Ant Financial Makes Full Exit from Indian Fintech Giant Paytm

Paytm has recently experienced a notable surge in institutional investment during the September quarter, signaling robust investor confidence in the company's financial and operational prowess. According to the Q2FY26 shareholding pattern, domestic institutional investors (DIIs) significantly increased their stake, rising from 16 percent to nearly 20 percent. This growth was primarily fueled by heightened holdings from mutual funds and insurance companies. Domestic mutual funds, notably driven by Motilal Oswal Mutual Fund, elevated their shareholding from 14 percent to 16 percent, while insurance companies, with key contributions from Tata AIA Life Insurance Company, boosted their holdings from 1 percent to 3 percent. This consistent domestic investor confidence underscores trust in Paytm's fundamental strength and long-term growth trajectory.

Foreign portfolio investors (FPIs) also contributed to this trend, increasing their shareholding from 22 percent to 24 percent, with Societe Generale - Odi being a prominent contributor. Concurrently, a significant shift in Paytm's ownership structure occurred as foreign direct investment declined from 33 percent in Q1FY26 to 27 percent in Q2FY26. This decline was largely due to the complete exit of Antfin (Netherlands) Holding B.V., marking a pivotal transition in the company's ownership. The shareholding base is now more diversified and institutionally driven, moving from a concentrated strategic ownership to a widely held shareholder profile anchored by both domestic and global institutions.

This transformation in ownership coincides with Paytm's sustained strong financial performance. In Q1FY26, the company achieved profitability across all key financial metrics, reporting a profit after tax of ₹123 crore and an EBITDA of ₹72 crore. Operating revenue also saw a healthy increase, rising 28 percent year-on-year to ₹1,918 crore. These financial achievements demonstrate the company's robust operational capabilities and efficient management.

As India navigates the intelligence revolution, Paytm is proactively positioning itself at the forefront of AI-driven financial technology. The company is developing a growing suite of intelligent products designed to empower merchants and businesses of all sizes. Building upon its pioneering legacy of QR code-based mobile payments and the introduction of the trusted Soundbox for in-store transactions, Paytm is now advancing with AI innovations such as the Paytm AI Soundbox. These solutions are specifically engineered to make artificial intelligence accessible to millions of small and micro businesses, enabling enterprises to scale faster and operate with enhanced efficiency. As a homegrown fintech pioneer, Paytm remains dedicated to developing technology that is inclusive, reliable, and secure, thereby reinforcing trust and driving sustainable growth across India's rapidly evolving digital economy.

You may also like...

Ex-Premier League Referee Faces Prison After Guilty Plea in Child Image Case

Former Premier League referee David Coote has pleaded guilty to the serious charge of making an indecent image of a chil...

Osimhen's Hat-Trick Fuels Super Eagles' World Cup Hopes in Thrilling Benin Clash

Nigeria's Super Eagles secured a playoff spot for the 2026 FIFA World Cup with a dominant 4-0 victory over Benin, highli...

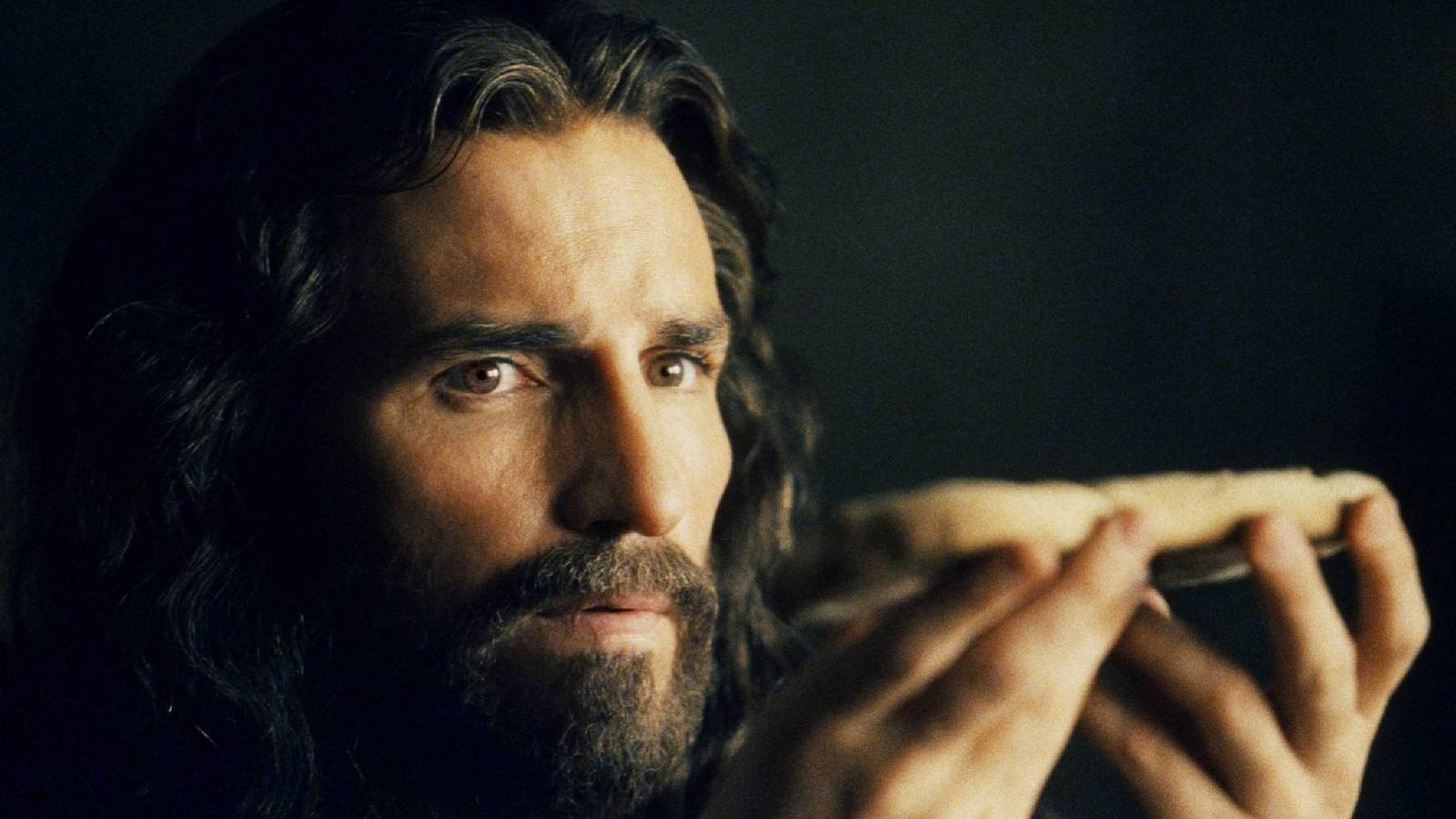

Mel Gibson Casts New Jesus for Highly Anticipated ‘Passion of the Christ’ Sequel

"The Resurrection of the Christ," Mel Gibson's highly anticipated sequel to "The Passion of the Christ," has begun filmi...

Legendary ‘Star Wars’ & ‘Blade Runner’ Poster Artist Drew Struzan Passes Away at 78

Renowned artist Drew Struzan, known for his iconic film posters for movies like “Star Wars” and “Blade Runner,” has pass...

Cosmic Sounds: Brian Eno & Beatie Wolfe Launch New Album Into Space

Brian Eno and Beatie Wolfe have unveiled a trio of ambient albums born from a strikingly normal creative process, now cu...

King Kylie Storms Music Scene: Kylie Jenner Drops Debut Track ‘Fourth Strike’

Kylie Jenner has released her debut song, "Fourth Strike," collaborating with pop duo Terror Jr and reviving her King Ky...

Secret Affair Unveiled: Katy Perry Confirms Justin Trudeau Romance at London Gig

Katy Perry has seemingly confirmed her new relationship with former Canadian Prime Minister Justin Trudeau during a Lond...

Jennifer Hudson Electrifies in Neon, Sets New Style Trend!

Jennifer Hudson made a dazzling entrance in a neon yellow gown and hot pink heels, electrifying the crowd in the spirit ...