TCS navigates a cautious market as clients delay investment decisions amid economic uncertainty and await clarity on trade discussions. The company is strategically shifting towards use-case driven Gen-AI implementations, focusing on industry-specific solutions and upgrading its AI platform. TCS is also investing in talent development and forging key partnerships to drive growth.

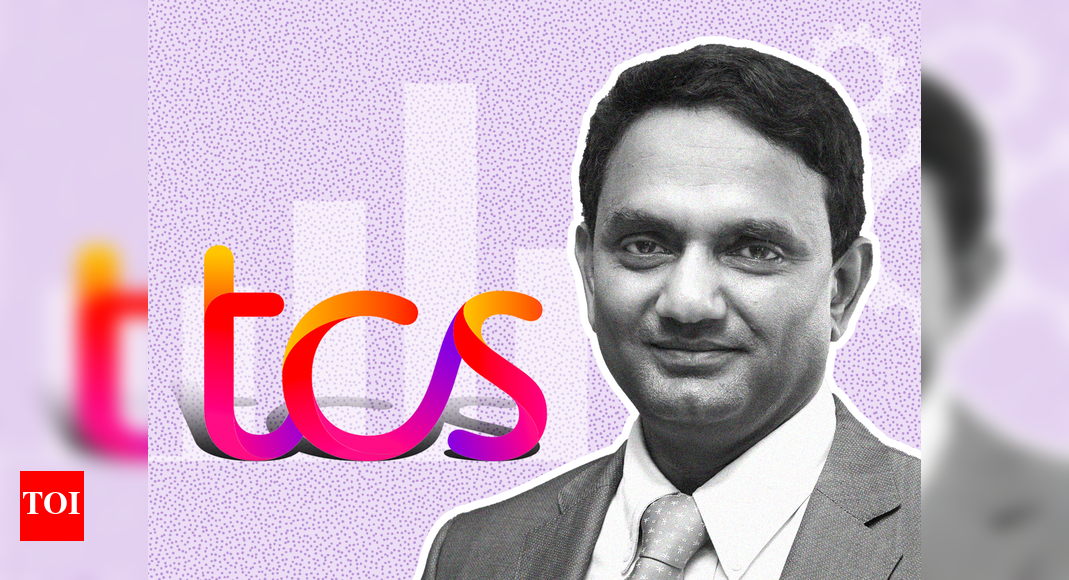

, in conversation with ET Now. TCS is observing a shift from experimental

Gen-AI projects to use-case driven implementations that deliver tangible business value. The company is investing in industry-specific and agentic AI solutions, upgrading its

TCS WisdomNext platform, and forging strategic partnerships with hyperscalers and AI innovators. TCS is also prioritizing talent development to keep pace with the rapidly evolving technology landscape.: I was using the word uncertain a lot and people said you are saying uncertain so many times. I would say people are going to wait and watch more and I have a feeling maybe once these discussions are over, sometime in July and August, there will be greater clarity on the direction the trade discussions take and also the new bill will be in place. All that will provide more clarity. Maybe the first week of August onwards, we should see a more definitive direction in the market.

There is. If a particular project is going to yield definitive and immediate results, you find that customers are starting off those projects, which typically tend to be the cost optimization projects. If a project is for investment or transformation, where the return on investment is uncertain, the customers are willing to wait for greater clarity before they embark or commit those investments.

Aarthi Subramanian: In the initial days of Gen-AI, everybody was in experimental mode, trying to understand what the technology is and what it can deliver. But after two-three years, now the power of the technology is well understood. So, what customers are looking at is how they shift from experimentation to a use case based approach to delivering projects which deliver a business value. That is the shift we are seeing.

From the new services revenues perspective – whether it is AI, cyber security, public cloud or TCS Interactive – many of these new service lines have grown well in this quarter and continue to have good demand. In terms of investing in these areas and especially talking about AI, we are looking at building industry specific solutions bespoke for a customer and we are also investing in building agentic AI solutions which are industry solutions that we can take to customers proactively where we can go and do this rapid build projects which can deliver short projects but can deliver value faster and that is one of the initiatives that we are driving.

The second area we are looking at is our flagship product, TCS WisdomNext. We have just upgraded it with the version 2.0 which has agentic AI capabilities and we are using our product and a platform-based approach to really see how we can accelerate buildout of these solutions.The third important element in any technology is partnerships. We are working with hyperscalers, model providers, and also new age partners like Vianai. We have just signed a partnership and we are seeing good uptake there. The last part of the equation and the most important is talent. We are doubling down on building the talent in a phase where the technology is rapidly evolving.

You have mentioned that there is some impact on demand. Which are these areas which you have identified?

K Krithivasan: You can look at it both from a vertical and horizontal perspective. Suppose you look at it from a vertical perspective, for instance manufacturing. Manufacturing auto as a segment that gets impacted because of the EV transition and confusion on where the investment is going to be because many of the auto manufacturers invested heavily in EV, but EV sales are still late to pick up globally, so there is a pullback on investments by auto.

Similarly, in the BFSI sector, insurance has been impacted for multiple reasons, particularly catastrophic losses in the US and other places. Capital markets tend to thrive under volatility, more than others. This is a broad classification. The tech sector, by and large, is doing well or if you take telcos, despite the expected reduction in interest rates, capex is not happening.