Report ranks Omaha in top 10 emerging tech talent markets in North America

Omaha was ranked seventh in the “North America’s Next 25 Markets” list featured in CBRE’s Scoring Tech Talent 2024 report. The city’s rank among other growing hubs of tech talent was based on recent trends in total tech workforce employment, total tech field graduates and average wages for tech jobs. The demographic data and analysis was highlighted in Site Selection Magazine’s 2025 Workforce Guide.

According to CBRE’s report, the top three growing tech talent hubs in North America were:

The analysis was done to highlight 25 “lesser-known and underdeveloped” markets where employers could find additional workers and grow their presence geographically with lower costs vs. expanding into larger, more expensive hubs. Site Selection Magazine pulled the top 10 from the 25 cities for its own article.

CBRE is a global commercial real estate company that provides investments, solutions and research to assist clients with business decisions. Site Selection Magazine is a publication dedicated to covering corporate real estate, expansion projects and economic development.

According to Scoring Tech Talent 2024, rates of higher education completion and the concentration of young people are two key characteristics for determining whether a place is a top market for tech talent. The report continued that college graduates tend to move away from where they went to school, looking for places with more career opportunities and higher pay.

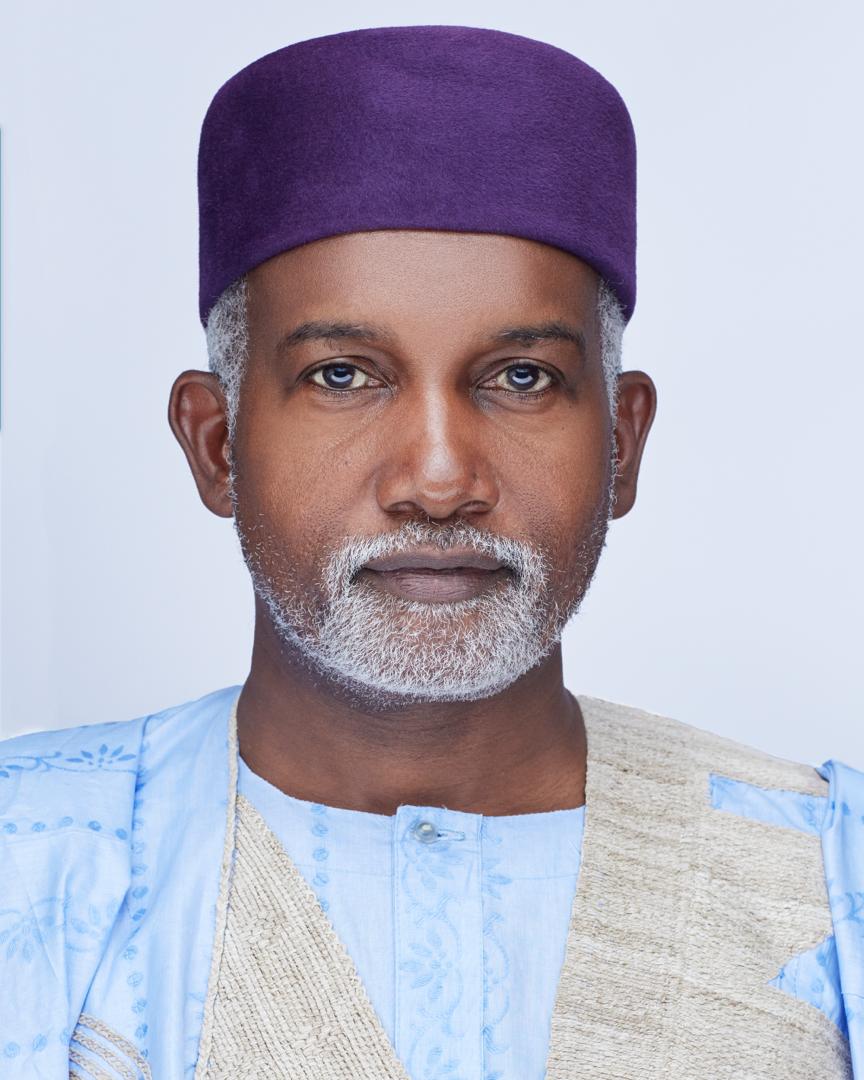

Greater Omaha Chamber CEO Heath Mello credited Omaha’s ranking to state and city programs and organizations, such as Intern Nebraska, the Nebraska Tech Collaborative and the University of Nebraska system, in a quote in Site Selection.

“We have some unique tech infrastructure in Omaha, such as the University of Nebraska Medical Center and the University of Nebraska at Omaha, which created the first-ever AI degree in Nebraska,” said Mello.

According to CBRE’s report, the average wage for tech talent in Omaha in 2023 was $101,814 with a growth rate of 24.9% over five years. There was also a total tech talent supply/employment of 23,330 in 2023 with a growth rate of -0.5% over five years. The report states that there were 910 total tech degree graduates in 2022 in the city.

Huntsville, in comparison, had an average wage for tech talent in 2023 at $114,085 with a growth rate of 19.6% over five years. The total tech talent supply/employment was 25,910 in 2023 with a growth rate of 17.9% over five years. The report states that there were 988 total tech talent degree graduates in 2022 in the city.

In the same article as Mello, Lucia Cape, senior vice president of economic development at the Chamber of Commerce of Huntsville/Madison County, credited initiatives like external recruiting and career awareness programs among high schools, colleges and universities for the city’s top ranking.

“More than 60% of our students at the University of Alabama-Huntsville are learning in STEM fields — and we retain about 80% of them who go on to work in these fields here after graduation,” said Cape.

Omaha’s ranking in “North America’s Next 25 Markets” by CBRE comes as the recent Silicon Prairie Rising report described leaders’ concerns of finding and hiring qualified talent in the greater Omaha region. Its findings placed Nebraska as 49th in startup survivability, 34th in new business formation and 35th in business R&D spending in comparison to other states.

Colin Yasukochi, executive director of CBRE’s Tech Insights Center and author of the Scoring Tech Talent 2024 report, said in an email to SPN that his team used occupation codes from the U.S. Bureau of Labor Statistics and degree codes from the National Center for Education Statistics to identify and calculate tech-based career and college info. Specifically, they used Occupational Employment Statistics and the Integrated Postsecondary Education Data System.

Yasukochi continued that the metrics they used to determine Omaha’s and other cities’ rankings were divided among four categories:

“Tech talent concentration metrics have the highest weights because they signify clustering of tech workers,” said Yasukochi. “Labor costs for tech talent are weighted more heavily than office rents because companies allocate more capital to labor than to real estate.”

Highlights of the report include an overall tech talent employment growth of 3.6% in the U.S. in 2023, an increased demand for and growth of tech talent due to desired artificial intelligence skills, and opportunities for geographic and demographic diversity in a workforce due to remote working.

Read the full report by CBRE on its website.