Onto Innovation (NYSE:ONTO) Enhances Leadership With New CFO And SVP Appointments

Last week, Onto Innovation (NYSE:ONTO) announced significant executive appointments with Brian Roberts as its new Chief Financial Officer and Shirley Chen as Senior Vice President of Customer Success, reinforcing the company's leadership team. Despite these changes, the stock moved in tandem with broader market trends, increasing by 6%. In the same period, the Dow Jones faced a 1.2% decline amid geopolitical tensions, yet major indexes showed signs of potential positive momentum. This recent leadership shift at Onto Innovation likely added positive weight to the company's market performance amidst an overall favorable trend.

Be aware that Onto Innovation is showing 1 risk in our investment analysis.

The recent executive appointments at Onto Innovation, with Brian Roberts as CFO and Shirley Chen as Senior Vice President of Customer Success, could influence the company's strategic direction and operational efficiency, potentially having a positive impact on its revenue and earnings forecasts. The enhancement in leadership might bolster confidence in the company's ability to capitalize on growth in AI packaging and metrology tools, aligning with expectations of revenue growth and product innovations poised to drive future advancements in semiconductor technology.

Over the last five years, Onto Innovation's total shareholder return, including share price appreciation and dividends, reached 192.14%, demonstrating robust performance. However, in the past year, its share price performance was below the US Semiconductor industry's return of 6.1%, and it also underperformed the broader US market, which saw an 11.7% return. These figures suggest that while its long-term growth has been strong, recent performance relative to peers and the market has been less favorable.

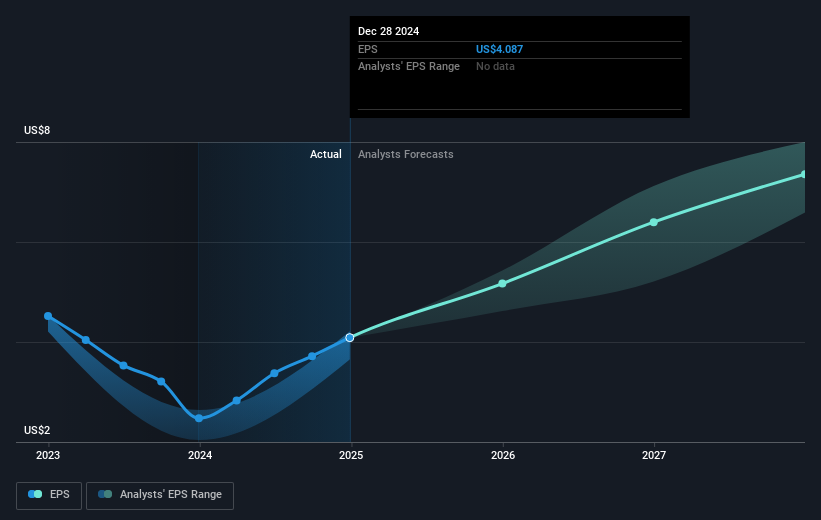

In terms of stock valuation, the current share price of US$122.42 trades at a discount to the consensus analyst price target of US$148.02, indicating potential upside. However, uncertainty remains around the assumptions underpinning the price target, such as expected revenue of US$1.3 billion by 2028 and earnings growth, which introduces some risk. The execution of its growth strategies, effective integration of its leadership, and the company's ability to navigate market challenges will be critical in determining whether the stock reaches its projected value.

Assess Onto Innovation's future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Alternatively, email [email protected]