Australian April Inflation Data Shows Consumer Prices Rise and Core Inflation Edges Higher

Australian consumer inflation remained steady in April, with the monthly consumer price index (CPI) recording a 2.4% increase compared to the same period last year. This figure, released by the Australian Bureau of Statistics, was unchanged from March's rate but came in slightly above median forecasts of 2.3%. The stability in the headline inflation figure was attributed to rising health and holiday costs, which counteracted a significant drop in petrol prices.

Measures of core inflation showed a slight uptick. The trimmed mean measure of core inflation rose to an annual rate of 2.8% in April, up from 2.7% in March. Similarly, a measure excluding volatile items and holiday travel also increased to 2.8% from 2.6%. Despite these increases, both core inflation figures remained within the Reserve Bank of Australia's (RBA) target band of 2-3%, suggesting underlying price pressures are still contained.

The market reaction to the April inflation data was described as muted. This is partly because the monthly CPI report only covers a portion of the full CPI basket and tends to be more concentrated on goods rather than services. For instance, goods prices saw a modest increase of only 0.9% from a year ago. The Australian dollar showed little change, trading at $0.6440, and three-year bond futures remained flat at 96.60 following the release.

EY chief economist Cherelle Murphy commented on the limitations of the monthly data, stating, "Today's monthly CPI reading is not a comprehensive measure of price growth in the economy, with price changes for durable goods such as clothing and household goods measured, while many services prices are held constant." Murphy further suggested that "The Reserve Bank is likely to deliver further monetary easing, given the upside risks to inflation have largely disappeared while global policy uncertainty remains elevated."

Market sentiment continues to lean towards further interest rate cuts. Swaps data indicated a 65% probability of a rate cut at the RBA's next meeting in July. A subsequent move in August is more than fully priced in, contingent on the release of the more comprehensive second-quarter CPI report at the end of July. This follows the RBA's decision last week to cut interest rates to a two-year low, citing cooling domestic inflation as providing scope to counter rising global trade risks, and signalling openness to further easing.

Despite the focus on inflation and potential monetary easing, the Australian labour market has demonstrated surprising resilience. It has consistently generated a solid number of new jobs each month, helping to maintain a low jobless rate of 4.1%. Furthermore, tepid wage growth suggests there are few risks of a damaging wage-price spiral, which could otherwise complicate the inflation outlook.

The April CPI report detailed several specific price movements. Health costs saw a notable increase of 4.4% year-on-year, primarily driven by a jump in health insurance premiums, which are typically adjusted in April. Holiday travel and accommodation costs also rose significantly by 5.3% due to stronger demand during the Easter and school holiday period. Conversely, prices for fuel experienced a sharp decline, tumbling 12% from a year ago. Rental prices increased by 5.0%, marking the slowest annual growth since February 2023, which could signal further inflation relief. Electricity prices fell by 6.5%, largely due to government rebates on power bills.

Recommended Articles

Australia's Inflation Dip & Interest Rate Outlook

Australia's inflation has slowed more than expected in May, driven by falling housing, food, and insurance costs, paving...

Australian Inflation Falls to Multi-Year Low

Australian consumer price inflation slowed more than expected in May, with core measures hitting multi-year lows, signif...

Jim Cramer Previews Key Economic Week: CPI Data and BlackRock Investor Day

Jim Cramer outlines a pivotal week for Wall Street, focusing on the upcoming Consumer Price Index report and its potenti...

Rewane Questions Credibility of Nigerian Inflation Data

Bismarck Rewane questions the reliability of Nigeria's CPI figures, citing discrepancies between food-producing and cons...

US Inflation Cools in April as Key Gauge Shows Positive Trend

U.S. inflation slowed in April, with the annual rate nearing the Federal Reserve's 2% target, as reported by the Commerc...

You may also like...

How Technology, Equity, and Resilience are Reshaping Global Healthcare

The global healthcare system is undergoing a profound transformation, driven by technological leaps, a renewed focus on ...

A World Unwell: Unpacking the Systemic Failures of Global Health

From recurring pandemics to glaring inequities, the global health system is under immense strain. This article explores ...

Sapa-Proof: The New Budget Hacks Young Nigerians Swear By

From thrift fashion swaps to bulk-buy WhatsApp groups, young Nigerians are mastering the art of sapa-proof living. Here ...

The New Age of African Railways: Connecting Communities and Markets

(5).jpeg)

African railways are undergoing a remarkable revival, connecting cities, boosting trade, creating jobs, and promoting gr...

Digital Nomadism in Africa: Dream or Delusion?

For many, networking feels like a performance — a string of rehearsed elevator pitches and awkward coffee chats. But it ...

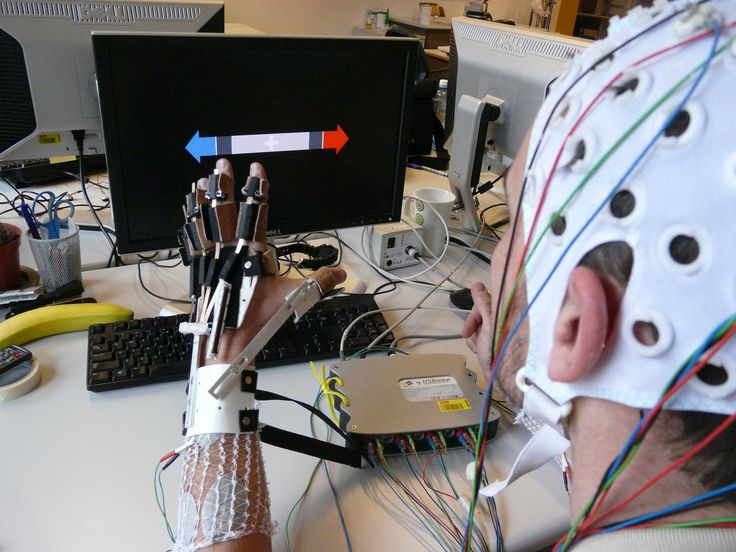

The Ethics of Brain-Computer Interfaces: When Technology Meets the Mind

This piece redefines networking as a practice rooted in curiosity, generosity, and mutual respect, sharing stories from ...

Carthage: The African Power That Challenged Rome

Long before Rome became the undisputed master of the Mediterranean, it faced a formidable African rival whose power, wea...

Africa’s Oldest Seat of Learning: The Story of al-Qarawiyyin

Long before Oxford or Harvard opened their doors, Africa was already home to a seat of learning that would shape global ...