Nigeria's PoS Agents Face New 'Monogamy' Rules, Impacting Cash Access

The financial landscape across Africa is witnessing a flurry of significant developments, marked by stringent regulatory shifts in Nigeria, groundbreaking profitability for a Kenyan pioneer, and innovative funding initiatives in East Africa, alongside major internet infrastructure aspirations.

In Nigeria, the Central Bank of Nigeria (CBN) is set to dramatically reshape the country's rapidly expanding agent banking sector. By April 2026, a new policy will mandate that every Point of Sale (PoS) agent must choose and operate exclusively with one financial institution. This means agents will no longer be able to utilize multiple PoS machines from various providers like OPay, PalmPay, Moniepoint, or traditional banks, a common practice that has long offered flexibility in a market prone to network issues and card incompatibilities. The CBN justifies this move by citing a need to enhance service quality, instill order, and address concerns such as fraud and poor traceability within a sector that processed an estimated ₦10.51 trillion ($7 billion) in transactions in the first quarter of 2025 alone, according to the Nigeria Inter-Bank Settlement System (NIBSS).

Beyond exclusivity, the new guidelines introduce geo-tagging for all PoS machines, effectively locking them to specific locations, and impose a daily withdrawal limit of ₦1.2 million ($816). While the regulator aims to strengthen the environment for offering safe financial services to the underbanked, this policy has stirred considerable debate among stakeholders. PoS agents, like Ibukun in Ojodu Berger, who relies on a 'rainbow of PoS machines' to ensure successful transactions amidst network failures, express skepticism. Agents typically leverage multiple platforms to manage varying transaction charges, network reliability, and daily limits, earning between ₦90,000 and ₦360,000 ($61 to $245) monthly from small commissions. Chinyere, an agent on Lagos Island, fears business disruption, while Obinna in Surulere dismisses the directive, citing past unenforced policies. Abdul of FEDAMS Technology believes the policy cannot work due to perennial network problems, a sentiment echoed by Zubair Onireke who credits his multi-operator system for business enhancement.

For customers, the new rule signifies a potential 'compatibility trap' and a loss of the crucial 'backup plan' that the current flexible system provides. Omolabe Iteoluwakiishi, a regular PoS user, prefers OPay-to-OPay transactions and fears being discouraged if an agent is limited to a single machine that might not work with her card. The policy’s 10-meter rule, restricting the distance between registered PoS locations, could further exacerbate access issues, especially in remote areas where a single agent often serves as the only bridge to formal financial services. The financial ripple effects are also concerning; agents operating on thin margins may pass increased operational costs to users through higher transaction charges, impacting spending behavior in an economy already battling inflation and cash shortages. Safaradeen Fasasi, national president of the Association of Mobile Money & Bank Agents in Nigeria (AMMBAN), highlights the dual nature of agency banking—partially regulated and partially entrepreneurial—suggesting that policy formulation must align with policy outcomes to avoid unintended disruptions to financial inclusion.

Meanwhile, Kenya’s M-KOPA, a pioneer in the pay-as-you-go (PAYGO) model, has achieved a significant milestone by turning its first profit in over a decade. In 2024, the company posted a profit of KES 1.2 billion ($9.2 million), a remarkable rebound from a KES 3.2 billion ($25 million) loss the previous year, with revenue soaring by 66% to KES 53.7 billion ($416 million). Founded in 2011 to provide solar systems on credit, M-KOPA has expanded into a comprehensive digital finance platform offering smartphones, cash loans, and insurance across Kenya, Uganda, Nigeria, and Ghana. This achievement underscores the viability of Africa’s asset-financing model at a time when investors are increasingly demanding clear paths to profitability from African startups.

In another notable development, Starlink, Elon Musk’s satellite internet company, is making a renewed push to enter South Africa. The company has pledged a $145 million investment, committing to comply with local empowerment laws through an 'equity equivalence' pathway. This plan includes investing in local infrastructure, equipping rescue vessels for the National Sea Rescue Institute, and providing free internet for 5,000 schools. Starlink aims to work through local partners, such as South African internet service providers, for installation, maintenance, and resale, and establish parts of its global network infrastructure in the country to create a regional hub. While this represents a shift from its earlier refusal to sell equity, South African lawmakers still have reservations, fearing that the equity equivalence route could undermine the long-standing Broad-based Black Economic Empowerment (BBEE) system.

Kenya is also pioneering an innovative approach to startup funding by proposing a policy that would legally require large corporations to channel a portion of their Corporate Social Responsibility (CSR) budgets into an innovation fund for startups. Drafted by the Kenya National Innovation Agency (KeNIA), this initiative aims to reframe traditional philanthropy as 'investing forward,' creating a steady local funding pipeline to nurture early-stage ventures. The proposal draws inspiration from India’s Companies Act of 2013, which mandates firms to allocate at least 2% of their net profits to CSR initiatives. If implemented, Kenya could become the first African nation to transform corporate responsibility into a dedicated source of startup capital.

Further expanding digital financial services, Paga has launched in the United States, offering digital banking services tailored for the African diaspora, enabling users to send, pay, and bank in US Dollars and Naira. Simultaneously, Paystack has introduced a 'Pay with Bank Transfer' option in Ghana, allowing businesses to accept secure, instant bank transfers. These diverse developments collectively paint a picture of a dynamic and evolving African tech and financial ecosystem, continuously navigating regulatory landscapes, fostering indigenous innovation, and expanding digital access.

Recommended Articles

You may also like...

Man Utd Future Unveiled: Ratcliffe Sets Three-Year Prove-It Deadline for Amorim

Manchester United co-owner Sir Jim Ratcliffe has affirmed his support for manager Ruben Amorim, advocating for a three-y...

Ronaldo Reaches Historic Billionaire Status, Leaving Messi Behind!

)

Portuguese football icon Cristiano Ronaldo has made history by becoming the first footballer to achieve billionaire stat...

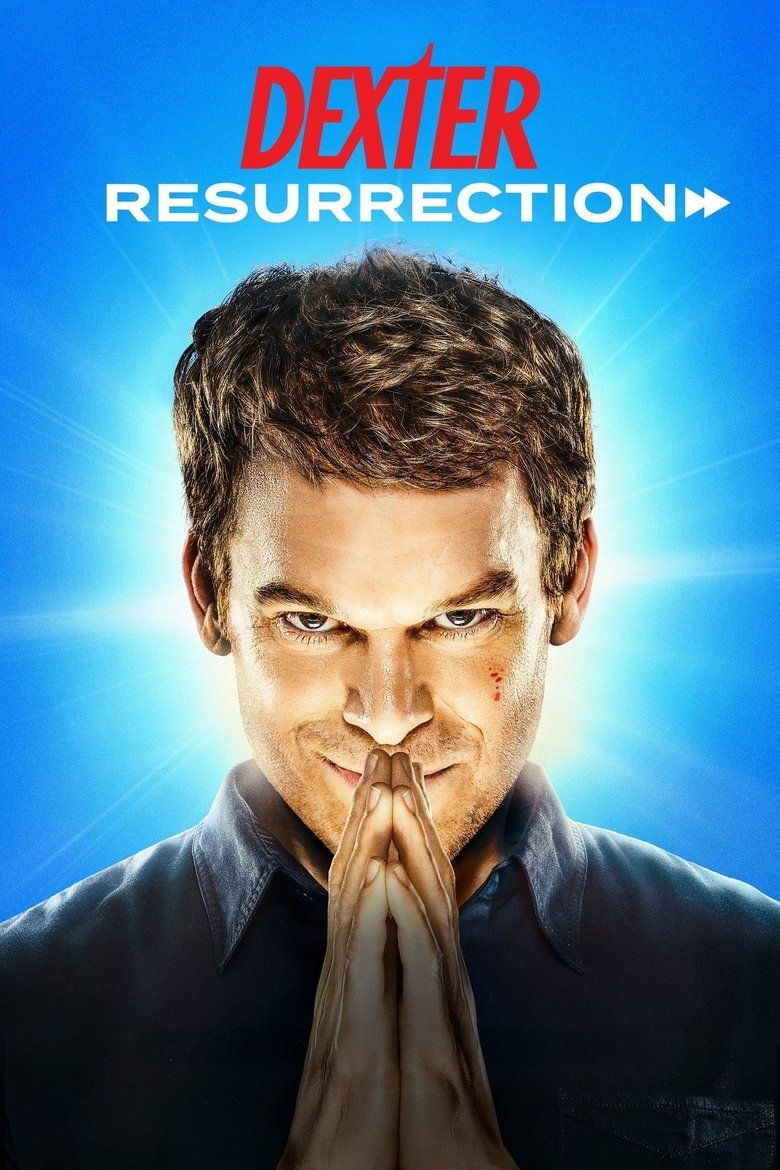

Paramount+ Shocker: 'Dexter: Resurrection' Scores Season 2 Renewal After Month-Long Wait!

Paramount+ has officially renewed “Dexter: Resurrection” for a second season, signaling the highly anticipated return of...

Taylor Swift's 'Showgirl' Takes the World by Storm: Travis Kelce's Reaction and Record-Breaking Potential

On his 'New Heights' podcast, Travis Kelce reacted to Taylor Swift's new album, 'The Life of a Showgirl,' specifically t...

Louis Tomlinson's Heartbreak: Reflecting on Liam Payne’s Devastating Passing

Louis Tomlinson opens up about the profound impact of Liam Payne's death, describing the loss as "impossibly difficult."...

Brooklyn Beckham's Legal Woes Mount As He Faces Another Setback!

Brooklyn Beckham faces ongoing legal battles for his Cloud 23 hot sauce business, narrowly resolving a trademark dispute...

Dolly Parton Shakes Off Death Rumors Amid Terrifying Health Scare!

Country music icon Dolly Parton has personally addressed and debunked swirling rumors about her health, assuring fans sh...

Malala's Powerful Abuja Visit: Advocating for Girls' Empowerment from Pottery to Policy

Nobel Laureate Malala Yousafzai recently visited Nigeria to advance girls' education, engaging with local champions, you...