MTN's BankTech disburses $592 million in Q1 loans amid rising credit demand

The surge highlights growing demand for microloans and the rising role of telcos in closing Africa’s credit gap.

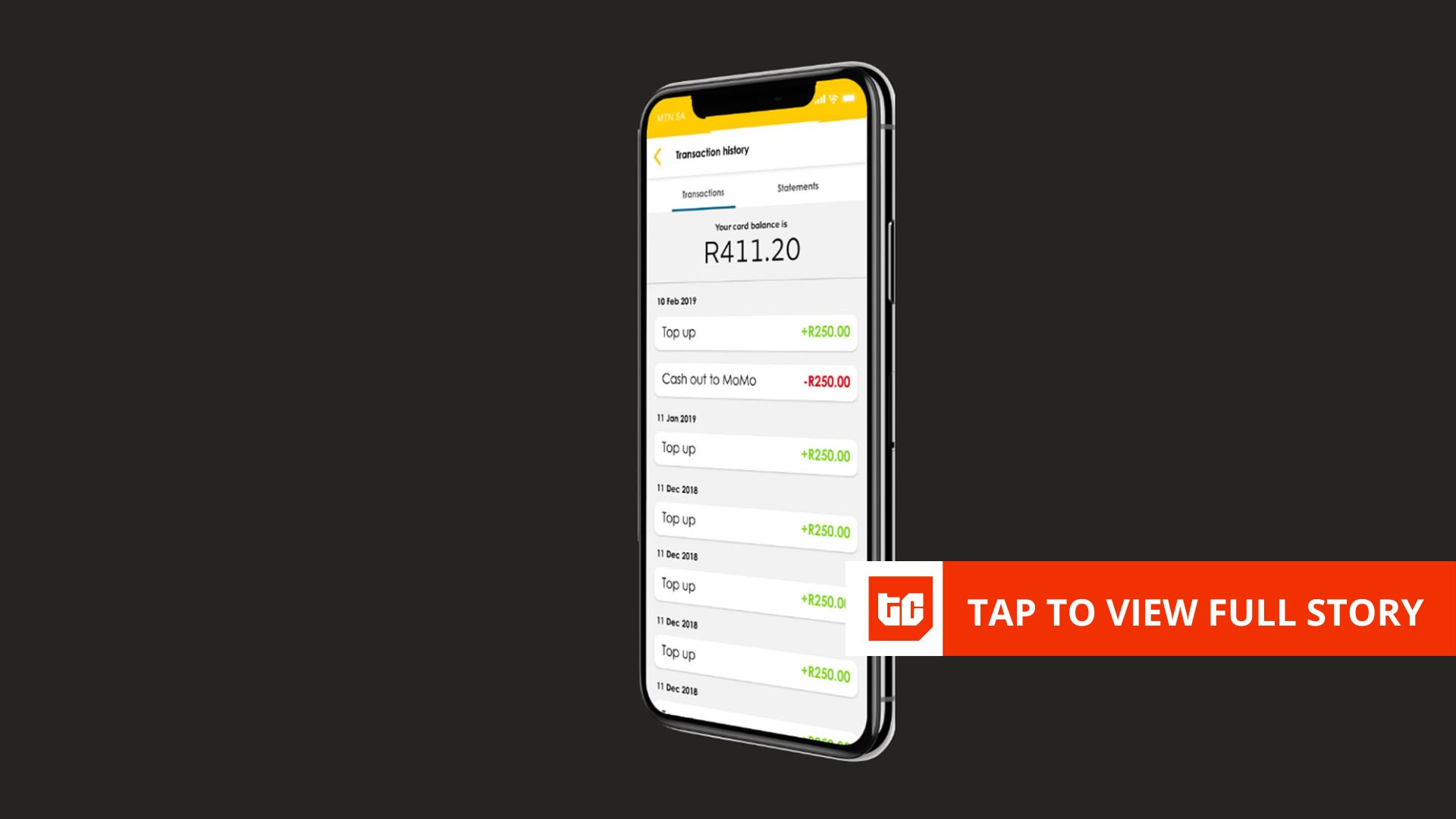

The lending platform is MTN’s strategic push into banking-as-a-service (BaaS), offering APIs that enable fintech startups, businesses, and digital platforms to integrate financial services, such as lending, savings, and insurance, directly into their ecosystems. Loans are primarily issued to individuals and small businesses through MTN’s BankTech platform.

BankTech highlights the growing role of telecoms in driving financial inclusion. Before MTN joined the digital lending space, platforms like Safaricom’s M-Shwari (launched in 2012), KCB M-Pesa (in partnership with Kenya Commercial Bank), Airtel Money Loans across East Africa, and Vodacom’s M-Pesa in South Africa had already paved the way for mobile-based consumer lending in Africa. Collectively, these telco-led platforms represent a consumer lending marketplace valued at approximately $247 million, all aiming to bridge Africa’s estimated $782 billion credit gap as of 2024.

BankTech’s growth reflects a shift in consumer confidence, showing that users are increasingly embracing telecom-driven financial solutions as credible alternatives to traditional banks. The platform started gaining momentum in 2024, disbursing $371.7 million in loans in the first quarter, followed by $359.9 million in Q2, $461.5 million in Q3, and $546.8 million in Q4. This steady growth led to a record $731.6 million in loans disbursed in Q1 2025.

According to MTN’s financial reports, the surge was largely driven by strong performance in Ghana, Uganda, and Cameroon—markets where MTN’s fintech services are growing quickly and digital lending is becoming more established