The Global Economy at a Crossroads: Navigating Uncertainty and Opportunity

The global economy is undergoing a series of fundamental, structural shifts that are reshaping industries, trade, and financial markets. One of the most significant trends is the retreat from globalization.

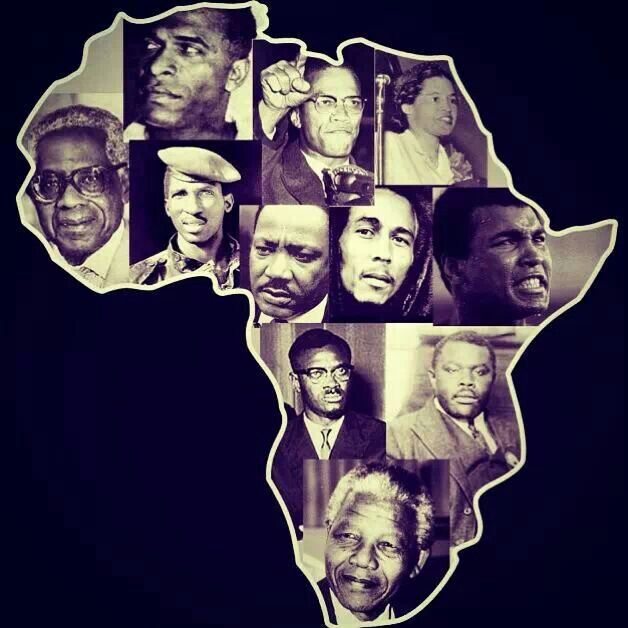

SOURCE: Google

Following decades of increasing integration, trade tensions and a reassessment of supply chain vulnerabilities have led to resurgent economic nationalism and a move toward regionalization.

This trend, which the IMF notes has seen a tripling of trade restrictions since 2019, increases inflationary pressures and reduces the efficiency gains from specialization.

Another powerful force is decarbonization. As climate change impacts intensify, the global shift towards green energy is accelerating, but it also creates inflationary pressures due to the immense investment needed to transition energy systems.

Demographic shifts are also a key factor. With aging populations in many developed and emerging economies, the share of working-age people is declining, putting strain on labor markets and social security systems.

The growing influence of emerging markets, however, continues to be a dominant trend, with countries like India and China becoming major hubs of economic activity and innovation, according to a report by the World Bank.

Navigating Geopolitical Headwinds and Supply Chain Disruptions

Geopolitical tensions and supply chain disruptions are significant headwinds influencing economic stability and growth. Conflicts and trade disputes have led to a more fragmented global economy, directly impacting trade flows and commodity prices.

The Russian invasion of Ukraine highlighted vulnerabilities in global food and energy supplies, while tensions between major economic powers have spurred companies to re-evaluate their reliance on single-country supply chains.

SOURCE: The Guardian

This move towards diversifying or "reshoring" production, while enhancing resilience, often comes with higher costs, contributing to persistent inflationary pressures.

The energy transition, a critical component of decarbonization, is also intertwined with geopolitics.

The shift away from fossil fuels and towards renewable energy sources is creating new dependencies and vulnerabilities, as countries compete for critical minerals and rare earths needed for batteries and other technologies.

These factors collectively increase the complexity and risk in the global economic system, requiring businesses and governments to be more proactive in their risk assessment and management, a strategy highlighted in a recent U.S. Bank analysis.

The Dual Role of Technology: Prosperity and Peril

Technological advancements, particularly in Artificial Intelligence (AI) and digitalization, are a primary driver of economic prosperity.

The application of AI in manufacturing and agriculture is optimizing production processes and improving efficiency, while in the digital economy, it is fueling the growth of e-commerce and data-driven business models.

A PwC report forecasts that AI could contribute up to $15.7 trillion to the global economy by 2030, showcasing technology's potential to boost revenue and innovation on a massive scale.

SOURCE: PWC

However, this rapid technological shift also creates significant challenges. AI and automation can lead to job displacement, particularly for those in routine or low-skill occupations, raising concerns about structural unemployment.

This technological disruption can exacerbate economic inequality, as those with the skills to work with and develop these new technologies command higher wages, while others are left behind.

There are also ethical dilemmas, such as the potential for algorithms to replicate and amplify existing societal biases, and the increasing cybersecurity threats that accompany a more digitalized world.

Demographic Shifts and Rising Inequalities

Demographic shifts are reshaping consumer spending, labor markets, and social cohesion on a global scale.

In many advanced economies, an aging population means a shrinking workforce and an increased burden on public finances to support healthcare and pension systems.

This shift reduces the "support ratio", the number of working-age people for every retiree, which is projected to fall to just four globally by 2050.

This demographic reality can slow economic growth and put pressure on fiscal policy.

Concurrently, rising inequalities are impacting global society. While overall global inequality between countries has decreased in recent decades due to the growth of emerging economies, inequality within countries is on the rise, particularly following shocks like the COVID-19 pandemic.

This can impact consumer spending patterns and lead to social and political unrest, as a growing gap between the rich and poor erodes social cohesion.

Addressing these disparities through education, social safety nets, and equitable tax policies is critical for fostering long-term stability. A report by the U.N. Development Programme highlights the urgency of tackling these issues to achieve sustainable development goals.

Strategies for Navigating Volatility

To navigate this period of economic volatility, governments and international organizations are implementing a range of strategies and policy responses.

Central banks are using monetary policy, such as interest rate adjustments, to combat inflation, while governments are exploring new fiscal measures to support vulnerable populations.

Policymakers are also focusing on improving supply chain resilience by encouraging diversification and investing in domestic production capabilities.

International organizations like the World Trade Organization (WTO) are attempting to manage trade tensions and promote multilateral cooperation. Governments are also increasing investment in key areas, such as infrastructure, renewable energy, and education, to build long-term economic resilience.

For businesses and investors, effective risk management is crucial, with many adopting new technologies like AI and machine learning to analyze market data, anticipate threats, and optimize portfolios.

Emerging Opportunities for a New Era

Despite the challenges, this evolving economic landscape presents significant opportunities for businesses and investors. The most lucrative areas for growth are often those addressing the very challenges the global economy faces.

The decarbonization trend, for instance, has created a boom in the clean energy sector, offering opportunities in solar, wind, and battery technology.

The digital transformation also presents a vast new frontier. Businesses can capitalize on the rapid expansion of e-commerce, fintech, and digital services, particularly in emerging markets in Southeast Asia and Africa where digital adoption is accelerating rapidly.

Furthermore, as supply chains are reconfigured, new regional hubs of manufacturing and trade are emerging.

Companies that can adapt their strategies to these new networks can gain a competitive advantage.

Finally, the growing needs of an aging population are creating opportunities in the healthcare, wellness, and technology sectors, all of which are poised for significant growth in the coming decades.

By identifying and capitalizing on these new trends, businesses and investors can thrive in an increasingly uncertain world.

You may also like...

Why Do Africans Become More African After Leaving Africa?

Why do Africans abroad suddenly embrace their roots with pride? From Afrobeats in London to Yoruba weddings in New York,...

Boxing Icon's Son in Legal Turmoil: Julio Cesar Chavez Jr. Faces Cartel Allegations & Deportation Drama!

Mexican boxer Julio César Chávez Jr. has been deported from the U.S. to Mexico, where he was immediately jailed for alle...

Super Falcons Make History: Nigeria Crowned WAFCON Champions for 10th Time in Thrilling Win!

)

Nigeria's Super Falcons made history by clinching their 10th Women's Africa Cup of Nations title with a spectacular 3-2 ...

Paolo Sorrentino's 'La Grazia' Dazzles Venice, Earns Raves

Paolo Sorrentino's latest film, 'La Grazia,' captivated the Venice Film Festival, earning a four-minute standing ovation...

KPop Demon Hunters Ignites Oscar Buzz, Captivates Audiences

The animated film "KPop Demon Hunters" has emerged as a record-breaking global phenomenon, topping Netflix viewership ch...

Naira Marley Breaks Silence: Explosive Defense in Mohbad Case Rocks Nigeria!

Naira Marley has released a documentary sharing his side of the story regarding the tragic death of his former signee, M...

Fans Buzzing as Reading & Leeds Festival Teases Major Secret Headliners!

Anticipation is high for the 2025 Reading and Leeds Festivals, with widespread rumors of secret sets from bands like Wol...

Britpop Backlash: Oasis Reunion Fuels Fan Fury, Ticketmaster Under Fire!

Oasis is set to embark on a highly anticipated reunion tour with Andy Bell confirming his involvement, playing 41 dates ...