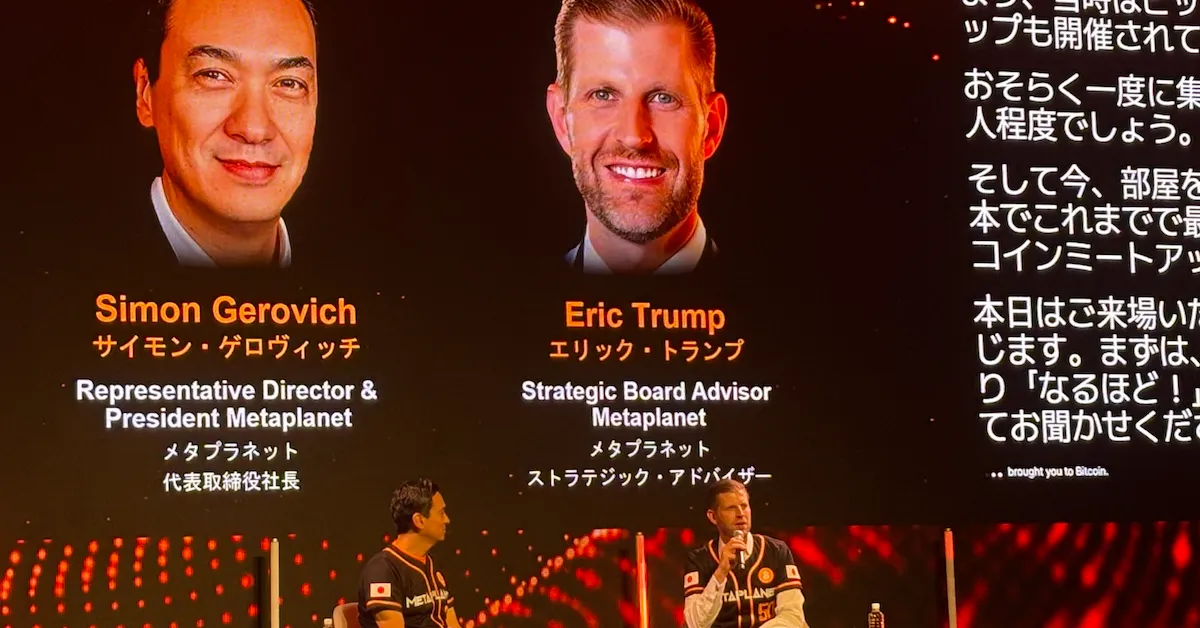

Crypto Giant Metaplanet Dives Deep: Massive Bitcoin Stash Acquired as Price Hovers Below $113K!

Tokyo-listed Metaplanet has made a significant stride in its Bitcoin acquisition strategy, purchasing an additional 5,419 Bitcoin for approximately $632.53 million. This substantial transaction was executed at an average price of $116,724 per coin, as disclosed to the Tokyo Stock Exchange. This latest acquisition elevates Metaplanet's total Bitcoin holdings to an impressive 25,555 BTC, which were acquired for a cumulative $2.7 billion at an average cost basis of $106,065 per Bitcoin.

This strategic move firmly establishes Metaplanet as the world’s fifth-largest corporate Bitcoin holder, surpassing Bullish. The company now ranks behind only prominent entities such as Strategy, Marathon Digital, XXI, and Bitcoin Standard Treasury Company, underscoring its growing influence in the institutional Bitcoin space. Dylan LeClair, Metaplanet’s head of Bitcoin strategy, indicated that this purchase represents just the “first tranche” of a larger plan, referencing the $1.4 billion recently raised for further Bitcoin acquisitions.

Metaplanet is making significant progress toward its ambitious Bitcoin accumulation targets. The latest acquisition brings the company to 85.2% of its year-end 2025 goal of 30,000 BTC and positions it strongly for its 2026 target of 100,000 coins. The company has also demonstrated robust performance metrics, with its BTC Yield—a key indicator reflecting Bitcoin holdings relative to fully diluted shares—reaching 95.6% in Q1 2025 and further increasing to 129.4% in Q2 2025.

The funding for this substantial purchase primarily stemmed from the proceeds of Metaplanet’s recent international share offering, which successfully garnered approximately $1.4 billion. From the $1.25 billion specifically allocated for Bitcoin acquisitions, Metaplanet has utilized about $632.53 million in this initial, significant transaction.

Metaplanet's aggressive expansion aligns with a broader trend of accelerating corporate Bitcoin adoption. Corporate Bitcoin treasury holdings have now collectively exceeded 1 million BTC, accounting for roughly 5% of Bitcoin’s circulating supply. This surge in institutional interest has been particularly evident since early 2025, with other companies like BitMine and Forward Industries also embracing Bitcoin for their corporate treasuries.

To further support its expanding operations and strategic initiatives, Metaplanet has established two key subsidiaries. Metaplanet Income Corp., a Miami-based entity with $15 million in initial capital, is tasked with managing derivatives operations separately from treasury activities, thereby enhancing governance and risk management. Additionally, Bitcoin Japan Inc., a new subsidiary in Japan, focuses on managing media, events, and services related to Bitcoin, complemented by the strategic acquisition of the Bitcoin.jp domain name.

Despite this significant corporate acquisition, the Bitcoin price has remained under some pressure, trading below $113,000 after recently touching highs above $117,000. Nevertheless, the continuous acceleration of institutional adoption, spearheaded by companies like Metaplanet, signifies a pivotal evolution in corporate treasury operations. The integration of Bitcoin into corporate balance sheets represents a profound shift in traditional financial management practices and is poised to establish new benchmarks for institutional engagement with digital assets.

Recommended Articles

Bitcoin Bloodbath: Satoshi's Empire Crumbles by $20 Billion as BTC Plunges!

Satoshi Nakamoto's estimated net worth has plunged by $20 billion due to recent Bitcoin price fluctuations, yet remains ...

Bitcoin Skyrockets Past $122,000 as BlackRock ETF Dominates with 800K BTC AUM!

Bitcoin has maintained its strong price position, greatly boosted by BlackRock's IBIT spot Bitcoin ETF surpassing 800,00...

Michael Saylor's Bitcoin Crusade: Unpacking His Latest Market Moves and Predictions

Strategy (formerly MicroStrategy), led by Michael Saylor, continues its aggressive Bitcoin accumulation strategy, recent...

OranjeBTC Unleashes $1.94M Bitcoin Blitz, Elevating Latin American Strategy

Brazil's OranjeBTC has expanded its Bitcoin holdings to 3,691 BTC after a recent acquisition, marking a 1.5% year-to-dat...

Crypto Giant Emerges: KindlyMD and Nakamoto Merge, Target Massive 1 Million BTC Acquisition

KindlyMD and Nakamoto Holdings have merged, forming a publicly traded Bitcoin treasury vehicle with the ambitious goal o...

You may also like...

The 1896 Adwa War: How Ethiopia Defied Colonialism

Ethiopia with the exception of Liberia which was used as a settler place for freed slaves remains the only African Count...

Why We Need Sleep: Inside the Brain’s Night Shift

Even when you’re asleep, your brain is quietly up to something, sorting, cleaning, and working behind the scenes.

When Nollywood Meets Netflix: The Creative Tug Between Local Storytelling and Global Algorithms

Nollywood’s partnership with Netflix is rewriting the script for African cinema, offering global reach but raising quest...

Mozambique's LNG Megaproject: A Promise or Peril?

TotalEnergies is leading a consortium in Mozambique as it promises potential restructuring of the nation's energy se...

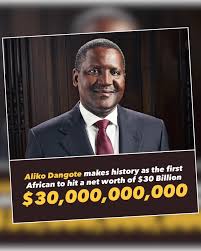

Aliko Dangote, Africa’s Wealth King: First African-Born Billionaire to Cross $30B

Aliko Dangote, the richest Black man in the world, has reached a new milestone, with a net worth of $30.3 billion, accor...

WAEC Conducts Trial Essay Test Ahead of Full Computer-Based WASSCE in 2026

The trial Computer-Based Test (CBT) for the WAEC essay was held on Thursday, October 23, 2025. The exercise was conducte...

Can Long- Distance Love really work?

Can love really survive when touch becomes a memory and connection lives behind a screen? For many, distance isn’t the ...

Nigeria’s Rental Crisis: House of Representatives Moves to Cap Rent Hikes at 20%

Nigeria's rental market has been under intense pressure, and now lawmakers are stepping in. The House of Rep. has called...