicting him on all seven counts including wire fraud, securities fraud, and money laundering conspiracy. Judge Lewis Kaplan sentenced him in March 2024 to 25 years in prison, calling his conduct “a calculated scheme driven by arrogance and greed.”

Now, nearly two years later, according the Africa Business Insider, Bankman-Fried is back in the headlines. His lawyers argue that FTX was not insolvent but merely illiquid. They claim he was not allowed to show that the company’s assets exceeded liabilities, and that the panic-driven withdrawal rush made it appear bankrupt.

This narrative has gained renewed momentum since FTX’s bankruptcy estate recovered over $7.3 billion in assets, leading to near-full repayment of customers. To the defense, that outcome is proof that customers were ultimately unharmed, but legal experts counter that repayment after-the-fact does not erase criminal fraud. The appeal also claims the trial judge limited SBF’s ability to testify freely, excluding evidence about FTX’s solvency and advice he received from lawyers, potentially skewing the jury’s perception.

Beyond the courtroom, Bankman-Fried’s supporters are reportedly exploring a presidential pardon. During his 2024 campaign, Donald Trump became increasingly vocal about supporting crypto, promising to “end Biden’s war on digital assets.” In accordance to CNN, in recent interviews, SBF has echoed conservative talking points, claiming he and Trump were both victims of judicial bias from the same judge, Lewis Kaplan. His parents who are both Stanford law professors have allegedly consulted attorneys with past ties to Trump’s campaign. Whether the former president would consider a pardon remains unclear, but it underscores the high-stakes strategy surrounding this appeal.

Trump’s previous clemencies to Changpeng Zhao, founder of Binance, and Ross Ulbricht, creator of the Silk Road, have already sparked fierce debate about political influence over justice, and on this issue the crypto world remains split. Some insiders argue that Bankman-Fried’s conviction helped the industry move past its reputation for scams and speculation. Others, noting FTX’s asset recovery, question whether his actions merit such a harsh sentence.

Gareth Rhodes, an attorney and managing director at Pacific Street Advisory, said that “The crypto sector cannot afford to normalize fraud, even if restitution was later achieved. Accountability is what separates innovation from chaos.” Meanwhile, watchdogs like Better Markets warn that potential pardons for wealthy white-collar offenders send the wrong signal. “The message is clear, crime pays if you’re rich enough,” said CEO Dennis Kelleher.

The outcome of Sam Bankman-Fried’s appeal will resonate far beyond one man’s fate. It will test how justice balances intent, restitution, and influence in the digital economy, and whether the next wave of financial leaders can learn from FTX’s fall. As the hearing unfolds, the world watches a cautionary tale of ambition, collapse, and the audacious hope of redemption, a story that continues to shape how we view crypto, trust, and accountability in the age of digital finance.

You may also like...

How to Navigate a Career Switch Without Starting Over

Changing careers doesn’t have to mean losing progress. With the right strategy, it’s possible to move into a new field c...

Top Skills That Will Future Proof Your Career

In a fast-changing world of work, staying relevant takes more than talent, it takes the right skills to future proof one...

The Tragic Case of Ochanya Elizabeth Ogbanje: From Abuse to Death and the Fight for Justice

The story of 13-year-old Ochanya Elizabeth Ogbanje: Her years of alleged sexual abuse, death in October 2018, how the ca...

Redefined Career Paths: The State of Work Across Africa in Late 2025.

From entrepreneurial partnerships to digital startups, millions of young people are redefining what it means to have a c...

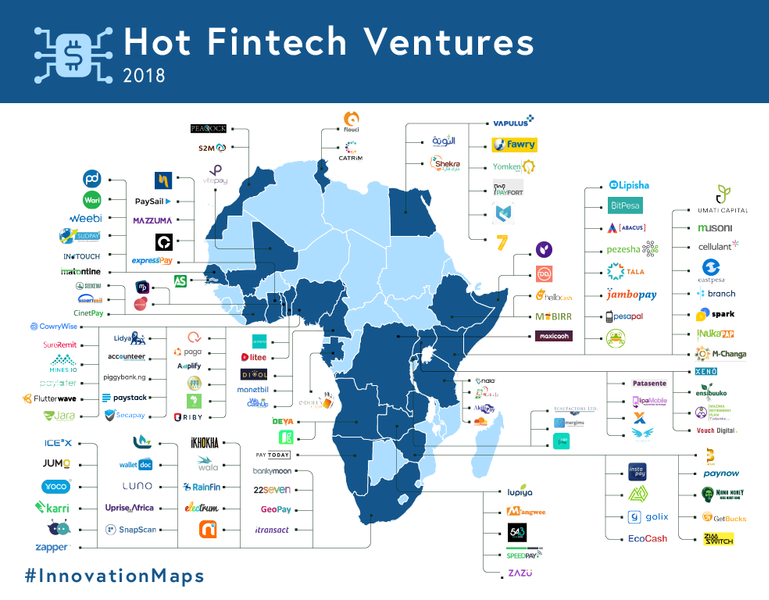

Digital Banking Platforms and the Financial Future of African Freelancers and Remote Workers

There is a revolution in the African Digital Economy. With a new generation of remote workers, digital banking platforms...

Breaking Barriers: How Women-Centered FinTech is Empowering Africa’s Entrepreneurs

Women-centered Fintechs in Nigeria and across Africa have taken the initiative in transforming the idea of financial inc...

A Wired Decade: Africa Rebuilt Itself Through Technology 2015–2025

Over the past decade, Africa has quietly assembled one of the most dynamic digital ecosystems in the world.

AI Tokens: The New Spoiler in the Crypto Market Drama

AI tokens were once the hottest trend in crypto until they led a sudden market pullback. This article explores how hype,...