Analysts Predict Tron (TRX) Poised for Growth from Future Retail Activity

Over the past week, the Tron (TRX) market has exhibited choppy price action, culminating in a 2.10% decline. Despite this recent volatility, TRX has demonstrated steady price growth since the beginning of April, registering a notable increase of 17.39%. Adding to the positive sentiment, prominent crypto analyst Burak Kesmeci has shared an intriguing market insight, suggesting that TRX is likely to maintain its upward trajectory for the foreseeable future.

In an X post on May 30, Burak Kesmeci elaborated on his analysis, postulating that TRX is in a prime position for further price gains. This assessment is based on developments observed in futures retail activity. Utilizing data from CryptoQuant, Kesmeci explained that TRX previously reached a market price of $0.45 in December 2024. This peak coincided with a period of intense retail speculation, as indicated by a cluster of red dots on the referenced chart. During this phase, many traders likely adopted leveraged long positions, trading the rally in anticipation of a sustained price uptrend.

However, this bullish period was followed by a significant market correction. TRX prices subsequently crashed to $0.21 during a broader downturn that persisted for the majority of the first trimester of 2025. This correction phase is characterized by a sparse amount of gray dots on the chart, suggesting neutral retail participation in the futures market. Amidst the resumed crypto bull market rebound, TRX prices have recovered to around $0.27. Notably, retail activity has remained neutral, without a significant uptick in speculation or the emergence of a “mad crowd” phenomenon as witnessed in December 2024.

According to Burak Kesmeci, these findings indicate that there is significant potential for an upswing in the TRX market, primarily because retail futures activity is far from being overheated. However, Kesmeci also cautioned that for these projected gains to materialize, there is a need for macroeconomic and geopolitical tensions to subside. Illustrating this point, the crypto market recently produced a negative reaction to reports of the United States and China failing to find common ground in ongoing trade talks, which are occurring amidst a 90-day truce period before both countries engage further.

At the time of writing, TRX is trading at $0.26, reflecting a 2.87% decline over the past day. Meanwhile, the token’s daily trading volume is valued at $806.98 million. Despite these recent losses, data from CoinCodex indicates that TRX investors remain strongly bullish, as evidenced by a Fear & Greed Index reading of 60.

CoinCodex analysts project that TRX will soon rediscover its bullish form. Their forecasts include price targets of $0.32 within the next five days and $0.29 within the next thirty days. Furthermore, they paint a positive long-term outlook for the cryptocurrency, with a price target of $0.51 anticipated in six months.

It is important to note that this information is provided for informational purposes only. Past performance is not indicative of future results, and investors should conduct their own research before making any investment decisions.

You may also like...

How Technology, Equity, and Resilience are Reshaping Global Healthcare

The global healthcare system is undergoing a profound transformation, driven by technological leaps, a renewed focus on ...

A World Unwell: Unpacking the Systemic Failures of Global Health

From recurring pandemics to glaring inequities, the global health system is under immense strain. This article explores ...

Sapa-Proof: The New Budget Hacks Young Nigerians Swear By

From thrift fashion swaps to bulk-buy WhatsApp groups, young Nigerians are mastering the art of sapa-proof living. Here ...

The New Age of African Railways: Connecting Communities and Markets

(5).jpeg)

African railways are undergoing a remarkable revival, connecting cities, boosting trade, creating jobs, and promoting gr...

Digital Nomadism in Africa: Dream or Delusion?

For many, networking feels like a performance — a string of rehearsed elevator pitches and awkward coffee chats. But it ...

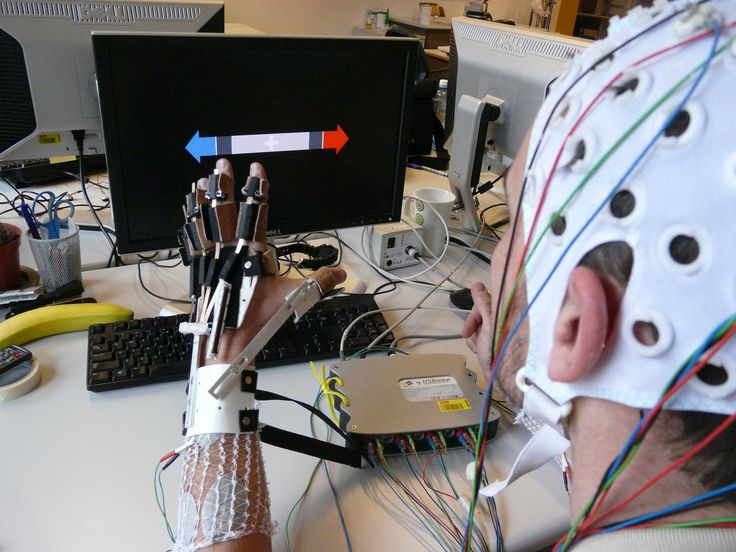

The Ethics of Brain-Computer Interfaces: When Technology Meets the Mind

This piece redefines networking as a practice rooted in curiosity, generosity, and mutual respect, sharing stories from ...

Carthage: The African Power That Challenged Rome

Long before Rome became the undisputed master of the Mediterranean, it faced a formidable African rival whose power, wea...

Africa’s Oldest Seat of Learning: The Story of al-Qarawiyyin

Long before Oxford or Harvard opened their doors, Africa was already home to a seat of learning that would shape global ...