Coinbase CEO Teases AmEx-Powered Crypto Credit Card with Bitcoin Rewards

Coinbase CEO Brian Armstrong officially unveiled the company's new cryptocurrency credit card, dubbed the Coinbase One Card, on Thursday, June 12, 2025. This innovative card is designed to offer users an attractive incentive of up to 4% cashback in Bitcoin for every purchase they make. The announcement, shared by Armstrong on X, highlighted several distinct features of the card, positioning it as a significant offering in the evolving crypto payments landscape.

Crafted from metal, each Coinbase One Card is uniquely engraved with Bitcoin's Genesis block, providing a tangible connection to the cryptocurrency's origins. A pivotal aspect of the card's functionality is its partnership with payments giant American Express, which powers the new offering. This collaboration aims to leverage American Express's extensive network and payment processing capabilities to facilitate seamless transactions for cardholders.

However, access to these Bitcoin rewards comes with specific conditions. The Coinbase One Card will be exclusively available to subscribers of Coinbase's premium service, Coinbase One, which requires an annual membership starting at $49.99. Furthermore, the volume of Bitcoin rewards a user receives will be directly proportional to their Coinbase balance; a larger balance translates to more significant BTC rewards. The company also retains the right to determine which transactions are eligible for these cashback incentives. The eagerly anticipated launch of the Coinbase One Card is scheduled for the fall of 2025.

This move by Coinbase follows a similar strategic offering from its rival cryptocurrency exchange, Gemini, which introduced its own Bitcoin credit card the previous month. Gemini's card, powered by MasterCard, also provides up to 4% cashback in Bitcoin, specifically on categories such as gas, EV charging, transit, taxis, and rideshare services, notably without any annual or foreign transaction fees. The competitive landscape in crypto-backed credit cards is clearly heating up as exchanges seek to deepen user engagement and adoption.

Beyond its new credit card, Coinbase has recently achieved several notable milestones. Last month, the company made history by becoming the first pure-play cryptocurrency stock to be included in the S&P 500 Index, a widely recognized benchmark for the U.S. stock market. Additionally, Coinbase has expanded its footprint in the global crypto derivatives market through a significant acquisition of the crypto options exchange Deribit, in a deal valued at approximately $2.9 billion in cash and stock.

Despite these advancements, shares of Coinbase experienced a downturn on Thursday. The stock fell 0.38% in after-hours trading, following a 3.84% decline during the regular trading session to close at $241.05. Year-to-date, Coinbase's stock has seen a 2.92% loss. American Express stock also closed down 0.37% at $297.99 on the same day. While Coinbase (COIN) has shown strong performance on the Growth metric, it has lagged in Momentum and Value metrics.

You may also like...

How Technology, Equity, and Resilience are Reshaping Global Healthcare

The global healthcare system is undergoing a profound transformation, driven by technological leaps, a renewed focus on ...

A World Unwell: Unpacking the Systemic Failures of Global Health

From recurring pandemics to glaring inequities, the global health system is under immense strain. This article explores ...

Sapa-Proof: The New Budget Hacks Young Nigerians Swear By

From thrift fashion swaps to bulk-buy WhatsApp groups, young Nigerians are mastering the art of sapa-proof living. Here ...

The New Age of African Railways: Connecting Communities and Markets

(5).jpeg)

African railways are undergoing a remarkable revival, connecting cities, boosting trade, creating jobs, and promoting gr...

Digital Nomadism in Africa: Dream or Delusion?

For many, networking feels like a performance — a string of rehearsed elevator pitches and awkward coffee chats. But it ...

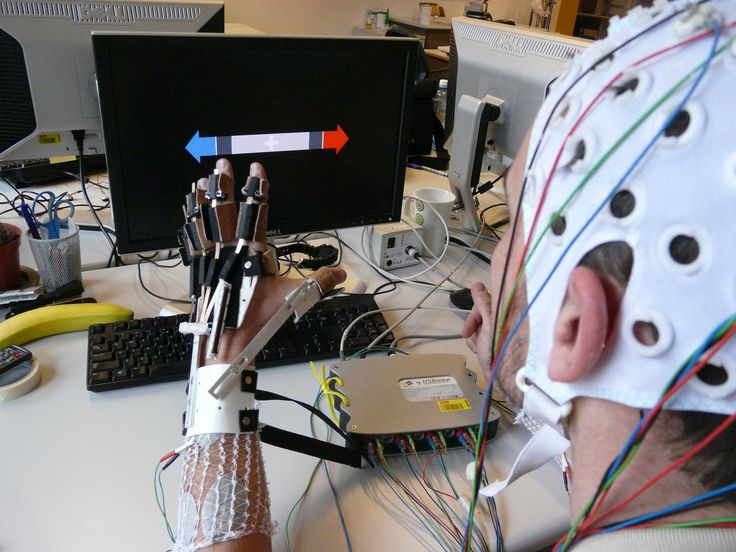

The Ethics of Brain-Computer Interfaces: When Technology Meets the Mind

This piece redefines networking as a practice rooted in curiosity, generosity, and mutual respect, sharing stories from ...

Carthage: The African Power That Challenged Rome

Long before Rome became the undisputed master of the Mediterranean, it faced a formidable African rival whose power, wea...

Africa’s Oldest Seat of Learning: The Story of al-Qarawiyyin

Long before Oxford or Harvard opened their doors, Africa was already home to a seat of learning that would shape global ...

![Big Tech and Consumer Giants Report Q[Quarter Number] Earnings](https://image.cnbcfm.com/api/v1/image/104951455-IMG_1534r.jpg?v=1692054813&w=1920&h=1080)