Brazil's Central Bank Under Fire: Court Challenge Erupts Over Controversial Bank Liquidation!

Brazil’s central bank is currently facing extraordinary judicial scrutiny over its decision to liquidate Banco Master SA, a rare instance of intervention by both the country’s Supreme Court and Audit Court. This unprecedented situation risks undermining the legal certainty of the regulator’s decisions, with the central bank under a looming deadline to provide detailed information regarding the liquidation.

The central bank’s decision to liquidate Banco Master followed months of intensive investigations into the bank’s operations and its politically connected Chief Executive Officer, Daniel Vorcaro. Vorcaro had previously spent approximately a month in jail before being released and fitted with an ankle monitor. The investigations uncovered evidence suggesting attempted fraud in a proposed sale of Banco Master to Banco de Brasilia SA, an institution owned by the Federal District government. These findings were subsequently forwarded to the federal police and the federal public prosecutor’s office, leading to the request for the arrest of Vorcaro and other executives on November 17.

The judicial oversight is particularly significant as it marks the first time a decision falling under the central bank’s exclusive jurisdiction has come under such close scrutiny by Brazil’s highest courts. This situation underscores the considerable challenges policymakers encounter when navigating Brasilia’s intricate web of political connections, a terrain in which Vorcaro has long demonstrated adeptness.

The Supreme Court’s involvement escalated in early December when Justice Dias Toffoli assumed control of the investigation. This move occurred after a defense lawyer contended that police actions could potentially affect individuals with parliamentary immunity. Among the documents seized during a search of Vorcaro’s home was paperwork pertaining to a real estate transaction involving a federal lawmaker. Although this document was unrelated to the Banco Master investigation itself, Justice Toffoli ruled it sufficient to mandate that “any legal action be evaluated beforehand by this court rather than by a lower court.”

Further complicating matters, Justice Toffoli controversially scheduled a confrontation hearing for December 30, over the Christmas period. This hearing involved Vorcaro, former Banco de Brasilia chief Paulo Henrique Costa (who was fired after the investigation became public), and central bank supervision director Ailton de Aquino. The hearing was scheduled without any request from either the federal police or the public prosecutor’s office, and the attorney general’s office advised against it, arguing that such a procedure should only take place after individuals involved in the probe have been individually questioned. Justice Toffoli has not provided further explanation for summoning Aquino, whose role at the central bank is supervisory, not directly related to the decision-making process for the Banco Master sale.

Central bank President Gabriel Galipolo has publicly affirmed his willingness to appear before the Supreme Court to explain the regulator’s actions. On December 18, he stated in a press conference: “As president, I am available to the Supreme Court to provide all the data that we have already provided to the public prosecutor’s office and the federal police. We have documented everything: each of the actions taken, each of the meetings, exchanges of messages, communications, all of this is duly documented. I, in particular, am available to provide all kinds of support and assistance to the investigation.”

Concurrently, on the same day, Audit Court Minister Jhonatan de Jesus initiated a separate investigation into the central bank. His ruling cited potential failures in the central bank’s supervision of Banco Master, noting that the regulator’s actions “may have been marked by omissions and insufficiently timely responses to signs of the institution’s financial deterioration, undermining the effectiveness of the regulatory framework and increasing systemic risk.” Critics have long argued that the central bank delayed in liquidating a lender that was evidently in distress. Both the Supreme Court and Audit Court investigations are currently under seal.

Banco Master, once lauded as a rising star in Brazilian finance, had attracted billions of reais from retail investors by promoting its bonds as secure due to their backing by Brazil’s deposit insurance system, the Credit Guarantee Fund (FGC). The FGC covers up to 250,000 reais per investor, with a cap of 1 million reais over four years. However, a central bank rule change in December 2023 tightened access to the FGC, effectively punching a hole in Banco Master’s business model. A second rule change, approved in August, will further require banks to contribute to the fund based on their risk profile starting in June 2026.

The liquidation of Banco Master could have significant financial repercussions for the FGC, with estimates suggesting a potential cost of as much as 55 billion reais ($10 billion) if other smaller banks also experience failures. Such a scenario would necessitate the replenishment of the fund by Brazil’s largest banks.

Recommended Articles

Fierce Debate Rages: Civil Societies & Experts Demand Electronic Transmission of 2027 Election Results

Legal experts, civil society groups, and lawmakers are pressuring Nigeria's National Assembly to mandate electronic tran...

Kpandai MP Nyindam Triumphs as Supreme Court Restores Contested Seat

The Supreme Court has reinstated Kpandai MP Matthew Nyindam, overturning a High Court decision that annulled his electio...

Ghana Erupts as Supreme Court Overturns Kpandai Election, Igniting Political Firestorm!

The Supreme Court has reinstated Matthew Nyindam as Kpandai MP, overturning a High Court decision in a 4–1 majority ruli...

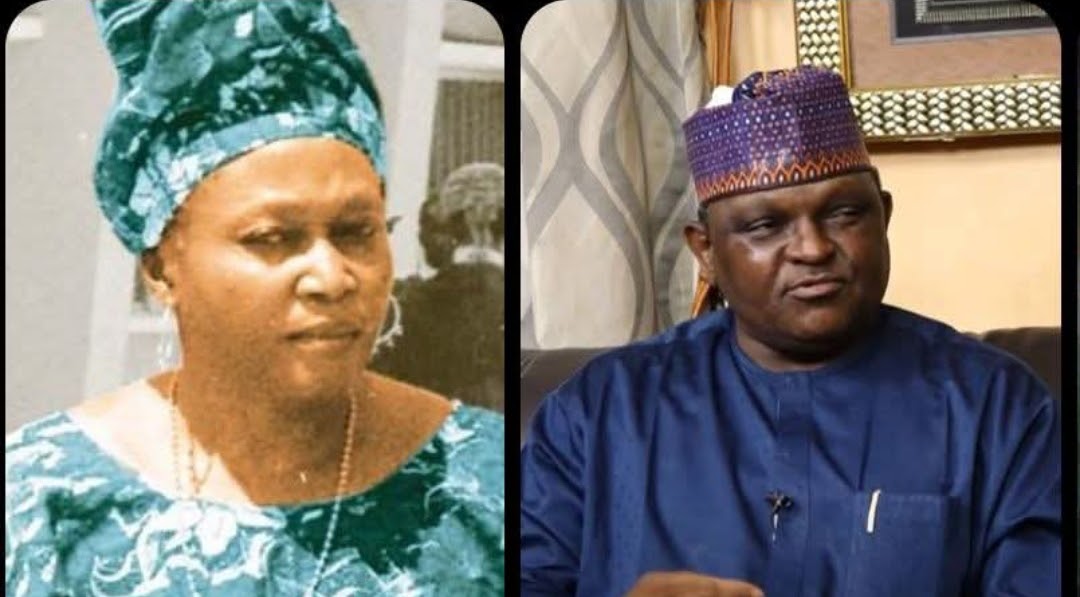

Controversial Verdict: Supreme Court Finally Dismisses Al-Mustapha's Decades-Old Kudirat Abiola Murder Trial

The Supreme Court has dismissed the murder trial of Major Hamza Al-Mustapha, former CSO to General Sani Abacha, concerni...

Political Earthquake: Court Sacks Abure as Labour Party Chairman Amidst Fierce Power Tussle

The Federal High Court in Abuja removes Julius Abure as Labour Party chairman, affirming Senator Esther Nenadi Usman's c...

You may also like...

When Sacred Calendars Align: What a Rare Religious Overlap Can Teach Us

As Lent, Ramadan, and the Lunar calendar converge in February 2026, this short piece explores religious tolerance, commu...

Arsenal Under Fire: Arteta Defiantly Rejects 'Bottlers' Label Amid Title Race Nerves!

Mikel Arteta vehemently denies accusations of Arsenal being "bottlers" following a stumble against Wolves, which handed ...

Sensational Transfer Buzz: Casemiro Linked with Messi or Ronaldo Reunion Post-Man Utd Exit!

The latest transfer window sees major shifts as Manchester United's Casemiro draws interest from Inter Miami and Al Nass...

WBD Deal Heats Up: Netflix Co-CEO Fights for Takeover Amid DOJ Approval Claims!

Netflix co-CEO Ted Sarandos is vigorously advocating for the company's $83 billion acquisition of Warner Bros. Discovery...

KPop Demon Hunters' Stars and Songwriters Celebrate Lunar New Year Success!

Brooks Brothers and Gold House celebrated Lunar New Year with a celebrity-filled dinner in Beverly Hills, featuring rema...

Life-Saving Breakthrough: New US-Backed HIV Injection to Reach Thousands in Zimbabwe

The United States is backing a new twice-yearly HIV prevention injection, lenacapavir (LEN), for 271,000 people in Zimba...

OpenAI's Moral Crossroads: Nearly Tipped Off Police About School Shooter Threat Months Ago

ChatGPT-maker OpenAI disclosed it had identified Jesse Van Rootselaar's account for violent activities last year, prior ...

MTN Nigeria's Market Soars: Stock Hits Record High Post $6.2B Deal

MTN Nigeria's shares surged to a record high following MTN Group's $6.2 billion acquisition of IHS Towers. This strategi...