Bessent's Bitcoin Market Shocks: From Price Collapse to US Buy Hints

The price of Bitcoin, the leading cryptocurrency by market capitalization, experienced a significant sharp collapse earlier this Thursday. This downturn occurred after U.S. Treasury Secretary Scott Bessent initially confirmed that the U.S. would not be purchasing crypto for its strategic reserve. At 12:35 UTC, Bitcoin plunged to an intraday low of $117,719 on the Bitstamp exchange, struggling to regain ground and trading around $118,544. This occurred on the very same day it had reached a new all-time high of $124,517, marking a nearly 4% decline. Altcoins took an even bigger hit, with XRP plunging 7% within minutes and briefly dipping below the $3 level. Overall, CoinGlass data showed that over $1 billion worth of crypto had been liquidated over the past 24 hours, with long positions accounting for the overwhelming majority of this wipeout, totaling $778 million.

Bessent had initially stated that the U.S. would cease selling existing coins, a policy maintained by the current administration since the establishment of the cryptocurrency reserve in March. However, he explicitly ruled out new Bitcoin purchases, despite previous suggestions that avenues for buying more could be found. This stance caused the odds of the U.S. establishing its own strategic Bitcoin reserve in 2025, as tracked on Polymarket (a major cryptocurrency-based betting platform), to collapse to a new all-time low of just 16%. Bessent also clarified that the government's current holdings, comprised of confiscated coins, stand at up to $20 billion, making the U.S. the largest holder of top cryptocurrencies among all countries, with China and the U.K. also in the top three. Notably, China is reportedly considering selling its vast Bitcoin holdings to help fill a budget hole for its current Labour Party government.

In a contradictory development, Treasury Secretary Scott Bessent later indicated that the U.S. might indeed buy more Bitcoin, walking back his earlier comment that had contributed to the recent crypto market correction. This conflicting social media post puzzled some members of the cryptocurrency community. Despite having previously ruled out additional BTC purchases on top of the forfeited coins during a wide-ranging interview, Bessent subsequently posted on X (formerly Twitter) claiming that the U.S. Treasury is committed to finding “budget-neutral” pathways for acquiring more coins, echoing comments he made back in March. Bloomberg had previously estimated a 30% chance of the U.S. actually buying Bitcoin in 2025, with potential funds for such purchases possibly coming from the Exchange Stabilization Fund (ESF).

Bitcoin continued to exhibit volatility, trading at $118,156 following Bessent's most recent social media post, after earlier reaching an intraday low of $117,201. Michael Saylor, the executive chairman of business intelligence firm Strategy (formerly MicroStrategy), remained unfazed by the recent correction. He succinctly brushed off Bitcoin's recent plunge with a social media post asserting that

You may also like...

How to Navigate a Career Switch Without Starting Over

Changing careers doesn’t have to mean losing progress. With the right strategy, it’s possible to move into a new field c...

Top Skills That Will Future Proof Your Career

In a fast-changing world of work, staying relevant takes more than talent, it takes the right skills to future proof one...

The Tragic Case of Ochanya Elizabeth Ogbanje: From Abuse to Death and the Fight for Justice

The story of 13-year-old Ochanya Elizabeth Ogbanje: Her years of alleged sexual abuse, death in October 2018, how the ca...

Redefined Career Paths: The State of Work Across Africa in Late 2025.

From entrepreneurial partnerships to digital startups, millions of young people are redefining what it means to have a c...

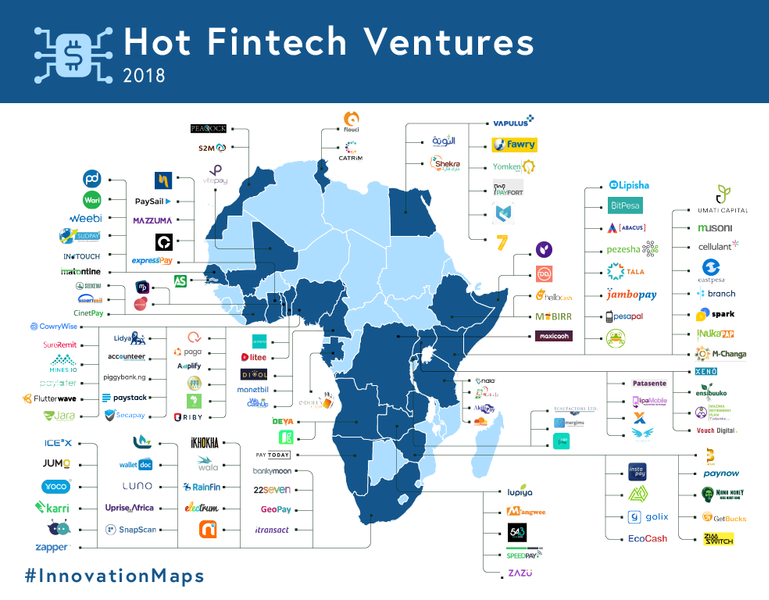

Digital Banking Platforms and the Financial Future of African Freelancers and Remote Workers

There is a revolution in the African Digital Economy. With a new generation of remote workers, digital banking platforms...

Breaking Barriers: How Women-Centered FinTech is Empowering Africa’s Entrepreneurs

Women-centered Fintechs in Nigeria and across Africa have taken the initiative in transforming the idea of financial inc...

A Wired Decade: Africa Rebuilt Itself Through Technology 2015–2025

Over the past decade, Africa has quietly assembled one of the most dynamic digital ecosystems in the world.

AI Tokens: The New Spoiler in the Crypto Market Drama

AI tokens were once the hottest trend in crypto until they led a sudden market pullback. This article explores how hype,...