MicroStrategy's Bold Billion-Dollar Bitcoin Grab!

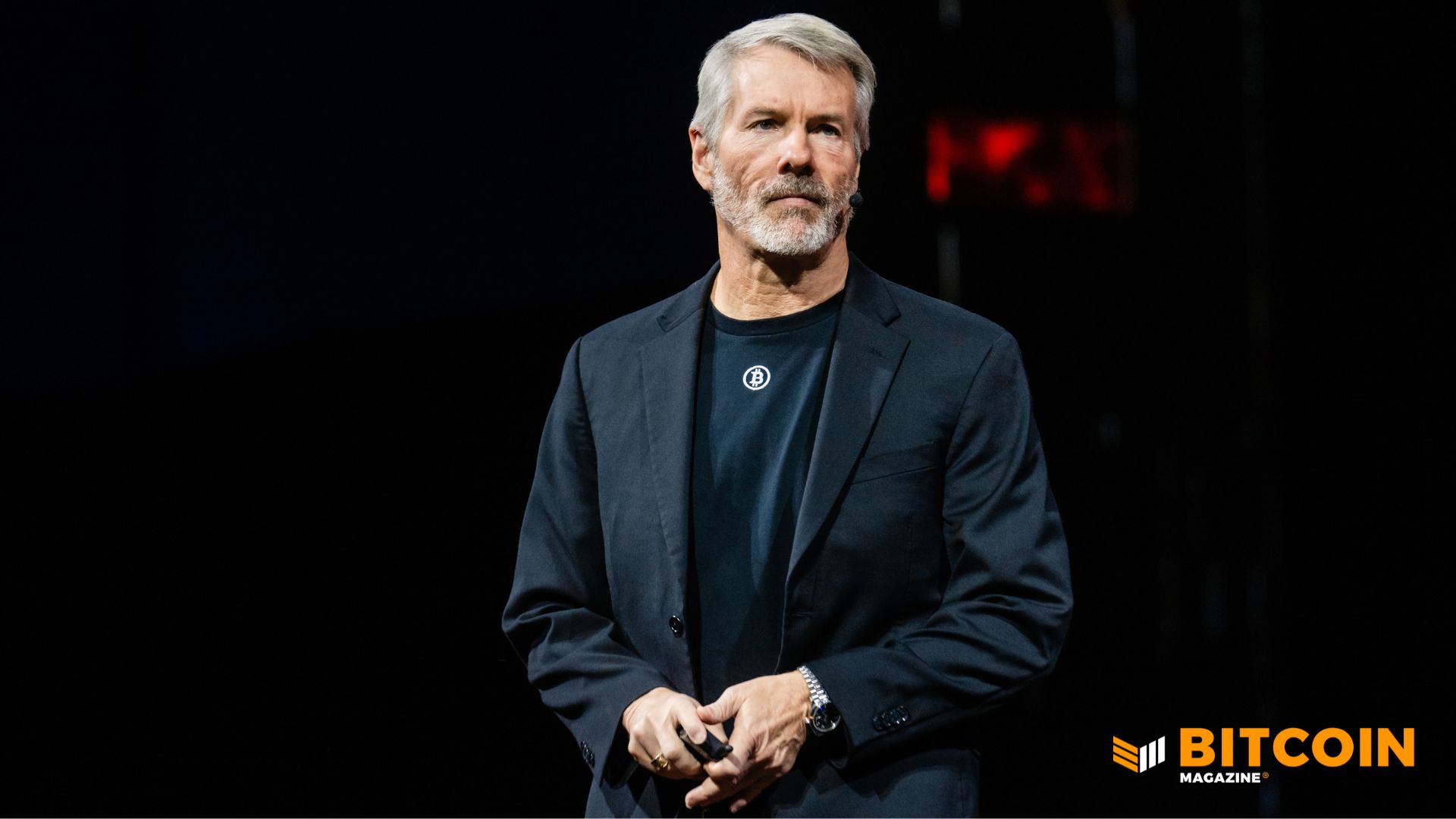

Strategy, the leading publicly traded holder of bitcoin, announced a significant acquisition last week, purchasing 10,624 BTC for approximately $962.7 million. This marked a return to large-scale purchases not seen since mid-year, coinciding with a period of steadied market volatility. The company paid an average price of $90,615 per bitcoin during the December 1–7 period, as detailed in a regulatory filing and a statement from Executive Chairman Michael Saylor.

This latest acquisition substantially increased Strategy’s total bitcoin holdings to 660,624 coins. These holdings were accumulated for roughly $49.35 billion, at an average cost of $74,696 per bitcoin. With bitcoin prices near $94,000 at the time of the announcement, Strategy’s bitcoin stash was valued at approximately $60.5 billion, resulting in an estimated $11 billion in unrealized gains for the firm.

The purchase, which represents Strategy’s largest weekly bitcoin acquisition since July, was primarily funded through its at-the-market equity sales program. The company successfully raised $928.1 million from the sale of 5.13 million shares of its MSTR common stock and an additional $34.9 million by selling 442,536 shares of its STRD preferred stock. The net proceeds from these sales totaled about $963 million, effectively covering the cost of the bitcoin acquisition. Strategy continues to hold substantial remaining issuance capacity, with approximately $13.45 billion in common stock and over $26 billion across various preferred and structured offerings, including STRK, STRF, STRC, and STRD.

In market trading, shares of Strategy (MSTR) showed a modest increase of about 2% in premarket trading on Monday, aligning with a small advance in bitcoin. The stock had previously rebounded from a low near $155 on December 1, following a sharp selloff across crypto-linked equities, though it remains down more than 50% over the past six months. Bitcoin itself saw a recovery, rising about 3% over 24 hours and roughly 1.5% on Monday morning, pulling back from recent weakness that pushed prices into the low $80,000s. Some analysts have attributed this bounce to expectations of a potential Federal Reserve interest rate cut this week, which could provide support for risk assets.

Executive Chairman Michael Saylor has been actively engaged in promoting bitcoin and Strategy’s unique position. While attending the BTC Conference in Abu Dhabi, Saylor spent the week meeting with sovereign wealth funds, banks, family offices, and hedge funds across the Middle East to discuss bitcoin and capital markets. He also highlighted the company’s "BTC Yield" metric, which reached 24.7% year-to-date in 2025. This metric is designed to reflect the growth in bitcoin held per diluted share, rather than changes in dollar value, and is central to Strategy’s investor messaging as it solidifies its identity as a bitcoin-focused treasury and structured finance business.

Despite its aggressive strategy, the backdrop for Strategy remains unsettled. Investors continue to scrutinize whether the company’s strategy of using extensive equity issuance to acquire bitcoin amplifies both potential upside and downside risks for shareholders. This comes after the firm raised nearly $2 billion just two weeks prior, largely to establish a cash buffer for preferred dividend obligations, before re-entering markets to fund its latest bitcoin purchases.

A significant challenge Strategy faces revolves around index inclusion, as MSCI is currently reviewing whether companies with substantial digital-asset holdings should remain within traditional equity benchmarks. JPMorgan analysts have cautioned that an exclusion could trigger billions of dollars in passive outflows from Strategy if index funds are compelled to divest. Saylor has consistently countered these concerns, asserting that Strategy operates as a legitimate software business with a growing Bitcoin-backed credit operation, rather than merely a fund or trust, and that such classification debates do not sway the firm's long-term strategic approach.

For the foreseeable future, Strategy is committed to its established approach. With over 660,000 bitcoin on its balance sheet and continuous access to capital markets, Strategy continues to serve as the most prominent corporate proxy for bitcoin exposure in public equities. This remains true even as both crypto prices and its own share price exhibit persistent volatility. The current bitcoin price is near $91,500.

Recommended Articles

MSCI Rejection Fuels Bitcoin Treasury Companies, Elevating Saylor's Strategy in Global Indexes

Global index provider MSCI has decided not to exclude digital asset treasury companies (DATCOs) from its flagship indexe...

MSCI's Crypto Verdict Looms: Unpacking the Impact on Bitcoin Treasury Giants

MSCI is poised to decide on January 15, 2026, whether to exclude companies with significant Bitcoin reserves from its gl...

Michael Saylor's MicroStrategy Strikes Again: Second $1 Billion Bitcoin Buy Confirmed!

Strategy, the world's largest publicly traded bitcoin holder, has made its second consecutive mega-purchase, acquiring 1...

High Stakes: Vivek Ramaswamy's Strive Pressures MSCI on Bitcoin Index Exclusion

Strive Asset Management is vigorously opposing MSCI's proposal to remove companies with significant bitcoin holdings fro...

MicroStrategy's $261 Million Bitcoin Shopping Spree Fuels Crypto Hopes

Strategy, formerly MicroStrategy, has acquired an additional 2,932 Bitcoin for $264.1 million, bringing its total holdin...

You may also like...

Bundesliga's New Nigerian Star Shines: Ogundu's Explosive Augsburg Debut!

Nigerian players experienced a weekend of mixed results in the German Bundesliga's 23rd match day. Uchenna Ogundu enjoye...

Capello Unleashes Juventus' Secret Weapon Against Osimhen in UCL Showdown!

Juventus faces an uphill battle against Galatasaray in the UEFA Champions League Round of 16 second leg, needing to over...

Berlinale Shocker: 'Yellow Letters' Takes Golden Bear, 'AnyMart' Director Debuts!

The Berlin Film Festival honored

Shocking Trend: Sudan's 'Lion Cubs' – Child Soldiers Going Viral on TikTok

A joint investigation reveals that child soldiers, dubbed 'lion cubs,' have become viral sensations on TikTok and other ...

Gregory Maqoma's 'Genesis': A Powerful Artistic Call for Healing in South Africa

Gregory Maqoma's new dance-opera, "Genesis: The Beginning and End of Time," has premiered in Cape Town, offering a capti...

Massive Rivian 2026.03 Update Boosts R1 Performance and Utility!

Rivian's latest software update, 2026.03, brings substantial enhancements to its R1S SUV and R1T pickup, broadening perf...

Bitcoin's Dire 29% Drop: VanEck Signals Seller Exhaustion Amid Market Carnage!

Bitcoin has suffered a sharp 29% price drop, but a VanEck report suggests seller exhaustion and a potential market botto...

Crypto Titans Shake-Up: Ripple & Deutsche Bank Partner, XRP Dips, CZ's UAE Bitcoin Mining Role Revealed!

Deutsche Bank is set to adopt Ripple's technology for faster, cheaper cross-border payments, marking a significant insti...