Neutral Funding Rates Persist Amid Bullish Market Sentiment

Key Points:

On July 14, 2025, Coinglass data indicates that mainstream CEX and DEX funding rates remain neutral, suggesting an equilibrium in the cryptocurrency market.

This neutrality comes despite BTC and ETH achieving new highs, with $237 million in liquidations occurring over 24 hours.

shows funding rates are neutral, hovering around 0.01%, suggesting no dominant market trend. This neutrality is reflected across BTC, ETH, and major altcoins, with rates maintaining market balance between longs and shorts.

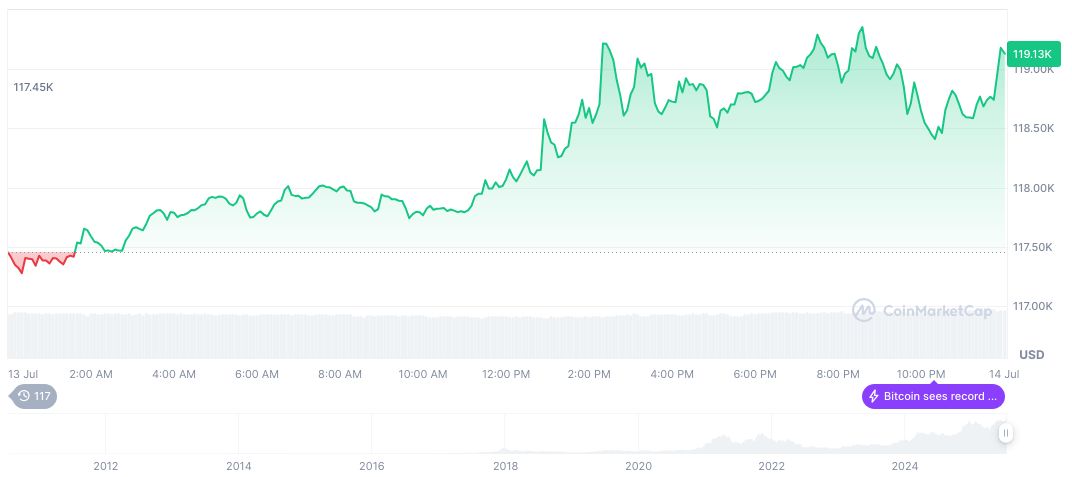

The neutral funding positions impact pricing trends, as BTC exceeds and ETH surpasses . Despite these price movements, occurred, indicating active market realignment.

CZ, CEO, Binance, – “The market’s current neutrality is like watching the calm before a potential storm, setting the stage for movements that could catch many off-guard.”

Prior periods of neutral funding rates frequently lead to volatility spikes, as shifts in sentiment coupled with increased leverage initiate significant market movements.

Bitcoin (BTC) is priced at $122,355.75, holding a market cap of $2.43 trillion and commanding 63.76% market dominance. Trading volume within the last 24 hours showed an increase of 42.70%, with the price rising by 3.80%. These insights, provided by CoinMarketCap, reflect its robust market position.

The anticipates that neutral funding regimes could precede volatility spurts once market sentiment shifts. This expectation relies on observed , where neutrality transitioned into volatility due to leverage and emotional extremes.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

You may also like...

Diddy's Legal Troubles & Racketeering Trial

Music mogul Sean 'Diddy' Combs was acquitted of sex trafficking and racketeering charges but convicted on transportation...

Thomas Partey Faces Rape & Sexual Assault Charges

Former Arsenal midfielder Thomas Partey has been formally charged with multiple counts of rape and sexual assault by UK ...

Nigeria Universities Changes Admission Policies

JAMB has clarified its admission policies, rectifying a student's status, reiterating the necessity of its Central Admis...

Ghana's Economic Reforms & Gold Sector Initiatives

Ghana is undertaking a comprehensive economic overhaul with President John Dramani Mahama's 24-Hour Economy and Accelera...

WAFCON 2024 African Women's Football Tournament

The 2024 Women's Africa Cup of Nations opened with thrilling matches, seeing Nigeria's Super Falcons secure a dominant 3...

Emergence & Dynamics of Nigeria's ADC Coalition

A new opposition coalition, led by the African Democratic Congress (ADC), is emerging to challenge President Bola Ahmed ...

Demise of Olubadan of Ibadanland

Oba Owolabi Olakulehin, the 43rd Olubadan of Ibadanland, has died at 90, concluding a life of distinguished service in t...

Death of Nigerian Goalkeeping Legend Peter Rufai

Nigerian football mourns the death of legendary Super Eagles goalkeeper Peter Rufai, who passed away at 61. Known as 'Do...