Bitcoin Skyrockets Past $91K as Wall Street Dives In!

Bitcoin's price surged back above $91,000 on Tuesday, marking a powerful rebound as major Wall Street institutions intensify their involvement in digital assets. The cryptocurrency traded at $91,089 at press time, showing an 8% increase over the last 24 hours. This price surge was accompanied by a significant increase in trading volume, reaching $78 billion, indicating one of the strongest trading sessions in the past month. Bitcoin is now positioned above its 7-day high of $89,966 and maintains a 7% lead over last week’s low of $83,989. The asset's market capitalization climbed to $1.79 trillion, driven by fresh institutional capital flowing into the market. The momentum shifted dramatically in the early morning session, pushing BTC past the $90,000 level after successfully holding key support zones over the weekend. This rebound occurs at a crucial time when major banks and brokerages, previously cautious, are now providing pathways for regulated Bitcoin exposure.

A significant development on Wall Street comes from Bank of America, which is making its most substantial move into digital assets to date. The bank will now permit its 15,000 wealth advisers to recommend a crypto allocation ranging from 1% to 4%. This represents a dramatic shift, fully integrating one of the largest financial institutions into the Bitcoin ETF era. This change is effective January 5, coinciding with the bank’s chief investment office initiating formal research coverage on four leading Bitcoin ETFs: Bitwise BITB, Fidelity FBTC, Grayscale Bitcoin Mini Trust, and BlackRock IBIT. Previously, advisers were prohibited from discussing Bitcoin unless clients specifically initiated the conversation, a restriction that has now been lifted. Chris Hyzy, CIO for Bank of America Private Bank, stated that the bank is adopting a "measured" approach, framing crypto as a thematic innovation suitable only through regulated products. Conservative investors are expected to opt for the lower end of the allocation range (1%), while higher-risk clients might consider up to 4%. Bank of America's decision aligns it with other financial giants; Morgan Stanley recommended a 2%–4% Bitcoin allocation in October, and BlackRock has suggested that a 1%–2% BTC allocation can enhance long-term portfolio efficiency.

Further demonstrating this institutional shift, Vanguard, the world's second-largest asset manager, has also reversed its long-standing stance. Starting today, Vanguard will begin allowing Bitcoin and crypto-linked ETFs and mutual funds on its platform. This move grants over 50 million brokerage clients access to crypto exposure for the first time. For years, Vanguard had dismissed Bitcoin as too speculative for long-term portfolios, making this a major policy reversal.

Despite today's sharp upward price action, the broader outlook for Bitcoin remains tense. The cryptocurrency has been in a two-month downtrend since reaching a peak above $126,000 in October, experiencing nearly a 30% decline before finding support between $83,800 and $84,000. This support zone was repeatedly defended by traders over the past week. Last month's close was bearish, with November producing a large red monthly candle that erased gains from April through June and confirmed a bearish MACD cross on the monthly chart. This high-time-frame signal has historically indicated weak momentum for several months.

Key price levels are becoming clearer on the chart. Bitcoin currently faces immediate resistance at $91,400, followed by $93,000 and $94,000. There is also substantial resistance between $98,000 and $103,000, which continues to act as a major ceiling for the market. While bulls successfully pushed the price above $90,000 today, they still confront strong overhead pressure within the $91,400–$94,000 zone. On the downside, initial support is found at $87,000, which aligns with the 0.146 Fibonacci level, followed by $84,000. Deeper support levels are present at $75,000 and the broader $69,000–$72,000 range. The next significant support beyond that lies near $57,700. Analysts from Bitcoin Magazine caution that if BTC loses $84,000 again with momentum, the path to $75,000 could open quickly.

The Federal Reserve's December 9–10 meeting is also a significant factor. Markets are currently pricing in an over 80% chance of a 25 basis point rate cut, a move that historically supports risk assets. However, a decision to pause rate cuts could trigger another wave of selling in the market. At the time of writing, the bitcoin price trades at $91,039.

You may also like...

Premier League Giants Battle for USMNT Star Adams: Man Utd, Chelsea, Liverpool in Transfer Frenzy!

The latest football transfer market updates reveal intense activity among top clubs. Manchester United, Chelsea, and Liv...

Wemby's Relief: NBA Star Victor Wembanyama Speaks Out After Friend's Safe Return

San Antonio Spurs star Victor Wembanyama's longtime friend, Elijah Hoard, was safely located after going missing at Chic...

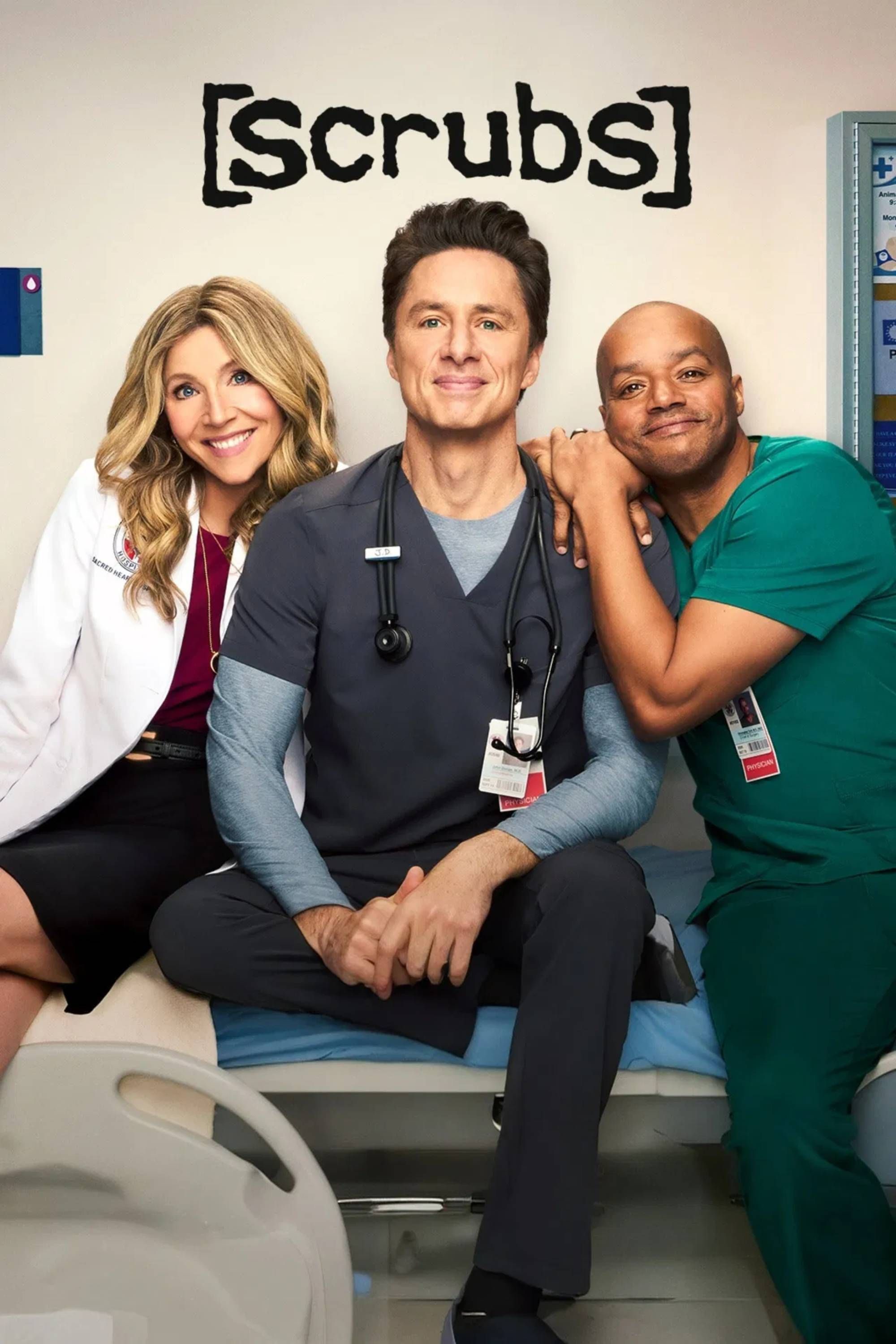

Iconic Comedy 'Scrubs' Makes Triumphant Comeback After 16 Years With Record-Shattering Ratings

The iconic medical sitcom "Scrubs" has made a triumphant return to ABC, drawing over 11 million viewers and achieving AB...

Streaming Shake-Up: HBO Max Merges With Divisive Rival, Promising Big Changes for Subscribers

The potential merger of Paramount and Warner Bros. Discovery is set to significantly reshape the streaming landscape, pa...

Twisted Sister Shocker: Sebastian Bach Joins for 50th Anniversary as Snider Steps Down!

Twisted Sister's 50th-anniversary shows are set to continue, with Sebastian Bach joining as the lead vocalist for select...

Global Tensions Silence the Decks: Charlotte de Witte Cancels Australia Tour Over Middle East Conflict Fallout

Belgian techno DJ Charlotte de Witte has cancelled her highly anticipated Australian shows, including performances in Sy...

Fiennes Tiffin Teases Epic Sherlock Season 2 Showdown

The Prime Video series 'Young Sherlock' reintroduces a nascent Sherlock Holmes, portrayed by Hero Fiennes Tiffin, embark...

Middle East Tensions Ripple: Namibians Stranded in Dubai, Kenya Airways Launches Repatriation Flights Amid Iran Attacks

Middle East military tensions have prompted Kenya Airways to operate special repatriation flights to Dubai, aiding stran...