Believe - Internet Capital Markets: What You Need to Know

Believe plays into the broader idea of Internet Capital Markets. The thesis is simple: more areas of existing finance and capital markets will move onchain. This can be thought of as an extension of Solana’s ‘decentralized NASDAQ’ aspirations.

In today’s edition, we’ll discuss how Believe works, how the protocol has fared so far, and more…

Stay informed in the markets ⬇

Believe first came to market as clout.me earlier this year, offering virtually the same capabilities as Believe today, allowing users to easily deploy a token by tagging the account on X. This mechanic should be familiar with users, as many tweets already contain replies tagging grok. Clanker. We previously covered Clanker, a launchpad on Base that effectively offered the same functionality as Believe, but on Farcaster instead of X.

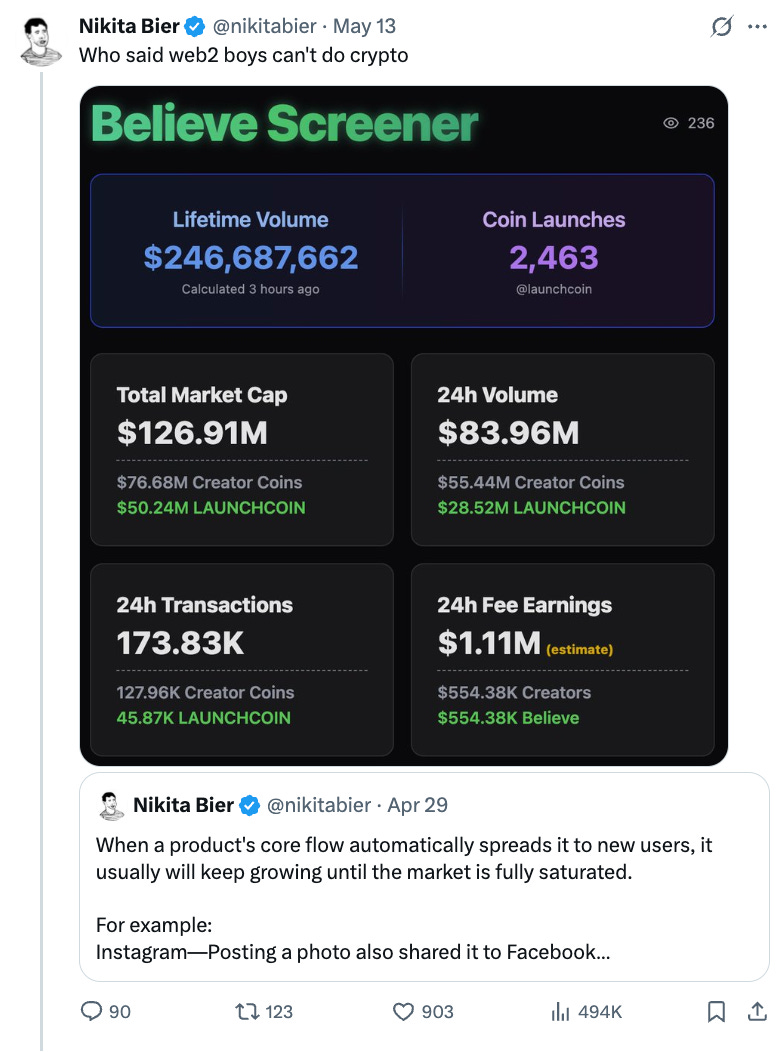

With a combination of positive market conditions and an emphasis on targeting existing Web2 founders, Believe’s Founder, Ben Pasternack, has been able to coin a new narrative. Similar to Zora on Base, Believe is supported by its host chain, Solana. Well-known Web2 social-app founder Nikita Bier serves as an Advisor to Solana, also involved with Believe specifically.

This provides the ecosystem with a level of expertise as well as credibility, positively impacting the perception of Solana and Believe for both active Web3 users and non crypto-natives. Nikita is a Co-founder of Dupe, a company featured on the Believe launchpad.

Dupe functions sort of similarly to the scan feature on popular e-commerce app, which allows users to find similar products by simply providing a photo of the original item. Instead of taking a photo or screenshot of an item, users can simply paste the URL of an item they are interested in purchasing on any e-commerce platform, or use the dupe’s browser extension or app. Dupe specializes in furniture, taking user-inputed product information and giving them quotes directly from factories.

Dupe sets a relatively high bar for what other projects and companies on Believe can bring to market. While the platform doesn’t exclude VC-backed companies, Believe’s main use case right now is to provide a funding mechanism for developers and founders with some previous experience and successes, but not enough to raise meaningful venture capital for their ideas.

This can be compared to the AI agents meta that began in late October 2024, which allowed small teams of developers who probably wouldn’t have been able to easily raise VC funding to launch tokens and achieve enormous marketcaps.

It can be debated whether or not the calibre of talent in the Believe ecosystem will be of equal standing or exceed that of the AI agents meta. This is difficult to quantify, but what retail investors might appreciate most about Believe is the ability for real businesses to find funding and support via crypto.

While memecoins have reached large marketcaps on Believe, the team’s self-stated impetus is to focus on supporting the existing founders on the platform, building real products that aim to generate revenues. The top tokens on the platform by marketcap are a mix of memes & more serious projects.

The revenue component is another part of what makes Believe interesting; in the past 24 hours, the protocol has raked in $8.6M in fees, with this being split 50/50 between the platform and its creators. This comes at a time where the onchain Solana trading landscape is being shaken up, with Raydium and BONK both rolling out viable launchpads to compete with Pump.Fun’s historical dominance…

Become a Premium member to unlock all our research & reports including access to our members-only discord server.

Join thousands of sharp crypto investors & traders by becoming a & gain an edge in the markets. For just $129/month, you can access our full suite of offerings: