Nigeria, Netherlands begin renegotiation of double taxation treaty

The Federal Inland Revenue Service (FIRS) and the Kingdom of the Netherlands on Monday commenced formal talks to renegotiate the existing Double Taxation Agreement between both countries.

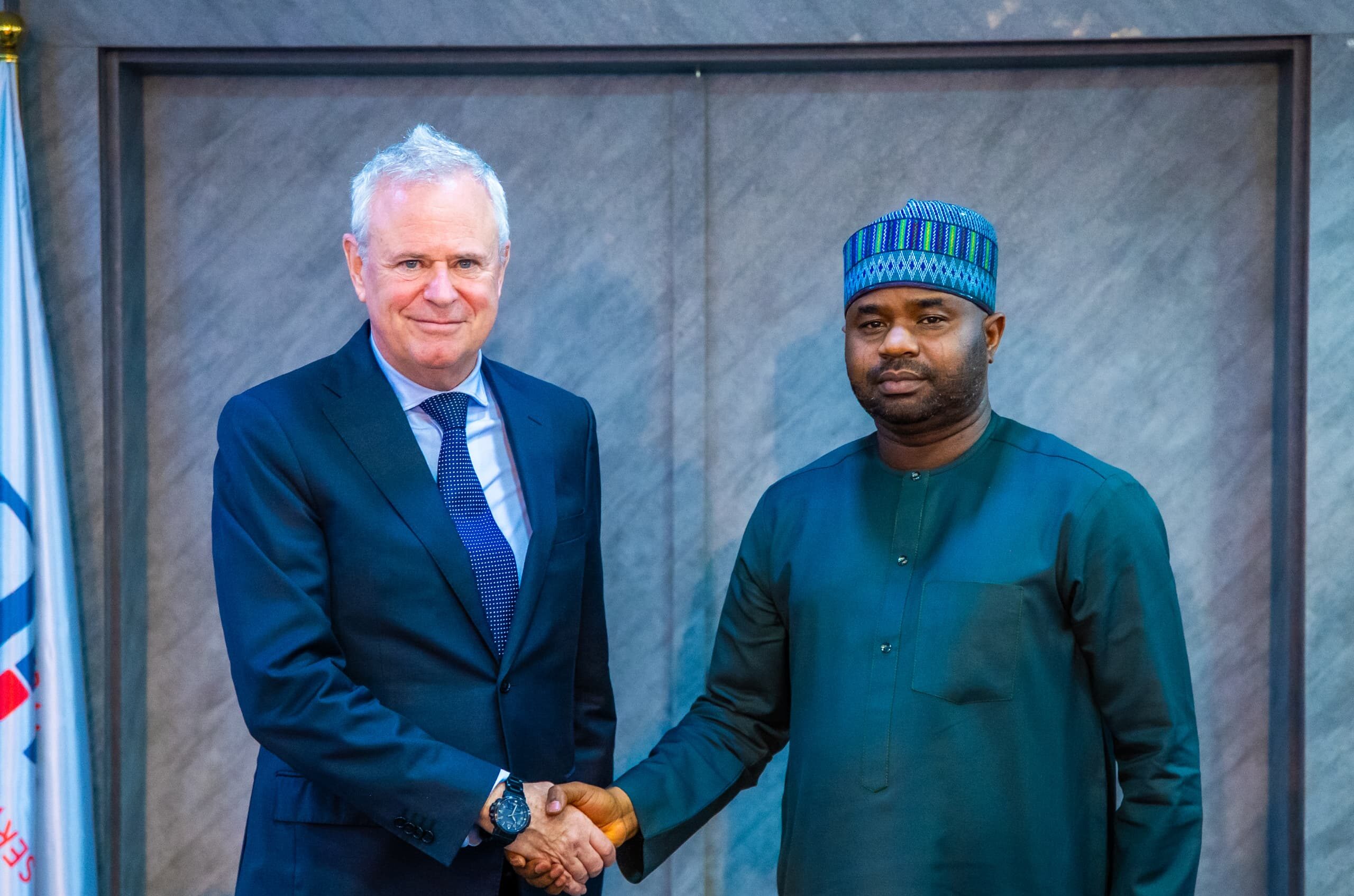

The meeting, held at the Revenue House in Abuja, was attended by the Executive Chairman of FIRS, Dr. Zacch Adedeji, and the Netherlands’ Ambassador to Nigeria, Bengt van Loosdrecht, who led the Dutch delegation.

According to a statement issued by FIRS, the renegotiation follows the recent enactment of tax reform legislation in Nigeria, including the Nigeria Tax Act, the Nigeria Tax Administration Act, the Nigeria Revenue Service (Establishment) Act, and the Joint Tax Board (Establishment) Act. These laws restructure the administration and coordination of tax matters in the country.

Dr. Adedeji described the engagement as necessary given changes in both domestic and global tax standards. “Recent developments in the domestic and global tax landscape have made the review of the existing agreement unavoidable,” he said.

He cited the ongoing tax reforms by the Nigerian government and international initiatives such as the Base Erosion and Profit Shifting (BEPS) measures as drivers of the renegotiation effort.

“This renegotiation meets with the policy objectives of the ongoing fiscal and tax reforms initiated by the administration of President Bola Tinubu. We are committed to broadening the domestic tax base, strengthening tax administration, and ensuring that our tax system supports inclusive economic growth,” Adedeji added.

Ambassador van Loosdrecht said the renewed discussions reflected mutual goodwill and a shared interest in fair taxation. “The fact that we meet here today is an indication of the goodwill and the good faith with which we want to meet with each other. My colleagues from the Netherlands will act in good faith,” he said.

He expressed confidence in the expertise of both negotiating teams, noting, “Ultimately, a treaty is about finding common ground and building upon that common ground. I know both of our sides have very competent, professional teams.”

FIRS noted that the next six months will be used to align tax data systems, implement the newly enacted tax laws, and prepare for the full operationalisation of the Nigeria Revenue Service on January 1, 2026.

As part of this transition, all existing tax treaties will be reviewed to ensure consistency with the reformed tax framework.

You may also like...

Diddy's Legal Troubles & Racketeering Trial

Music mogul Sean 'Diddy' Combs was acquitted of sex trafficking and racketeering charges but convicted on transportation...

Thomas Partey Faces Rape & Sexual Assault Charges

Former Arsenal midfielder Thomas Partey has been formally charged with multiple counts of rape and sexual assault by UK ...

Nigeria Universities Changes Admission Policies

JAMB has clarified its admission policies, rectifying a student's status, reiterating the necessity of its Central Admis...

Ghana's Economic Reforms & Gold Sector Initiatives

Ghana is undertaking a comprehensive economic overhaul with President John Dramani Mahama's 24-Hour Economy and Accelera...

WAFCON 2024 African Women's Football Tournament

The 2024 Women's Africa Cup of Nations opened with thrilling matches, seeing Nigeria's Super Falcons secure a dominant 3...

Emergence & Dynamics of Nigeria's ADC Coalition

A new opposition coalition, led by the African Democratic Congress (ADC), is emerging to challenge President Bola Ahmed ...

Demise of Olubadan of Ibadanland

Oba Owolabi Olakulehin, the 43rd Olubadan of Ibadanland, has died at 90, concluding a life of distinguished service in t...

Death of Nigerian Goalkeeping Legend Peter Rufai

Nigerian football mourns the death of legendary Super Eagles goalkeeper Peter Rufai, who passed away at 61. Known as 'Do...