STL's FY25 Results and Growth Outlook

STL (Sterlite Technologies Ltd) has announced its financial results for the year ended March 31, 2025, reporting revenues of INR 1052 Cr for the quarter and INR 3996 Cr for FY25 across its Optical Networking and Digital business units. The company achieved an EBITDA of INR 146 Cr, the highest in the last six quarters, with EBITDA margins of 13.8%. STL is focusing on customer centricity, product innovation, and cost leadership to strengthen its position as a partner for global digital infrastructure development.

In Q4 FY25, the Optical Networking Business saw a 26% revenue growth and a 110% EBITDA increase compared to Q4 FY24. This growth was fueled by momentum in the Enterprise Connectivity and Data Centre Business, along with a ~22% attach rate in the Optical Connectivity Business (OC). The Enterprise and Data Centre Business experienced strong demand in Europe and India, where STL supported key players in expanding their end-customer connectivity solutions.

STL Digital achieved EBITDA positive results for two consecutive quarters, demonstrating steady YoY revenue growth and a strong order book. STL Digital has formed strategic partnerships with over 40 technology companies and acquired more than 25 global customers across India and the U.S.

STL completed the demerger of its Global Services Business, which transitioned to STL Networks Limited under the brand name 'Invenia'. STL has added a diverse range of customers across different regions, establishing partnerships with service providers like Archtop Fiber in the U.S., Connexin, Netomnia, and Wyre in the UK and Europe, Vocus in Australia, du Telecom in MEA, and Bharatnet and Vedanta in India.

STL has focused on product innovation, co-creation with customers, and next-generation optical solutions, developing ultra-thin optical fiber of 160-micron, 180-micron, and 864F Microcables, AI-led data center solutions, Multi-core fiber (MCF) for quantum communications and silicon photonics, and an Optical Connectivity portfolio for the U.S. STL also introduced the Rapid series of Optical products, compliant with the 'Build America, Buy America' (BABA) regulations. The company concluded the year with 740 patents, including 76 new patents filed in FY25.

STL's Net Debt: Equity ratio has improved to 0.68 times compared to 1.39 times post demerger and Post QIP (YoY). Ankit Agarwal, Managing Director of STL, noted that FY25 was marked by resilience and customer focus, with the company laying the groundwork for future growth by prioritizing customer and cost leadership. He also highlighted the importance of AI-ready infrastructure, rural fiberization, and data center expansion as cornerstones of global digitalization, for which STL is well-prepared with its connectivity solutions.

Recommended Articles

Hikal introduces Digital Infrastructure at 130 year old Zilla Parishad School in Alibaug

/PRNewswire/ -- Hikal, a preferred long-term partner to global life sciences companies, has strengthened its commitment ...

NCC Developing Cybersecurity Regulatory Framework for Nigerian Telecoms Sector

The Nigerian Communications Commission (NCC) is developing a comprehensive cybersecurity framework, with World Bank supp...

E& Enterprise Named A Leader In IDC Marketscaape For Gulf Countries Colocation Services 2025

e& enterprise, the digital transformation arm of e&, has been recognised as a Leader in the IDC MarketScape: Gulf Countr...

ZTE and XLSMART Announce Strategic Partnership for Digital Infrastructure

ZTE Corporation and XLSMART have forged a strategic partnership to enhance Indonesia's digital infrastructure. The colla...

PLN Startup Day 2025: PLN's Support for Indonesia's Greentech Startups | finanzen.net

Reference #18.5eec1702.1748330510.312c3a4a

You may also like...

Ripple Unleashes $200M Stablecoin Bomb: Major Acquisition Shakes Crypto World!

Ripple has confirmed its $200 million acquisition of Rail, a stablecoin payment infrastructure provider, to strengthen i...

SEC Confirms Ripple's Victory: Legal Battle Concludes as Fundraising Greenlit!

The SEC has granted Ripple a crucial waiver, eliminating its 'bad actor' disqualification and significantly easing priva...

Legal Firestorm: South Korean Ex-President's Wife Targeted in High-Stakes Arrest Warrant

A South Korean court has ordered the arrest of Kim Keon Hee, wife of jailed former President Yoon Suk Yeol, on charges i...

ASEAN-Brokered Breakthrough: Thailand & Cambodia Edge Closer to Historic Border Deal

Thailand and Cambodia held urgent talks in Malaysia, addressing escalating border tensions and affirming Thailand's terr...

Kenya's Central Bank Slashes Key Rate to 9.5%: Economic Impact Looms

The Central Bank of Kenya's Monetary Policy Committee has lowered its benchmark rate to 9.50 percent, aiming to stimulat...

Is Humanity Trading Connection for AI Comfort? A Deep Dive

Amidst growing struggles to find genuine human emotional support, many individuals are increasingly turning to AI for co...

Local Tragedy: Hotel Under Construction Collapses in Edo, Claims Owner's Life

A hotel owner was tragically killed in a building collapse in Uromi, Benin City, while supervising the construction of h...

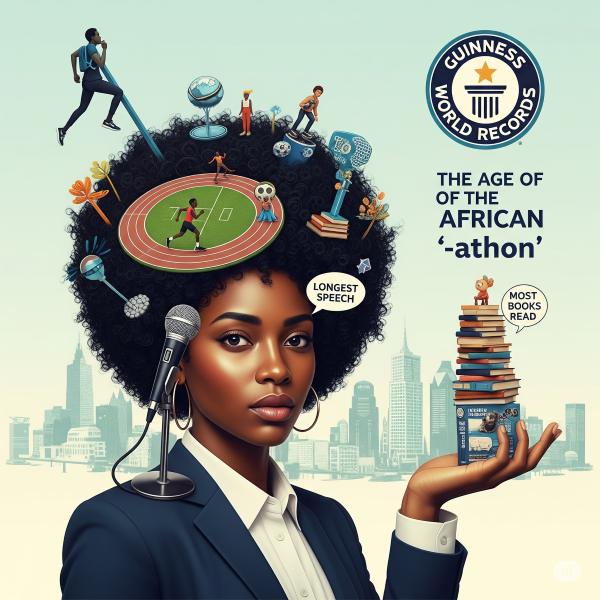

Guinness World Records & The Age of the African “-athon”

Just how many Africans have graced and attempted to grace the books of Guinness world records?