Bitcoin Soars Towards $100,000, Reaching New Heights Since 2025

Bitcoin has demonstrated a significant upward trajectory in 2026, successfully breaching the $96,000 threshold for the first time since November. This impressive movement is primarily fueled by an intensification of spot market demand, drawing substantial fresh interest from a diverse range of investors and traders. Over the last 24 hours alone, BTC has recorded an appreciation of more than 4.5 percent, signaling a robust resurgence of bullish momentum after what had been a rather tentative start to the year. This renewed vigor has reignited discussions and predictions concerning the highly anticipated breach of the $100,000 milestone, with market participants now debating when, rather than if, this will occur.

This current rally distinguishes itself from previous upward trends in several key aspects. The buying activity has been predominantly concentrated in spot markets, as opposed to being driven by futures and leveraged positions. This indicates that the demand stems from actual capital flowing into the asset, representing genuine investment rather than speculative, leveraged bets on its future direction. Further supporting this observation, market data reveals over $600 million in short liquidations that transpired after prices successfully pushed through critical resistance levels. This phenomenon forced bearish positions to close, thereby adding significant momentum and fuel to Bitcoin's ongoing advance.

The $100,000 price point carries immense significance, serving as both a psychological barrier and a crucial market signal. Successfully breaching this six-figure mark would undoubtedly amplify positive sentiment across the market and is expected to attract further interest from both retail and institutional participants. For a considerable number of investors, a sustained move above this threshold would effectively set the tone for what could evolve into a protracted bull run.

From a technical perspective, Bitcoin appears to be exceptionally well supported. Its price currently holds above all major moving averages, a bullish indicator, and it has successfully cleared a notable resistance zone, roughly between $94,500 and $96,800, which had previously constrained its ascent in recent weeks. Analysts suggest that maintaining levels above this newly conquered resistance significantly increases the probability of further upside. A notable characteristic of the current market behavior is that buyers are consistently stepping in on dips. Market observers, including Michaël van de Poppe, founder of MN Trading Capital, have highlighted that pullbacks are being perceived and utilized as opportune buying occasions rather than triggers for selling. This behavioral shift is instrumental in reducing short-term volatility and is vital for sustaining upward price pressure.

Institutional flows are also exhibiting a constructive trend. Recent data indicates consistent inflows into Spot Bitcoin ETFs in the United States. These inflows mark a reversal of the outflows that had exerted downward pressure on the market throughout late 2025. The consistent movement of capital into these regulated financial products underscores a cautious yet real entry of institutional capital into Bitcoin, thereby laying a foundation for a more durable path towards higher prices. Prediction markets are corroborating this sentiment, pricing in a near-term test of the $100,000 level. Data from Polymarket, for instance, shows traders assigning approximately a 50 percent probability that Bitcoin will either retest or exceed $100,000 by early February. This suggests that the market is increasingly viewing the current rally as more than just a fleeting bounce.

Despite the overwhelming positive signals, maintaining a degree of caution remains paramount. Bitcoin continues to trade below its late-2025 all-time high, which stood at over $126,000. The cryptocurrency market is susceptible to rapid shifts in sentiment driven by factors such as liquidity changes, unforeseen regulatory developments, and broader geopolitical tensions, like the ongoing unrest in Iran. While sharp reversals are considered less likely as long as the upward trend is robustly supported by spot buying, they are by no means impossible. Should spot demand persist and the market successfully hold above key support zones, a breakthrough above $100,000 appears to be a plausible event within weeks, rather than months. The trading sessions immediately ahead will be crucial, as both existing holders and new entrants will closely monitor the market's ability to maintain its footing during price dips. If it succeeds in doing so, the path to the six-figure mark will become increasingly clear.

You may also like...

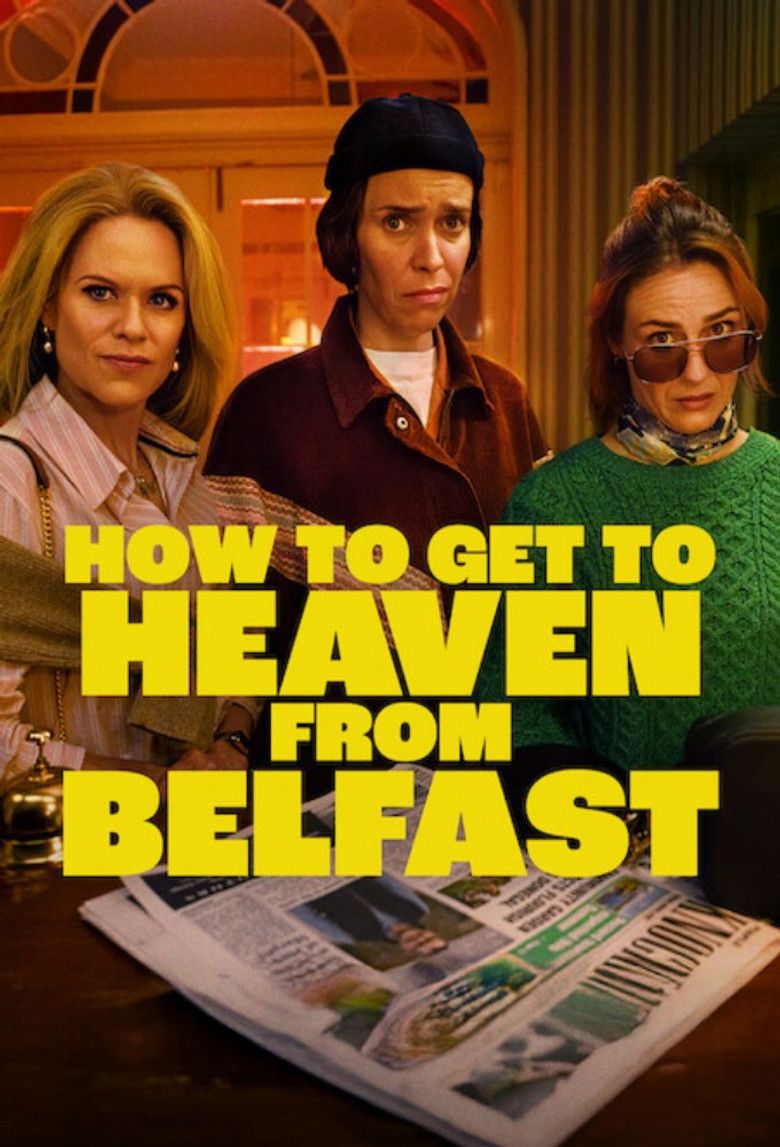

Binge-Worthy 8-Episode Thriller Masterpiece Lands on Netflix!

Lisa McGee, creator of "Derry Girls," brings "How To Get To Heaven From Belfast" to Netflix, a gripping comedy thriller....

Blockbuster Oscar Nominee Hits Netflix After Raking In Millions!

<i>Jurassic World Rebirth</i> redefines the beloved franchise by exploring scientific overreach and humanity's evolving ...

Little Mix's Leigh-Anne Reveals Dream Collaboration with Manon and Normani!

Leigh-Anne Pinnock expressed her desire to collaborate with Manon Bannerman and Normani, a wish that carries significant...

Music Star Thomas Rhett & Lauren Akins Announce Arrival of First Son!

Country music star Thomas Rhett and his wife, Lauren Akins, have welcomed their fifth child and first son, Brave Elijah ...

Bridgerton Stars Unveil Game-Changing Season 4 Death

An interview with the stars of Bridgerton Season 4 Part 2 delves into the tragic death of John Stirling and its aftermat...

Shocking Recruitment Scandal: Kenyan Faces Charges for Sending Youths to Ukraine War

A Kenyan man has been arraigned in court over alleged human trafficking, accused of recruiting 22 youths for the Russia-...

Angola Under Fire: Billion-Dollar Contracts Awarded Without Public Tender

A comprehensive review of Angolan presidential decrees has uncovered that at least US$61.5 billion in public spending wa...

Pentagon Declares AI Heavyweight Anthropic a Supply Chain Risk

The Trump administration has ordered federal agencies to cease using Anthropic products following a dispute over the com...