BlockFi, DOJ Reach Settlement on $35M Crypto Case

Key Points:

BlockFi has settled a major lawsuit with the DOJ, approving a $35 million settlement, marking progress in its bankruptcy proceedings.

The case dismissal aids BlockFi’s focus on meeting withdrawal deadlines by April 2024, prioritizing creditor repayments amidst ongoing industry challenges.

U.S. Bankruptcy Court Judge Michael B. Kaplan has approved the dismissal of a $35 million asset transfer lawsuit between BlockFi and the DOJ, as reported by ChainCatcher. The agreement involves the DOJ and BlockFi dismissing their case with prejudice.

This settlement marks a progress point in BlockFi’s bankruptcy process, with implications for creditors. The financial resolution aids BlockFi’s focus on meeting withdrawal deadlines by April 2024.

Despite the legal closure, . Neither BlockFi’s leadership nor major crypto voices issued statements, emphasizing ongoing focus on fulfilling creditor commitments. The DOJ’s agreement led to .

The legal resolution involving BlockFi mirrors previous complex crypto bankruptcy cases like Mt. Gox, illustrating recurring patterns in asset recovery and creditor prioritization in the digital asset sector.

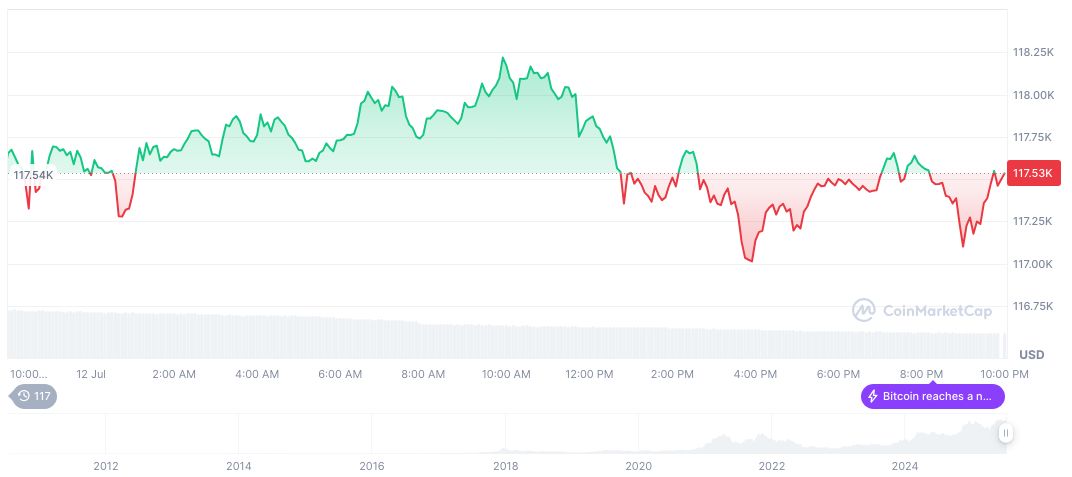

Bitcoin’s current market data, as recorded by CoinMarketCap, indicates a price of $118,644.01 and a market cap of $2.36 trillion. Its 24-hour trading volume stands at $47.99 billion, with a moderate price increase of 0.98% over the same period. The asset dominates 63.68% of the total crypto market.

that while the BlockFi settlement has localized effects, broader industry implications remain minimal. The event underlines ongoing financial legalities within crypto firm bankruptcies, maintaining focus on compliance and fund distribution to affected users.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

You may also like...

Diddy's Legal Troubles & Racketeering Trial

Music mogul Sean 'Diddy' Combs was acquitted of sex trafficking and racketeering charges but convicted on transportation...

Thomas Partey Faces Rape & Sexual Assault Charges

Former Arsenal midfielder Thomas Partey has been formally charged with multiple counts of rape and sexual assault by UK ...

Nigeria Universities Changes Admission Policies

JAMB has clarified its admission policies, rectifying a student's status, reiterating the necessity of its Central Admis...

Ghana's Economic Reforms & Gold Sector Initiatives

Ghana is undertaking a comprehensive economic overhaul with President John Dramani Mahama's 24-Hour Economy and Accelera...

WAFCON 2024 African Women's Football Tournament

The 2024 Women's Africa Cup of Nations opened with thrilling matches, seeing Nigeria's Super Falcons secure a dominant 3...

Emergence & Dynamics of Nigeria's ADC Coalition

A new opposition coalition, led by the African Democratic Congress (ADC), is emerging to challenge President Bola Ahmed ...

Demise of Olubadan of Ibadanland

Oba Owolabi Olakulehin, the 43rd Olubadan of Ibadanland, has died at 90, concluding a life of distinguished service in t...

Death of Nigerian Goalkeeping Legend Peter Rufai

Nigerian football mourns the death of legendary Super Eagles goalkeeper Peter Rufai, who passed away at 61. Known as 'Do...