Transcatheter Heart Valve Replacement Market Growth & Forecast 2025 to 2035

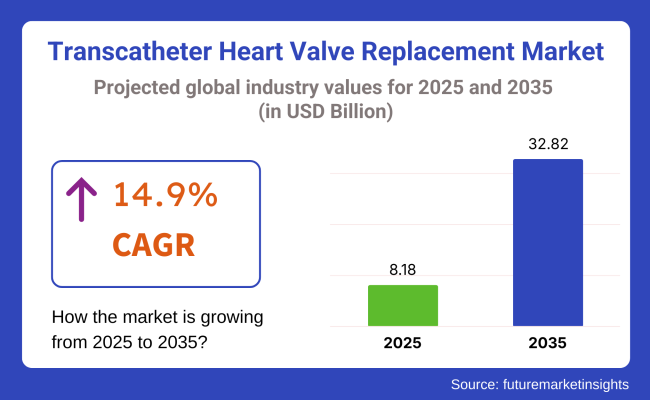

The global transcatheter heart valve replacement (TAVR) market is estimated to be valued at USD 8.18 billion in 2025 and is projected to reach USD 32.82 billion by 2035, registering a compound annual growth rate (CAGR) of 14.9% over the forecast period. The market is expected to witness a robust expansion, fueled by increasing TAVI procedural volumes, expanded indications for low- and intermediate-risk patients, and rising global burden of aortic stenosis among aging populations.

The shift from surgical aortic valve replacement (SAVR) to minimally invasive TAVR is being accelerated by favorable long-term outcome data, improved device safety profiles, and reduced perioperative complications. Innovations in next-generation valve designs, including retrievable, repositionable, and supra-annular devices, are enhancing procedural precision and reducing paravalvular leak risks. Procedural adoption is further supported by streamlined reimbursement pathways, particularly in North America and Europe, which have incentivized both public and private hospital networks to expand TAVR programs.

Key players driving the TAVR market include Edwards Lifesciences, Medtronic, Boston Scientific, Abbott, and JenaValve, who are actively expanding their global portfolios through next-gen valve platforms and clinical data generation. In 2025, Edwards Lifesciences received FDA approval for its Transcatheter aortic valve replacement (TAVR) therapy, the SAPIEN 3 platform, for severe aortic stenosis (AS) patients without symptoms.

"This approval is a powerful opportunity to streamline patient care and improve the efficiency of the healthcare system,” said Larry Wood, Edwards’ Corporate Vice President and Group President, Edwards Lifesciences. “We are proud to partner with leading physicians to advance our knowledge of this deadly disease with high quality science and optimize the treatment pathway for patients.”

One of the key technological developments is the integration of polymer leaflet technology in next-generation TAVR valves. Several manufacturers are advancing polymer-based leaflets that offer superior durability, lower thrombogenicity, and enhanced hemodynamics compared to conventional bovine or porcine pericardial tissue valves.

North America dominates the TAVR market, driven by early regulatory approvals, robust reimbursement coverage, and high procedural volumes across specialized structural heart centers. The 2024 CMS update expanding coverage for low-risk patients has triggered a significant increase in younger patient referrals. Private payers are aligning reimbursement policies with guideline-directed care, supporting rapid procedural expansion across both hospital-based and ambulatory cardiac centers.

Europe represents a rapidly growing TAVR market, supported by widespread adoption across national health systems and expanding indications under evolving ESC guidelines. Germany, France, and the UK are leading adoption, with procedural growth now extending into intermediate-risk and bicuspid cohorts under CE mark approvals. Increasing patient awareness, aging demographics and procedural centralization across high-volume valve centers continue to drive Europe's accelerated TAVR market penetration.

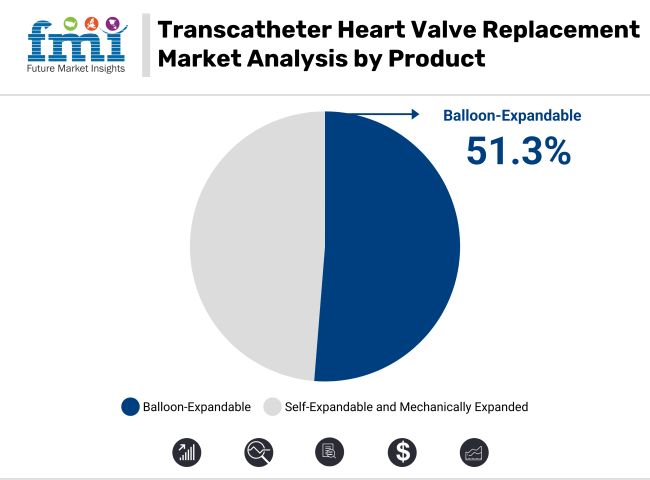

In 2025, balloon-expandable transcatheter aortic valves are expected to capture 51.3% of the revenue share in the TAVR market. This dominance is largely attributed to the proven clinical performance and flexibility of balloon-expandable valves in aortic valve replacement procedures. Balloon-expandable valves offer reliable and durable outcomes, particularly in patients with severe aortic stenosis. The balloon-expandable design allows for precise deployment under balloon inflation, ensuring optimal valve positioning within the aortic annulus.

This design, combined with their versatility in both standard and complex patient anatomies, has made balloon-expandable valves the preferred choice in clinical practice. The growth of this segment has also been driven by the increasing adoption of TAVR as a minimally invasive alternative to open heart surgery, particularly for high-risk patients. Furthermore, advancements in valve technology have further fueled the growth of this segment, solidifying its position as the leading product type in the TAVR market.

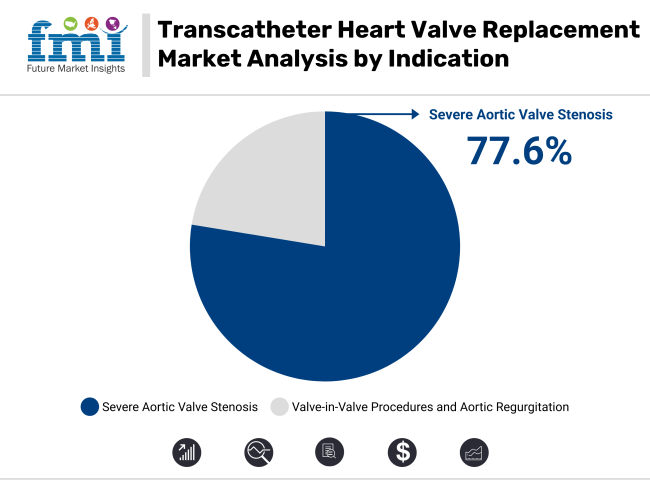

In 2025, severe aortic valve stenosis is projected to account for 77.6% of the revenue share in the TAVR market. This segment’s dominance is driven by the high prevalence of severe aortic stenosis, particularly in aging populations, which makes it a leading indication for TAVR procedures. Severe aortic valve stenosis, characterized by a significant narrowing of the aortic valve, restricts blood flow and can lead to heart failure if untreated.

TAVR has emerged as a preferred treatment option due to its minimally invasive nature, which is particularly advantageous for high-risk patients who may not be candidates for traditional open-heart surgery. The growing number of patients diagnosed with severe aortic stenosis, coupled with improved TAVR device technologies, has significantly driven the demand for transcatheter heart valve replacement procedures. Moreover, increased awareness and the expanding approval of TAVR for intermediate-risk patients have further contributed to the segment’s growth.

The high cost of transcatheter heart valve replacement compared to surgical valve replacement may render this therapy inaccessible to patients living in low-income and other developing countries. Insurance coverage and reimbursement policies in several nations restrict market access, given that obtaining the treatment can be prohibitive.

Hurdles to market entry for novel devices come in the form of strict regulations and protracted approvals for novel transcatheter valve technologies. Regional players who wish to make their footprint and world players who wish toalityto challenge in this domain find there are many opportunities but at the same time it is not easy as the market faces challenges of bio availability, and also variability in terms of healthcare regulations in each sector also varies from country to country.

Although transcatheter heart valves bring a minimally invasive alternative, they carry worries regarding long-term durability, vein thrombosis risk, and procedural complications, including paravalvular leakages. Scientists are attempting to create next-generation valves with enhanced durability, higher biocompatibility, and a smaller chance of complications.

The use of AI-driven diagnostics and live imaging technologies are improving accuracy in transcatheter heart valve placement, decreasing risk and improving patient care. Merging AI with robotic-assisted cardiac surgeries is further enhancing the precision, efficiency, and recovery times for patients receiving transcatheter interventions.

Development of new surgical techniques and devices, as well as advances in transcatheter valve replacement (TAVR), transcatheter mitral valve replacement (TMVR), and transcatheter pulmonary valve replacement (TPVR), are also helping to shape this emerging market. However, expanding indications among younger low risk patients are driving adoption of transcatheter valve therapies in lieu of surgical alternatives.

Recognizing this, companies are investing in biodegradable polymer valves, tissue-engineered valves, and hybrid prosthetic designs that offer prolonged durability and muted immune response. Investigations into regenerative medicine approaches seek to develop self-healing, patient-matched heart valve substitutes.

Growing numbers of ambulatory surgical centers (ASCs) and outpatient cardiac clinics are bringing transcatheter valve procedures closer to patients and decreasing hospital length of stay and treatment costs. Combining cardiac care follow-ups with telemedicine is helping post-procedure patient monitoring and long-term success.

The United States THVR Market for Trans catheter Heart Valve Replacement is witness to an emergence owing to prevalence of valvar heart disease, increasing acceptance of minimally invasive cardiac procedure and revolutionary Tran's catheter valve technology. According to the American Heart Association (AHA), valvar heart disease (VHD) affects more than 5 million Americans each year, creating a strong need for Tran's catheter aortic valve replacement (TAVR) and Tran's catheter mitral valve replacement (TMVR) procedures.

The rapid increase in TAVR procedures, which have already overtaken traditional open-heart surgery for treating aortic valve stenosis, is one of the key market drivers. Low-risk TAVR in younger adults is also driving procedural volumes, with FDA approvals.

Increasing adoption of next-generation trans catheter mitral and tricuspid valve replacement (TMVR & TTVR) devices is also contributing to the growth of the market, where the likes of Edwards Lifesciences, Medtronic and Abbott are continuing to invest in food durability, AI-enhanced imaging and robotic-assisted delivery systems. Moreover, expanded Medicare & private insurance coverage for TAVR procedures facilitates patient access, while the rise of hybrid operating room (OR) in leading cardiac centres enhances surgical outcomes.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 14.6% |

The United Kingdom Trans catheter Heart Valve Replacement (THVR) Market is expanding at a rapid rate due to the increasing aging population, NHS-supported cardiac care programs, and increasing practice of minimally invasive heart valve replacement surgeries. The elderly population of the UK, where over 12 million are above 65 years of age, is one of the main drivers of TAVR and TMVR procedure demand since aortic stenosis and mitral regurgitation are very prevalent in geriatric patients.

The National Health Service (NHS) is giving priority to early diagnosis and treatment of valvar heart diseases, increasing access to Tran's catheter procedures in large hospitals and cardiac centres. The expansion of AI-supported imaging for valve replacement planning and robotic-assisted TAVR/TMVR procedures is improving the accuracy of surgery and recovery time for patients. In addition, government grants for heart valve replacement research are financing next-generation valve designs with enhanced longevity and biocompatibility.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 14.2% |

The Trans catheter Heart Valve Replacement (THVR) Market in the European Union is growing due to increasing government investments in cardiac healthcare, rising adoption of Trans catheter valve procedures, and strong presence of medical device manufacturers. The EU’s Horizon Europe Program, with €6 billion allocated for cardiovascular research, is supporting the development of next-generation heart valves, robotic-assisted valve replacement, and AI-driven imaging systems.

Germany, France, and Italy are at the forefront of TAVR and TMVR adoption, with hybrid surgical procedures and catheter-based valve implantation procedures provided by specialized heart centres. The growing application of digital twin technology in heart valve simulation is improving pre-procedural planning, lowering complications, and enhancing long-term durability of the valve. Furthermore, stringent EU medical device regulatory structures are fuelling innovation in biocompatible valve materials and non-invasive Tran's catheter delivery systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 14.3% |

The Japan Trans catheter Heart Valve Replacement (THVR) Market is expanding as a result of the growing geriatric population, enhanced government incentives for cardiovascular care, and speedy advancements in minimally invasive valve therapies.

Japan has the world's second-largest number of elderly citizens with more than 28% of its population aged over 65 years who contribute to increased prevalence of aortic stenosis and mitral regurgitation. The government of Japan has provided USD 3.5 billion for cardiovascular studies and next-generation heart failure treatments, underpinning next-gen Tran's catheter heart valves.

Implementation of AI-driven heart valve evaluation technology is enhancing the selection of patients for TAVR and TMVR procedures, lowering post-surgical complications and readmissions. The development of bioengineered and polymer-based Tran's catheter valves is providing more durable solutions with better hemodynamic, ensuring improved patient outcomes.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 14.5% |

The South Korea THVR market for Trans catheter Heart Valve Replacement is growing swiftly with a high incidence of heart disease, an upsurge in adoption of robotic valve procedures, and considerable government expenditure in medical device R&D. South Korea's Ministry of Health and Welfare has pledged USD 2 billion to cardiovascular medicine, funding for cutting-edge treatments for heart failure and valve replacement technology.

The use of robotic-assisted TAVR and TMVR procedures is increasing surgical accuracy and decreasing recovery periods, making valve replacement with less invasive techniques available to high-risk patients.

Advances in AI-enhanced cardiac imaging and 3D printing of heart valve models are increasing pre-surgical planning and individualized valve designs to provide improved patient-specific results. In addition, South Korea's dominant role in biomaterials and biotechnology research is also driving the growth of next-generation flexible polymer valves with improved durability.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 14.7% |

Transcatheter Heart Valve Replacement (THVR) market is increasing with an increasing incidence of valvular heart diseases, increased utilization of minimally invasive therapy, and second-generation transcatheter aortic valve replacement (TAVR) technology.

The industry is focusing on AI-driven valve delivery, longer durability, and next-generation material to enhance patient outcome, reduce surgical risk, and optimize long-term valve performance. The industry features top global companies and expert cardiovascular device makers, each developing technologies in percutaneous valve implantation, repositionable heart valves, and AI-enhanced cardiac imaging.

Edwards Lifesciences dominates the THVR market, offering SAPIEN TAVR devices, known for AI-guided valve placement, balloon-expandable technology, and real-time cardiac imaging integration. The company focuses on advanced valve durability and minimally invasive implantation techniques.

Medtronic specializes in self-expanding TAVR valves (Evolut series), integrating recapturable, repositionable valve technology for precision placement and long-term structural performance. The company emphasizes next-gen valve durability with advanced hemodynamic flow optimization.

Abbott provides PORTICO and NAVITOR transcatheter valves, focusing on low-profile, fully retrievable designs for high-risk valve replacement patients. The company integrates 3D valve imaging and AI-powered deployment assistance.

Boston Scientific offers ACURATE neo2 TAVR systems, emphasizing minimally invasive heart valve replacement with precision leaflet technology for optimized valve function.

JenaValve develops TAVR solutions tailored for aortic regurgitation and stenosis, expanding TAVR applications beyond standard indications. The company focuses on next-generation heart valve materials and AI-guided deployment strategies.

Several emerging and established cardiovascular device manufacturers contribute to next-generation TAVR innovations, AI-assisted valve placement, and hybrid heart valve replacement strategies. These include: