Bitcoin Price Could Reach $159,000 This Cycle - Crypto Analyst Reveals How

The Bitcoin price struggled to keep up its 2024 momentum in the first quarter of 2025, crumbling under the macroeconomic uncertainty in the United States. While the crypto market looked set to continue its woes in early April, prices are looking to reclaim their cycle highs — thanks to the improving market climate.

According to recent price action data, the Bitcoin price has increased by more than 25% so far in this quarter, outperforming most large-cap assets in the same period. Interestingly, the premier cryptocurrency appears to have more room for further upside growth, with its current all-time high price seeming like the next immediate target.

In a May 17 post on the X platform, on-chain analyst Burak Kesmeci evaluated the potential of the Bitcoin price in the remaining weeks of this second quarter. In his latest analysis, the crypto pundit revealed three levels that may be critical to BTC’s price trajectory.

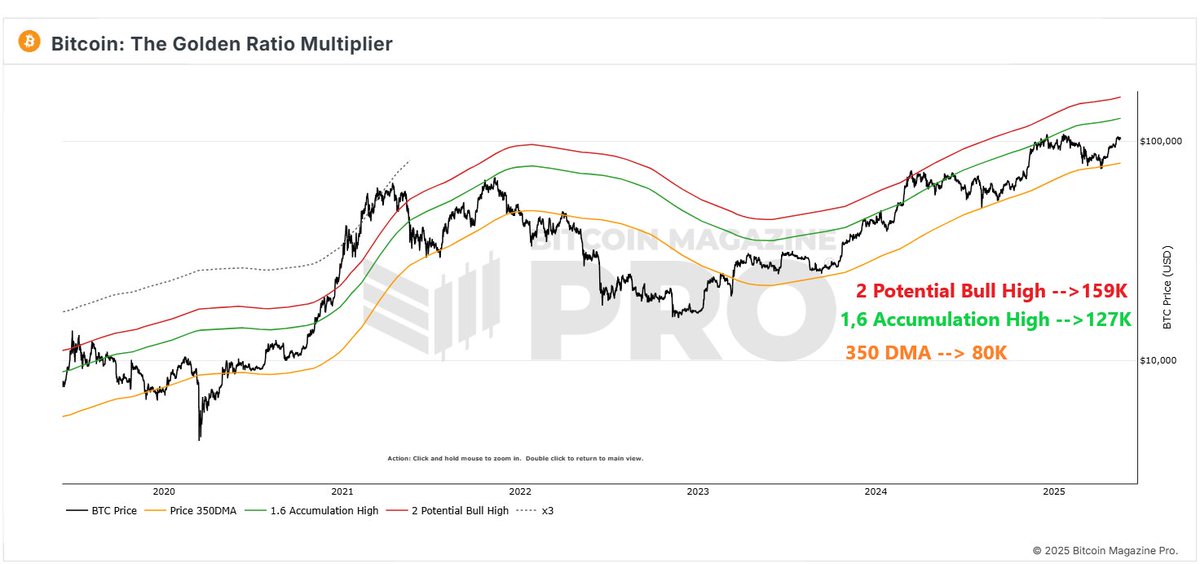

The relevant indicator here is the Golden Multiplier Ratio, which is useful primarily in tracking cyclical price behavior and identifying important price levels. This technical analysis tool applies Fibonacci-based multipliers to the 350-day moving average (350DMA) to identify potential price tops and bottoms.

Kesmeci identified the $127,000 and $159,000 levels as the resistance regions to watch in this bull rally. Specifically, the $127,000 level aligns with the 1.6x multiplier of the 350-day moving average, which served as a mid-cycle top in previous bull runs.

The $159,000 level, on the other hand, correlates with the 2x multiplier of the 350DMA and has historically signaled the cycle tops in the BTC market. However, the Bitcoin price would need to successfully breach the mid-cycle top if there is to be a chance of a rally towards the $159,000 level.

Furthermore, Kesmeci pinpointed the most important support level to watch for the Bitcoin price in the remaining days of the year’s second quarter. Based on the Golden Multiplier Ratio, this cushion lies at $80,000 around the 350-day moving average, where long-term accumulation typically occurs. A fall beneath this support could invalidate the bullish theory currently being held for the price of BTC.

In the end, Kesmeci noted that the Golden Multiplier Ratio is based on moving averages, and, as a result, the highlighted levels are subject to changes as the Bitcoin price moves in the coming days.

As of this writing, the value of BTC is hovering around $103,275, with no significant price movement in the past 24 hours.