This company may beat Nvidia, Apple, Microsoft, to become world's most valuable company. Its valuations will be Rs…

As the tech industry continues to grow at a rapid pace, one company is emerging as a strong contender to surpass the giants of the sector, including Nvidia, Apple, and Microsoft. With its aggressive investment strategies and groundbreaking innovations, this company is on track to reach an astonishing valuation of $5 trillion. The company is…

According to a report by Fortune, several analysts anticipate that the first company to achieve a $4 trillion valuation could emerge in 2025, with Nvidia, Apple, and Microsoft at the forefront of the race.

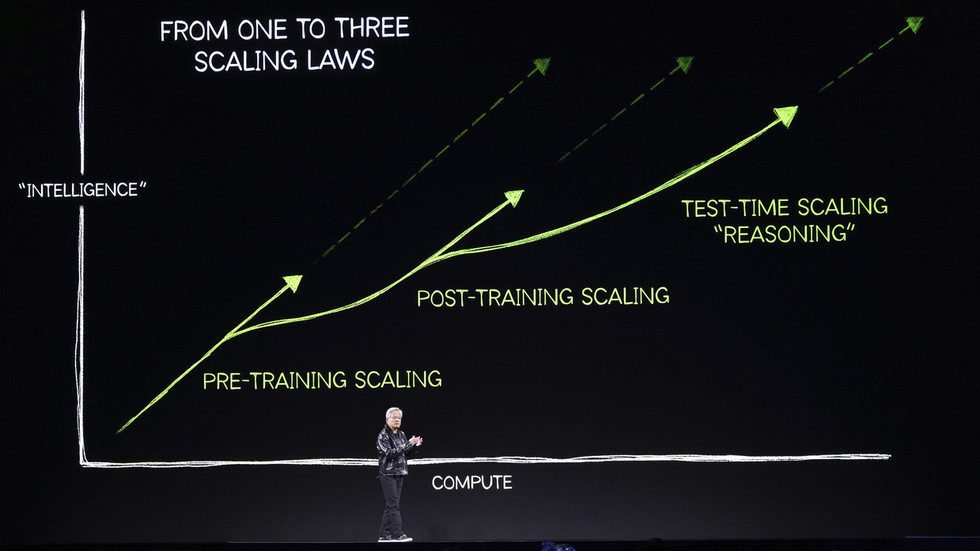

Fortune reports that Nvidia’s market capitalization has skyrocketed from $416 billion to $3.43 trillion, fueled by major investments in artificial intelligence (AI) as tech companies increase spending on data centers and advanced AI models. Similarly, Apple, currently valued at $3.67 trillion, has experienced significant growth, driven by its large iPhone user base and a rapidly expanding services sector, which stands to benefit from the integration of AI technologies.

On the other hand, Microsoft closely follows with a market capitalization of $3.16 trillion, supported by its early investment in OpenAI and robust sales from its Azure cloud platform.

Fortune highlighted that while any of these companies could reach the $4 trillion milestone, Amazon is emerging as a strong contender for a $5 trillion valuation by the end of this decade. This is due to Amazon’s aggressive investments in AI and cloud infrastructure, along with its thriving e-commerce and advertising businesses, which have led to record free cash flow.

Analysts suggest that as Amazon continues its heavy investments, it could see substantial growth in free cash flow, potentially driving its market capitalization toward the $5 trillion mark if current trends persist.

Amazon is one of the biggest investors in AI. Management said during its third-quarter earnings call in September that it expected to spend $75 billion on capital expenditures in 2024, reported Nasdaq.com.