Brits Brace for Blow: £50 Billion Black Hole Threatens Massive Tax Hikes!

Economists and business leaders are issuing dire warnings of 'unavoidable' tax hikes this autumn, as Chancellor Rachel Reeves faces a significant financial black hole estimated to be as large as £50 billion. This looming fiscal challenge stems from a worse-than-expected downgrade to the UK's productivity outlook by the Office for Budget Responsibility (OBR), the independent fiscal watchdog. The OBR is reportedly poised to cut its trend productivity forecast by about 0.3 percentage points, which could open a fresh hole in the public finances of over £20 billion, adding to an already anticipated multi-billion-pound deficit.

The scale of this challenge has led experts to believe that the Chancellor will likely have to break Labour's manifesto pledge not to increase income tax, National Insurance, or VAT. Rob Wood, chief UK economist at Pantheon Macroeconomics, indicated that meeting Budget rules and increasing 'headroom' could necessitate up to £50 billion in tax rises and spending cuts. Even a reduced estimate of £40 billion would 'significantly raise the probability that the Chancellor resorts to a manifesto-breaking income tax hike'. Martin Beck, chief economist at WPI Strategy, echoed this, stating that breaking the pledge on the 'big three' taxes 'may become unavoidable,' suggesting measures such as a 2p increase in income tax rates or reversing 2023-24 NICs cuts, which could each raise around £20 billion but come at a significant political cost.

Beyond the 'big three', speculation is mounting that the Chancellor is actively considering other revenue-generating measures. These include targeting pensions, property, and landlords. A controversial 'mansion tax' has also been revealed, which would impose a 1 per cent charge on the amount by which properties exceed £2 million, potentially resulting in an annual bill of £10,000 for a £3 million home. Property experts and even a former Bank of England governor have condemned these plans, warning of their negative impact on the housing market.

The business community has reacted with alarm to the prospect of further tax increases. The Confederation of British Industry (CBI) has warned that businesses 'cannot bear the brunt' of more tax hikes, reporting prolonged gloom among firms that has lasted longer than during the pandemic. Sentiment has been negative for 13 consecutive months, tracing back to the previous Budget's £25 billion raid on employer National Insurance. This uncertainty is causing firms to delay crucial hiring and investment decisions. Helm, an organization for 'scale-up' businesses, reported that 75 per cent of founders are holding off on such decisions until the Budget is delivered. Prominent business leaders, including M&S chief executive Stuart Machin and his predecessor Stuart Rose, have urged Ms Reeves to 'change course' to avoid an 'economic doom loop of ever-higher taxes and lower growth,' with Rose warning that Britain has been pushed to 'the edge of a crisis'.

Politically, the OBR's timing in delivering its productivity downgrade has reportedly 'angered' No 10 and the Treasury, particularly its decision to do so now rather than before the last general election. The Tories have seized on the forecast, calling it a 'damning verdict on Labour's failure to deliver' growth. Shadow Chancellor Mel Stride criticized Rachel Reeves for blaming others, asserting that Labour lacks a plan to fix productivity and the 'backbone to cut spending,' leading to a 'doom loop of more spending, increasing debt and high taxes.' Meanwhile, research from the Resolution Foundation think-tank highlighted that the 'effective tax rate' for average earners on £33,000 a year is already at 27 per cent, the highest in 13 years, with employer National Insurance significantly contributing to this burden, effectively paid by the employee.

You may also like...

Barcelona Blow: Pedri Sidelined for Crucial Chelsea Showdown Due to Injury

)

Barcelona confirms that midfielder Pedri will be sidelined for six to seven weeks with a thigh injury, missing key fixtu...

Trae Young's Injury Scare: Hawks Star Avoids ACL Tear, Awaits MRI Results

Atlanta Hawks star Trae Young sustained a right knee sprain, confirmed not to be an ACL injury, during a recent game aga...

Hollywood Beef Erupts: 'Road House' Director Clashes With Amazon Over Disconnected Sequel

A creative and legal showdown rocks Hollywood as director Doug Liman and original writer R. Lance Hill challenge Amazon ...

Anime Shockwave: 'One Piece' Ends 27-Year Tradition With Major 2026 Overhaul

Toei Animation announces a bold new era for One Piece ending its weekly broadcast model after 27 years. Beginning in 202...

Music & Mayhem: F1 Las Vegas Grand Prix Secures Superstar Lineup with Louis Tomlinson, Kane Brown

The 2025 Formula 1 Heineken Las Vegas Grand Prix is revving up with a star-studded musical lineup featuring Louis Tomlin...

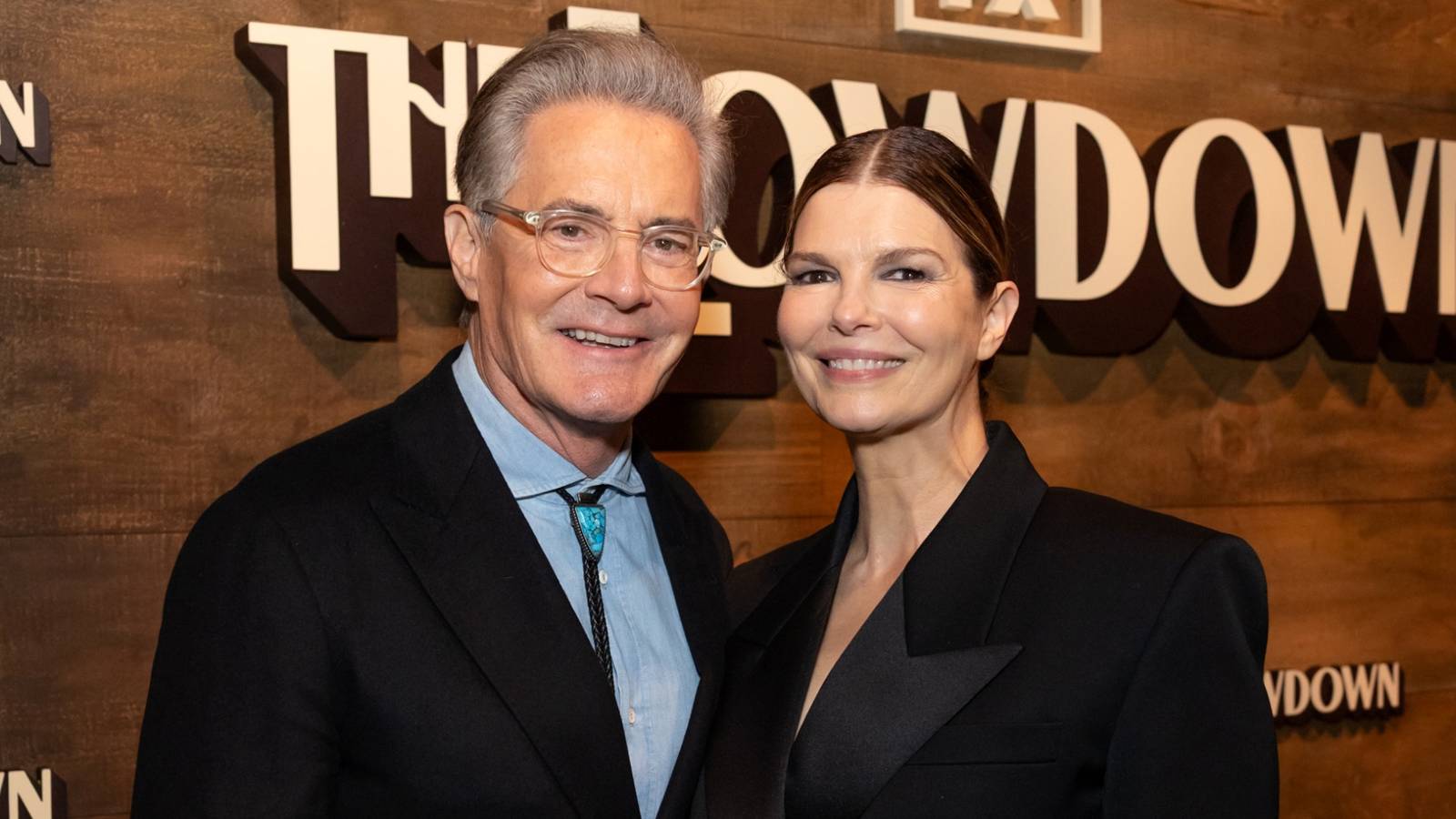

Kyle MacLachlan Unpacks 'Twin Peaks' & 'The Lowdown' Similarities

From 'Reservation Dogs' creator Sterlin Harjo, the FX series 'The Lowdown' is a moody mystery set in Tulsa, Oklahoma, ex...

Political Shockwave in Liberia: President Boakai's Sudden Purge Rocks Nation

President Joseph Boakai has initiated a wave of unexplained dismissals across his Liberian administration, creating an a...

Unveiling Uganda's Infamous 'Highway of Death': A Dangerous Journey Revealed

Uganda's Kampala-Gulu highway is a "corridor of death," highlighted by a recent fatal crash involving 46 lives. Bus driv...