You may also like...

Salah Shatters AFCON Records, Propels Egypt to Semi-Finals

)

Egypt secured a spot in the AFCON 2025 semi-finals by defeating Ivory Coast 3-2 in a thrilling quarter-final. Mohamed Sa...

Super Eagles Dominate Algeria, Advance in AFCON: A Nation's Roar!

)

Nigeria's Super Eagles secured a dominant 2-0 victory over Algeria in the AFCON 2025 quarter-finals, propelled by goals ...

Fan Outcry: 'The Rookie' Character Bailey Faces Creative Crisis in Season 8

Bailey Nune, a once-dynamic character on ABC's The Rookie, is facing a storyline crisis in Season 8. Despite her compell...

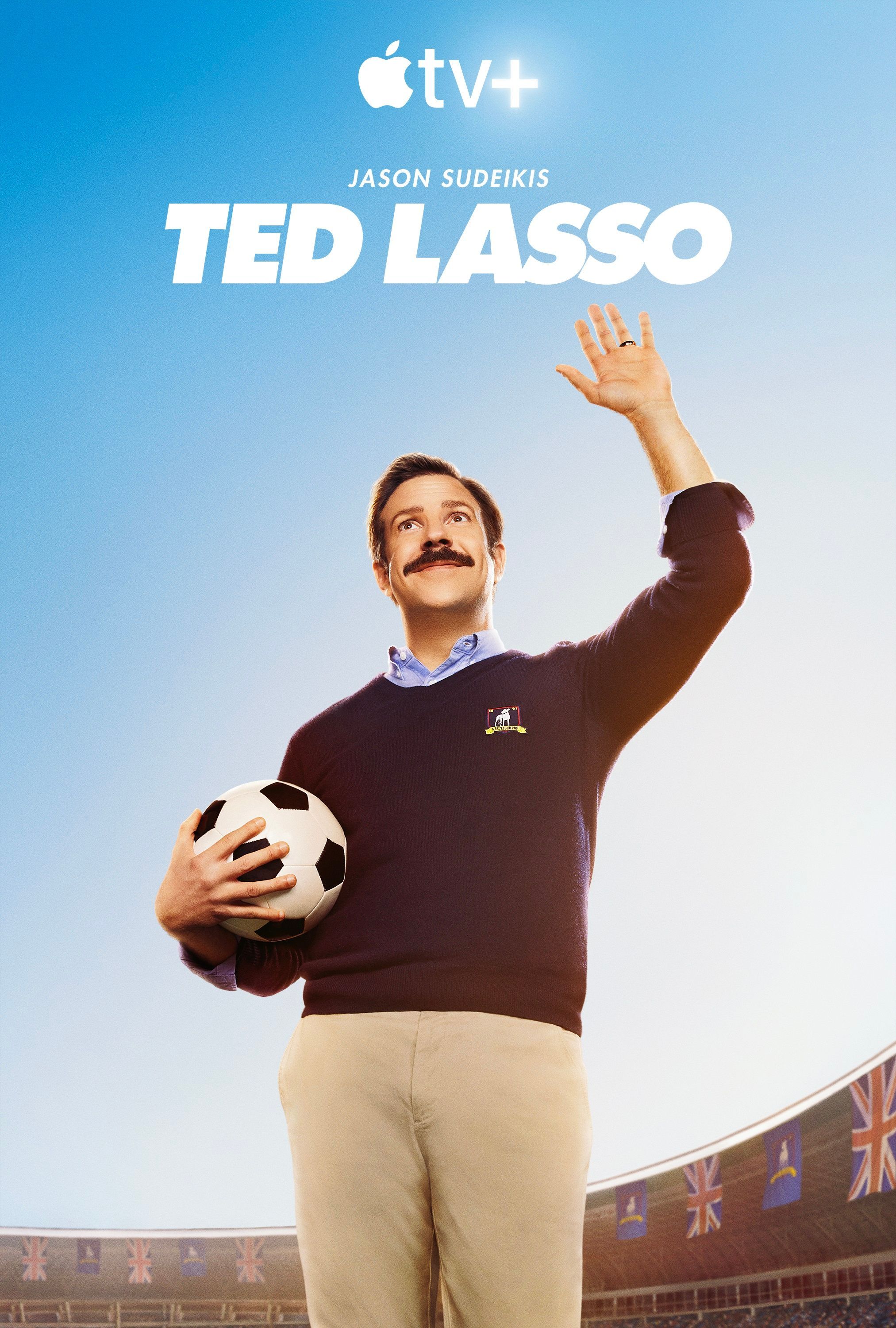

Apple TV's Undisputed Hit Dominates Charts, New Season Imminent!

Ted Lasso, Apple TV's beloved comedy, has made a surprising comeback to the platform's top ten charts, two years after i...

Legendary Tributes: Don Was Honors 'Fearless' Friend and Bandmate Bob Weir

Music legend Bob Weir, co-founder of the Grateful Dead, has died at 78 after battling cancer. His bandmate Don Was, pres...

Tragedy Strikes: Colombian Music Star Yeison Jiménez Dead in Horrific Plane Crash

Colombian singer-songwriter Yeison Jiménez, a prominent figure in “música popular,” died tragically at 34 in a plane cra...

Nigeria's Urgent Security Vow Amidst Looming U.S. Strike Threats

Nigeria is intensifying its fight against escalating insecurity amidst renewed threats from former US President Donald T...

Providus Bank's Shock Virtual Account Shutdown: Unveiling the True Story and Impact!

Providus Bank's sudden deactivation of virtual accounts has significantly impacted Nigerian fintech platforms like Piggy...