Bitcoin Skyrockets Past $122,000 as BlackRock ETF Dominates with 800K BTC AUM!

Bitcoin's price has demonstrated remarkable stability, consistently maintaining its position above $122,000, a trend significantly bolstered by institutional milestones. A key factor in this resilience is BlackRock’s IBIT spot Bitcoin ETF, which has reached an extraordinary benchmark, surpassing 800,000 BTC in assets under management (AUM). This achievement comes shortly after the world's largest cryptocurrency recorded a new all-time high of $126,199 earlier this week, indicating robust market confidence and sustained demand.

BlackRock’s IBIT, launched in January 2024, has rapidly accumulated approximately 802,257 BTC, valued at nearly $100 billion. This substantial holding represents about 3.8% of Bitcoin’s total supply and underscores its status as the fastest-growing ETF in history. The fund's rapid expansion is a result of consistent and substantial net inflows, including a recent influx of 3,510 BTC pushing its total holdings beyond the 800,000 BTC mark. The broader U.S. spot Bitcoin ETF market has collectively attracted over $60 billion in cumulative inflows since its inception, with a notable eight-day streak of positive inflows totaling more than $5.7 billion, $4.1 billion of which was directed to IBIT.

Beyond ETF inflows, the structural demand for Bitcoin is further solidified by the increasing participation of corporate treasuries. This trend sees companies actively adding Bitcoin to their balance sheets, viewing it as a strategic reserve asset and a hedge against inflation and currency devaluation. DDC Enterprise Limited recently announced a $124 million equity financing round specifically to expand its Bitcoin holdings, exemplifying this growing corporate interest. Notably, BlackRock’s IBIT now holds more Bitcoin than Michael Saylor’s MicroStrategy, which maintains approximately 640,031 BTC (3.1% of total supply), signaling a broader institutional acceptance of Bitcoin as a legitimate treasury asset.

Additional support for the Bitcoin market has come from the Federal Reserve’s latest monetary policy signals. Minutes from the September meeting revealed that approximately half of the policymakers anticipate two more rate cuts before the end of the year. This dovish outlook has contributed to a positive sentiment across various risk assets, including cryptocurrencies. Furthermore, a report from CryptoQuant indicates that despite Bitcoin reaching new all-time highs, profit-taking activity remains relatively low, suggesting the potential for continued upward momentum.

As geopolitical tensions ease and institutional adoption accelerates, Bitcoin’s position as a mainstream financial asset continues to strengthen. The combination of strong institutional demand, a favorable monetary policy outlook, and the accelerating trend of corporate treasury adoption suggests that Bitcoin’s current price levels are supported by more substantial fundamental factors than in previous bull markets, positioning the market for potential further gains in the fourth quarter of 2025.

Recommended Articles

Bitcoin Bloodbath: Satoshi's Empire Crumbles by $20 Billion as BTC Plunges!

Satoshi Nakamoto's estimated net worth has plunged by $20 billion due to recent Bitcoin price fluctuations, yet remains ...

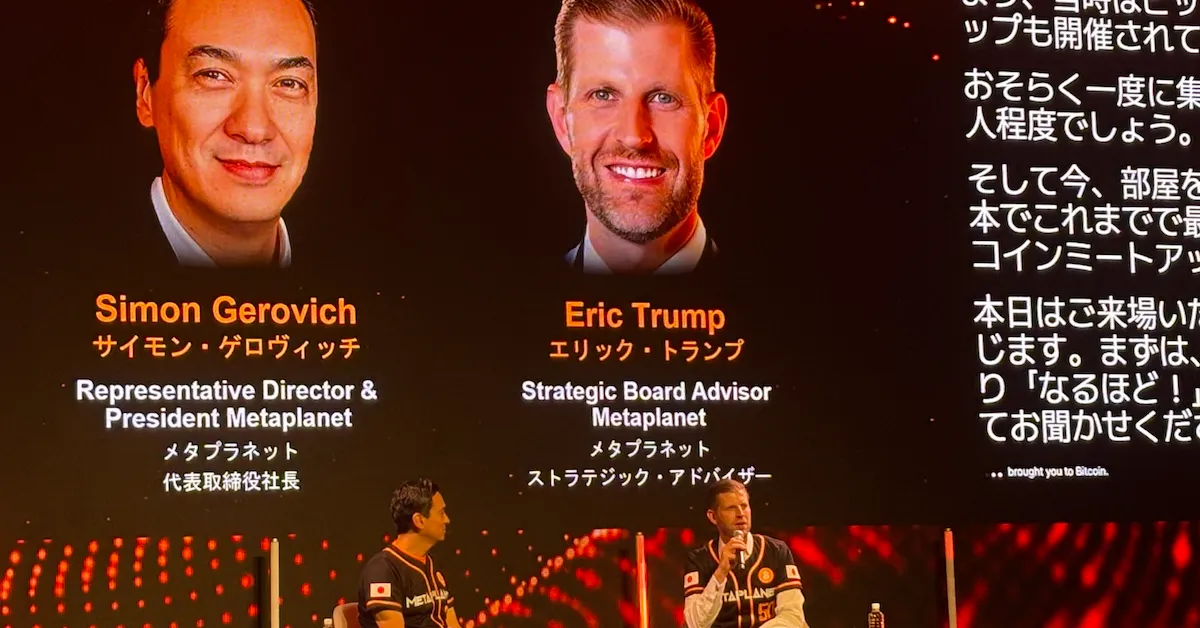

Crypto Giant Metaplanet Dives Deep: Massive Bitcoin Stash Acquired as Price Hovers Below $113K!

Tokyo-listed Metaplanet has significantly bolstered its Bitcoin holdings with a $632.53 million acquisition, raising its...

Michael Saylor's Bitcoin Crusade: Unpacking His Latest Market Moves and Predictions

Strategy (formerly MicroStrategy), led by Michael Saylor, continues its aggressive Bitcoin accumulation strategy, recent...

Bitcoin Takes a Dive Below $107,000, Sparking 'Buy-the-Dip' Frenzy

Bitcoin is navigating a volatile period, trading in the mid-$107,000s, with analysts from VanEck and Standard Chartered ...

Crypto Gold Rush: Bitcoin Mining Stocks Ignite Amidst Soaring Market Optimism

Leading Bitcoin mining firms like Marathon Digital, Riot Platforms, and CleanSpark experienced significant stock surges ...

You may also like...

The 1896 Adwa War: How Ethiopia Defied Colonialism

Ethiopia with the exception of Liberia which was used as a settler place for freed slaves remains the only African Count...

Why We Need Sleep: Inside the Brain’s Night Shift

Even when you’re asleep, your brain is quietly up to something, sorting, cleaning, and working behind the scenes.

When Nollywood Meets Netflix: The Creative Tug Between Local Storytelling and Global Algorithms

Nollywood’s partnership with Netflix is rewriting the script for African cinema, offering global reach but raising quest...

Mozambique's LNG Megaproject: A Promise or Peril?

TotalEnergies is leading a consortium in Mozambique as it promises potential restructuring of the nation's energy se...

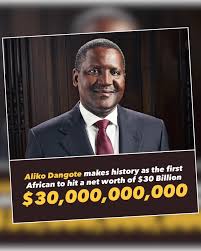

Aliko Dangote, Africa’s Wealth King: First African-Born Billionaire to Cross $30B

Aliko Dangote, the richest Black man in the world, has reached a new milestone, with a net worth of $30.3 billion, accor...

WAEC Conducts Trial Essay Test Ahead of Full Computer-Based WASSCE in 2026

The trial Computer-Based Test (CBT) for the WAEC essay was held on Thursday, October 23, 2025. The exercise was conducte...

Can Long- Distance Love really work?

Can love really survive when touch becomes a memory and connection lives behind a screen? For many, distance isn’t the ...

Nigeria’s Rental Crisis: House of Representatives Moves to Cap Rent Hikes at 20%

Nigeria's rental market has been under intense pressure, and now lawmakers are stepping in. The House of Rep. has called...