UBS' double upgrade lifts Aarti Industries shares 3% higher, 31% upside predicted - The Economic Times

Stories you might be interested in

Recommended Articles

March 2025 Quarter: Mixed Financial Results Across Industries

This article provides a summary of the financial results for several companies, comparing their performance in the quart...

Aarti Industries consolidated net profit declines 27.27% in the March 2025 quarter

Net profit of Aarti Industries declined 27.27% to Rs 96.00 crore in the quarter ended March 2025 as against Rs 132.00 cr...

Israel bombs Syria army HQ after warning Damascus to leave Druze alone - The Economic Times

Israel struck Syrian military headquarters in Damascus following a warning to the Islamist government. The warning was r...

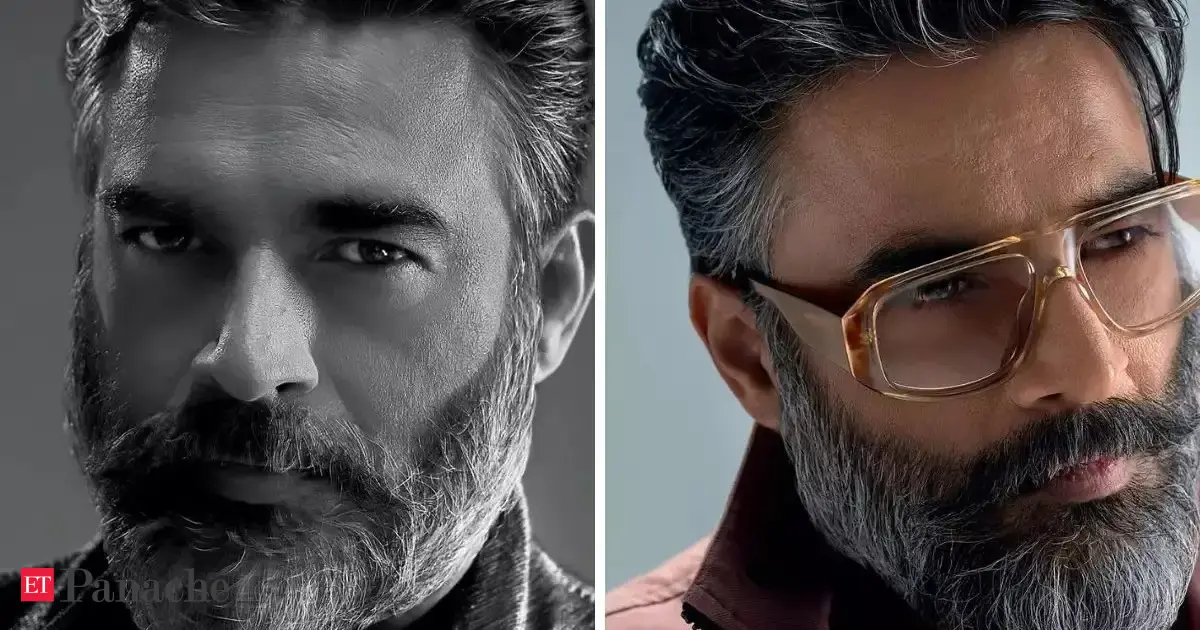

No chemicals. Actor Madhavan has a simple Ayurvedic routine for his hair and skin care. His diet will also surprise you - The Economic Times

R. Madhavan, who recently celebrated his 55th birthday in Dubai, shares his secrets to aging gracefully. He emphasizes s...

India isn't the West: Shark Anupam Mittal warns against blind reliance on AI in a billion-plus nation - The Economic Times

Anupam Mittal's LinkedIn post, featuring an elderly delivery agent, ignited a debate about India's tech-first approach. ...

You may also like...

Diddy's Legal Troubles & Racketeering Trial

Music mogul Sean 'Diddy' Combs was acquitted of sex trafficking and racketeering charges but convicted on transportation...

Thomas Partey Faces Rape & Sexual Assault Charges

Former Arsenal midfielder Thomas Partey has been formally charged with multiple counts of rape and sexual assault by UK ...

Nigeria Universities Changes Admission Policies

JAMB has clarified its admission policies, rectifying a student's status, reiterating the necessity of its Central Admis...

Ghana's Economic Reforms & Gold Sector Initiatives

Ghana is undertaking a comprehensive economic overhaul with President John Dramani Mahama's 24-Hour Economy and Accelera...

WAFCON 2024 African Women's Football Tournament

The 2024 Women's Africa Cup of Nations opened with thrilling matches, seeing Nigeria's Super Falcons secure a dominant 3...

Emergence & Dynamics of Nigeria's ADC Coalition

A new opposition coalition, led by the African Democratic Congress (ADC), is emerging to challenge President Bola Ahmed ...

Demise of Olubadan of Ibadanland

Oba Owolabi Olakulehin, the 43rd Olubadan of Ibadanland, has died at 90, concluding a life of distinguished service in t...

Death of Nigerian Goalkeeping Legend Peter Rufai

Nigerian football mourns the death of legendary Super Eagles goalkeeper Peter Rufai, who passed away at 61. Known as 'Do...