Vietnam to start automatic VAT collection for low-value express imports in August

Vietnam’s customs agency will implement an automated system for collecting value-added tax (VAT) on low-value imported goods shipped through express delivery services, starting from August 1.

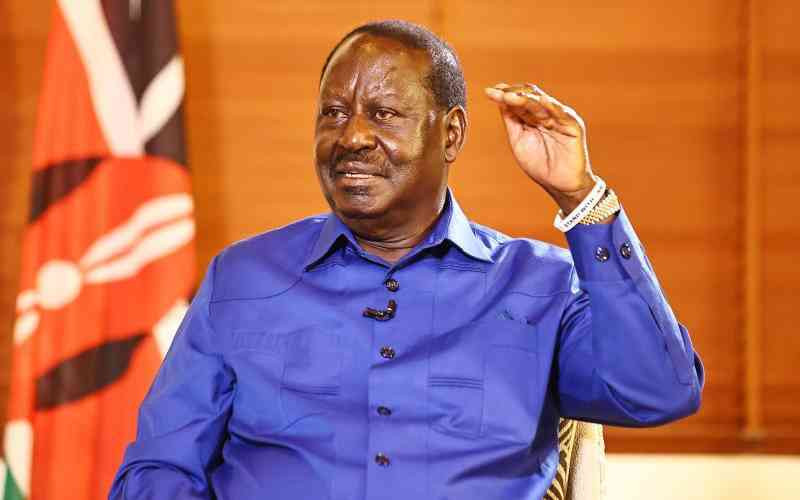

A delivery man drops off goods to a customer in Ho Chi Minh City. Photo: Quang Dinh / Tuoi Tre

The move targets imported shipments valued under VND1 million (US$38), which are transported via cross-border e-commerce platforms, mainly from China.

This change followed the cancellation of a previous policy that exempted such goods from VAT and import duties.

Since February 18, these goods have been subject to VAT, although import duties remain exempt.

The VAT collection is aimed at contributing to strengthening the state budget.

Up to five million low-value packages are delivered daily from China to Vietnam through e-commerce channels.

Before the launch of the automated collection system, the tax collection process had been manual, leading to resource wastefulness.

In response, the Ministry of Finance issued Circular No. 29, effective from July 9, to provide a legal and technical framework for automation.

The automation is meant to modernize tax collection procedures, reduce paperwork, and ensure accurate and comprehensive tax compliance.

A pilot phase involving selected express delivery service providers was scheduled to run from July 9 to July 31.

From August 1 onward, the automatic VAT collection system will be rolled out nationwide to all express delivery companies, regardless of the mode of transport–air, land, or rail.

Data from the General Department of Taxation indicated that in the first half of 2025, organizations and individuals doing business through online platforms contributed some VND98 trillion ($3.8 billion) in taxes, up 58 percent year on year.

Currently, Vietnam has some 725,000 online retailers, according to data submitted to tax authorities by 439 e-commerce platforms.

You may also like...

Diddy's Legal Troubles & Racketeering Trial

Music mogul Sean 'Diddy' Combs was acquitted of sex trafficking and racketeering charges but convicted on transportation...

Thomas Partey Faces Rape & Sexual Assault Charges

Former Arsenal midfielder Thomas Partey has been formally charged with multiple counts of rape and sexual assault by UK ...

Nigeria Universities Changes Admission Policies

JAMB has clarified its admission policies, rectifying a student's status, reiterating the necessity of its Central Admis...

Ghana's Economic Reforms & Gold Sector Initiatives

Ghana is undertaking a comprehensive economic overhaul with President John Dramani Mahama's 24-Hour Economy and Accelera...

WAFCON 2024 African Women's Football Tournament

The 2024 Women's Africa Cup of Nations opened with thrilling matches, seeing Nigeria's Super Falcons secure a dominant 3...

Emergence & Dynamics of Nigeria's ADC Coalition

A new opposition coalition, led by the African Democratic Congress (ADC), is emerging to challenge President Bola Ahmed ...

Demise of Olubadan of Ibadanland

Oba Owolabi Olakulehin, the 43rd Olubadan of Ibadanland, has died at 90, concluding a life of distinguished service in t...

Death of Nigerian Goalkeeping Legend Peter Rufai

Nigerian football mourns the death of legendary Super Eagles goalkeeper Peter Rufai, who passed away at 61. Known as 'Do...

![Benjamin v Safaricom Plc & 2 others; Consumers Federation of Kenya (COFEK) & another (Interested Parties) (Petition E554 of 2022) [2025] KEHC 9995 (KLR) (Constitutional and Human Rights) (11 July 2025) (Ruling)](./public/placeholder.png)