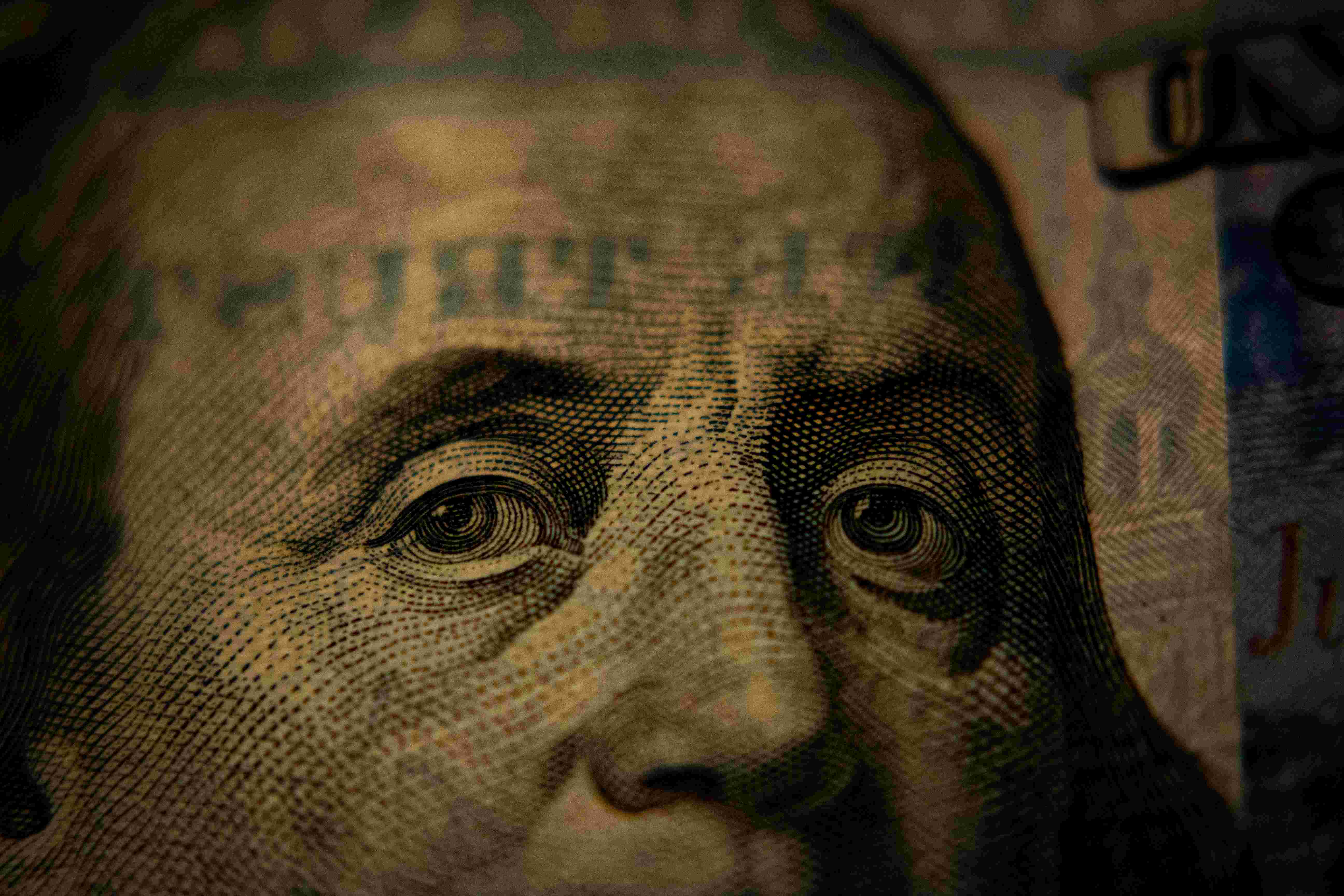

The Never-Ending Romance Between the Naira and the Dollar: How It Began and Where It Stands

AUTHOR: Olajide Felix of ZEAL NEWS AFRICA

If you're Nigerian, chances are you would anytime anyday prefer to be paid in "dollars." Whether it's a cab driver, a market trader, or a frustrated civil servant, there’s a shared understanding: the "dollar has become a symbol of value, stability, and survival." The naira? Well not not as much.

But this complicated relationship between Nigeria’s naira and the U.S. dollar didn’t start with memes or forex apps. It began over fifty years ago with high hopes, and today, it continues to shape the financial lives of over 200 million people.

A New Currency with Big Dreams

In 1973, Nigeria replaced the British pound with the naira, hoping to establish a new national identity backed by economic independence. At the time, the naira was strong. In fact, it exchanged slightly higher than the U.S. dollar, reflecting the confidence of a newly oil-rich nation.

Nigeria was the pride of West Africa, boasting large reserves of oil and a growing economy. With the oil boom of the 1970s, there was optimism that the country would industrialize quickly, build infrastructure, and use its natural resources to become self-sufficient.

But that optimism would soon face reality.

How the Dollar Rose While the Naira Faltered

The U.S. dollar, backed by one of the world’s most productive and globally integrated economies, steadily rose to become the dominant global reserve currency. Most international trade — from crude oil to grain — is now priced and settled in dollars.

This mattered a great deal for Nigeria, especially as it became increasingly dependent on the export of crude oil. Even though Nigeria was earning dollars by selling oil, but ended up spending even more of it importing back the refined fuel as well as machinery, food, medicine, and raw materials.

Over the decades, Nigeria failed to develop the capacity to refine its own fuel or manufacture key goods domestically. The country became locked in a cycle where it earned dollars through exports but needed even more dollars to sustain daily economic life -a dollar dollar-reliant country.

High Demand, Limited Supply

That’s where the pressure began.

Because most imports are paid for in dollars, the demand for foreign currency is consistently high. But Nigeria’s ability to earn dollars — through oil exports, foreign investment, or tourism — has been unstable. Any disruption in global oil prices, domestic production, or investor confidence reduces the flow of dollars into the country.

The result? A widening gap between "supply and demand". When dollars are scarce, the naira weakens. This has happened repeatedly over the past four decades, especially during oil price crashes or political instability.

From exchanging at "₦1 to $1 in the 1980s", the naira has now slid to about "₦1,500 to $1 in 2025". This isn't just a currency devaluation; it's a reflection of deeper economic problems.

Policy Shocks and Reforms

Recent years have brought a new wave of reform, particularly under the current administration. In 2023, the government removed fuel subsidies and unified the exchange rate, a bold attempt to eliminate black market distortions and allow market forces to determine the naira’s true value.

The Central Bank of Nigeria (CBN) also raised interest rates and reduced interventions in the foreign exchange market, hoping to restore investor confidence and encourage dollar inflows through official channels.

But the short-term impact has been painful.

Fuel subsidy removal pushed transportation and food costs higher. Exchange rate unification caused the official rate to jump suddenly, matching the parallel market. Many businesses that relied on subsidized or fixed forex rates were left exposed, leading to job losses, inflation, and weakened purchasing power for ordinary Nigerians.

As of mid-2025, inflation remains stubbornly high, hovering around 22%. Salaries are not rising fast enough to match prices, and many households are struggling to keep up.

Why the Dollar Still Reigns

For many Nigerians, holding dollars has become a "protective strategy". People save in dollars, trade in dollars, even set prices in dollars for rent and school fees — all in an effort to hedge against naira volatility.

This behavior reinforces the dollar’s dominance. As more individuals and businesses seek to store value in dollars, demand rises even further, worsening the naira’s fall. It becomes a self-fulfilling cycle.

What’s more, Nigeria lacks a diversified export base. While countries like Vietnam and Malaysia export everything from electronics to textiles, Nigeria still relies heavily on oil. Without a broader range of goods or services earning foreign exchange, the country remains vulnerable to external shocks.

More Than a Currency Issue

The naira’s weakness today is not just about numbers on a forex board. It reflects years of underinvestment in manufacturing, agriculture, infrastructure, and education. It reflects over-reliance on one export, and the inability to meet basic needs internally.

Efforts to diversify the economy have been made — investments in fintech, agriculture, and even local oil refining — but these changes take time to bear fruit.

Until Nigeria can produce more of what it consumes and export more than it imports, the structural demand for dollars will remain, and the naira will continue to feel the pressure.

But Is There Hope?

Yes — and it’s not wishful thinking.

Reforms already in motion may not yield immediate results, but they are laying a firmer foundation. The introduction of "biometric e-passports, digital banking expansion, and new tax frameworks" are helping formalize the economy and reduce leakages. At the same time, projects like the Dangote Refinery are promising to significantly reduce fuel import dependency — potentially saving billions in foreign exchange.

Nigeria's "young, tech-savvy population" is also creating new pathways for economic value. The "growth of fintech, remote services, and digital exports" is slowly attracting foreign capital and creating non-oil dollar inflows — a sign of a more diversified future.

The country is also gradually improving its ease of doing business, making it more attractive to investors. If these gains are protected and expanded, they can "strengthen confidence in the naira", stabilize its value, and reduce the everyday pressures Nigerians feel when buying goods priced in dollars.

A New Chapter for an Old Love

The naira and the dollar may be locked in a lopsided relationship today, but the story is not over. With deliberate investment in productivity, infrastructure, and innovation, Nigeria can rewrite the narrative.

It’s not about going back to the days of ₦1 to \$1. It’s about restoring "dignity to the naira", making it a currency people can trust, save, and build with.

The future of the naira doesn’t lie in abandoning the dollar. It lies in building an economy where the naira no longer has to compete desperately, because it finally stands tall on its own.

AUTHOR: Olajide Felix of ZEAL NEWS AFRICA

Cover Image Credit: Unsplash

You may also like...

Boxing Shocker: Hitchins Illness Forces IBF Title Defense Cancellation

The IBF junior welterweight title defense between Richardson Hitchins and Oscar Duarte has been cancelled due to champio...

Arteta's Fiery Warning: Arsenal Stars Must Endure 'Noise' or Exit Title Fight

Arsenal manager Mikel Arteta has issued a strong message to his title-chasing squad, urging them to embrace the intense ...

Hollywood Heavyweights Clash: Mark Ruffalo Blasts James Cameron Over Studio Deals

Mark Ruffalo has openly challenged James Cameron's critique of Netflix's potential acquisition of Warner Bros. Discovery...

Sopranos Shocker! Michael Imperioli Claims Characters Would Be Trump Supporters

Michael Imperioli, star of “The Sopranos,” believes the show's characters would likely be Donald Trump supporters today,...

Nollywood Sensation Mercy Johnson-Okojie Tapped for Key Public Role in Nigeria!

Edo State Governor Monday Okpebholo has appointed Nollywood icon Mercy Johnson-Okojie as Special Adviser on Public Engag...

Malawi's President Mutharika Unleashes Sweeping Ban on Health Workers Amidst Corruption Battle!

President Peter Mutharika has issued a tough executive order in Malawi, banning public hospital employees from owning pr...

Tragic Medical Mystery: Woman Loses All Limbs After Devastating Dog Lick Sepsis

Manjit Sangha, 56, lost all her limbs after contracting severe sepsis, believed to be from a dog lick. After 32 weeks in...

Global Economic Jolt: Trump Vows 15% Tariffs After Supreme Court Defeat

Following a Supreme Court ruling declaring his tariff policy unconstitutional, President Donald Trump escalated his trad...