Benjamin Cowen Predicts Multi-Month Bitcoin Correction

Prominent crypto analyst Benjamin Cowen, who has garnered a substantial following for his timely market calls, has issued a significant warning regarding the broader cryptocurrency market. Addressing his 1 million followers on the social media platform X, Cowen anticipates that Bitcoin (BTC) is poised to break its key support level at $100,000, potentially receding to the mid-$90,000 range.

Cowen’s prediction is rooted in his analysis of the ‘bull market support band,’ which he defines as the confluence of the 20-week simple moving average (SMA) and the 21-week exponential moving average (EMA). He suggests that Bitcoin will likely return to this band soon. This outlook is largely informed by Bitcoin’s price behavior over the past two years, where the third quarter has historically shown signs of weakness and a tendency for the asset to relinquish gains. As of the time of the analysis, Bitcoin was trading at $105,092.

The analyst has consistently highlighted on his YouTube channel that Bitcoin would likely begin to exhibit weakness around mid-June, coinciding with the typical onset of Q3 market softness. He points out that this pattern has been observed in previous years, leading him to project that the next significant low for Bitcoin could occur around August or September.

Looking beyond Bitcoin, Cowen extends his cautionary stance to the altcoin market. He warns that an anticipated correction in Bitcoin’s price will inevitably trigger a “brutal capitulation event” for altcoins. According to Cowen, this scenario implies that it may be “finally time to rip the band-aid off for ALT / BTC pairs,” suggesting these pairs are likely to fall to their range lows. A bearish performance of altcoins relative to Bitcoin indicates that altcoins would experience value depreciation at a faster rate than BTC during this downturn.

You may also like...

How Technology, Equity, and Resilience are Reshaping Global Healthcare

The global healthcare system is undergoing a profound transformation, driven by technological leaps, a renewed focus on ...

A World Unwell: Unpacking the Systemic Failures of Global Health

From recurring pandemics to glaring inequities, the global health system is under immense strain. This article explores ...

Sapa-Proof: The New Budget Hacks Young Nigerians Swear By

From thrift fashion swaps to bulk-buy WhatsApp groups, young Nigerians are mastering the art of sapa-proof living. Here ...

The New Age of African Railways: Connecting Communities and Markets

(5).jpeg)

African railways are undergoing a remarkable revival, connecting cities, boosting trade, creating jobs, and promoting gr...

Digital Nomadism in Africa: Dream or Delusion?

For many, networking feels like a performance — a string of rehearsed elevator pitches and awkward coffee chats. But it ...

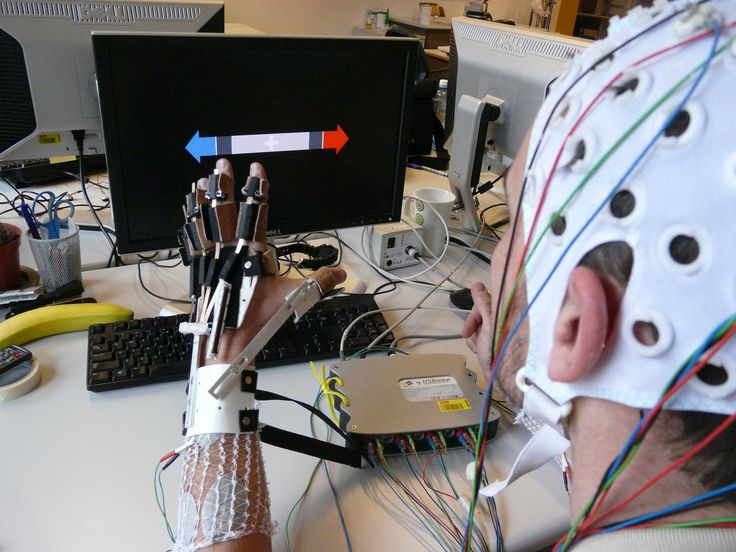

The Ethics of Brain-Computer Interfaces: When Technology Meets the Mind

This piece redefines networking as a practice rooted in curiosity, generosity, and mutual respect, sharing stories from ...

Carthage: The African Power That Challenged Rome

Long before Rome became the undisputed master of the Mediterranean, it faced a formidable African rival whose power, wea...

Africa’s Oldest Seat of Learning: The Story of al-Qarawiyyin

Long before Oxford or Harvard opened their doors, Africa was already home to a seat of learning that would shape global ...